Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

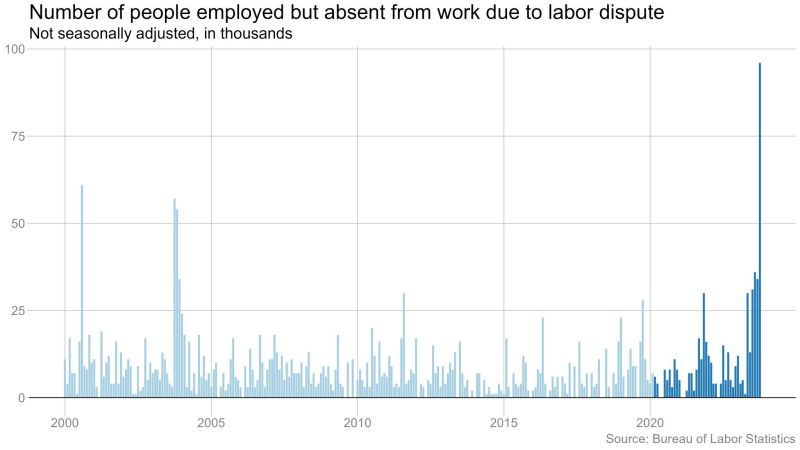

A very interesting chart highlighted by Tavi Costa

This is the largest number of workers on strike in the history of the data. As corporate profit margins remain comfortably above their typical averages, it leaves room to absorb increased labor costs. This could contribute significantly to inflation. Source: Tavi Costa

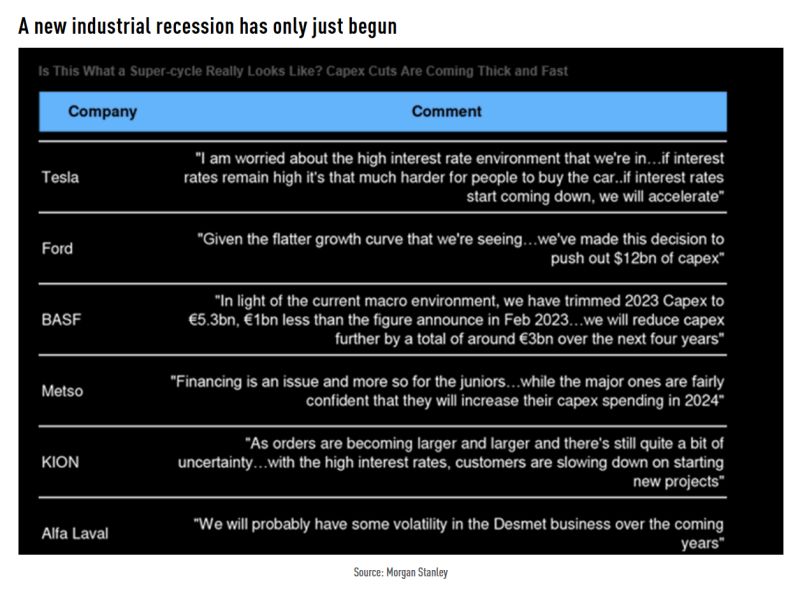

Morgan Stanley industrial team runs through their conclusions coming out of a choppy earnings season

A double-digit short-cycle slowdown is getting priced in, but ongoing inventory and incremental capex pressures are not. Source: MS, TME

