Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

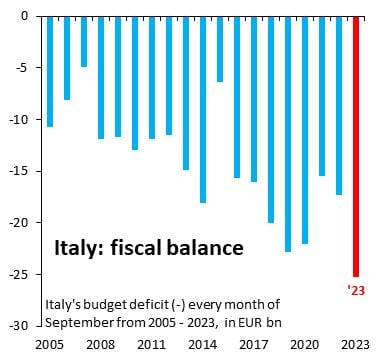

Italy budget deficit by Robin Brooks ->

Monthly data on Italy's fiscal balance are volatile, but the September 2023 budget deficit is the largest ever...