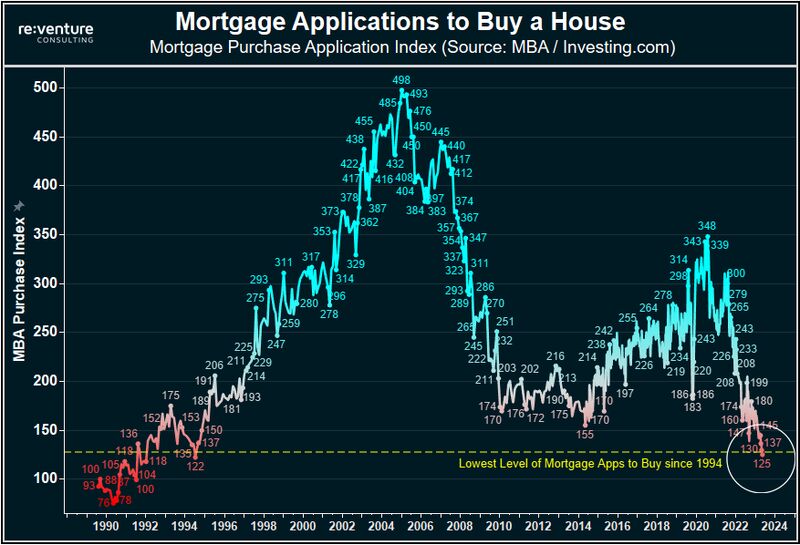

Mortgage demand is now down 50% from pre-pandemic levels and at its lowest level since 1994

From its peak in 2021, mortgage demand is down ~64%. Current mortgage demand is ~75% below the 2005 peak. The most incredible part of this? Mortgage rates are still only at their historical average. Housing market activity is coming to a halt. Source: The Kobeissi Letter

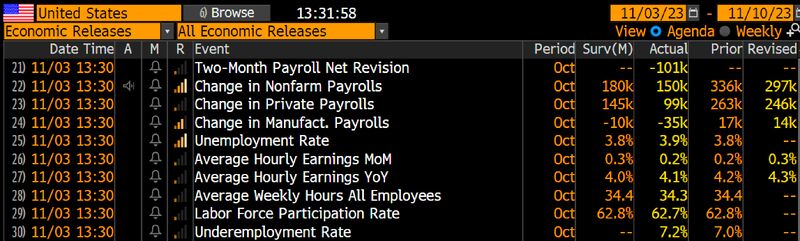

The U.S. economy saw job creation decelerate in October, confirming persistent expectations for a slowdown and possibly taking some heat off the Federal Reserve in its fight against inflation

Nonfarm payrolls increased by 150,000 for the month, the Labor Department reported Friday, against the Dow Jones consensus forecast for an increase of 170,000. The United Auto Workers strikes were primarily responsible for the gap as the impasse meant a net loss of jobs for the manufacturing industry. The unemployment rate rose to 3.9%, against expectations that it would hold steady at 3.8%. Employment as measured in the household survey, which is used to compute the unemployment rate, showed a decline of 348,000 workers, while the rolls of the unemployed rose by 146,000. A more encompassing jobless rate that includes discouraged workers and those holding part-time positions for economic reasons rose to 7.2%, an increase of 0.2 percentage point. Meanwhile, Household Survey showed a huge 348k loss in jobs during October. Dollar drops, Bond yields slide following VERY disappointing US jobs data which fuel bets Fed is done Source: CNBC, Bloomberg

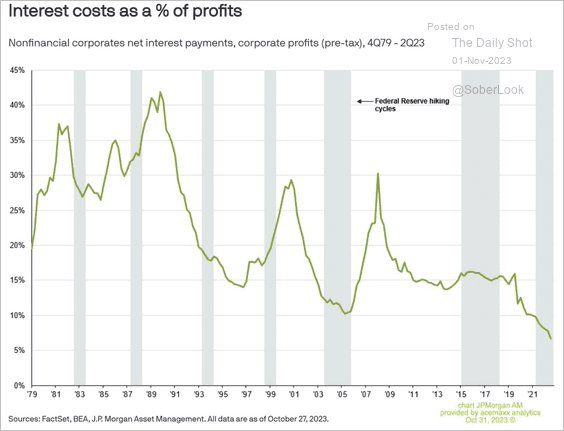

Interest costs as a share of US corporate profits are near the lowest levels in 40 years

This is partly because many companies have locked in long-term financing at low rates. This has kept profit margins elevated. Maybe companies are better to manage their debt schedule than the US Treasury... Source: The daily shot, Lance Roberts

Feed a family of 5 (hamburger, fries, shake) for $2.25 in June 1961

BLS CPI calculator says that's same as $23.24 today... Inflation calculator -> Source: Rudy Havenstein

Investing with intelligence

Our latest research, commentary and market outlooks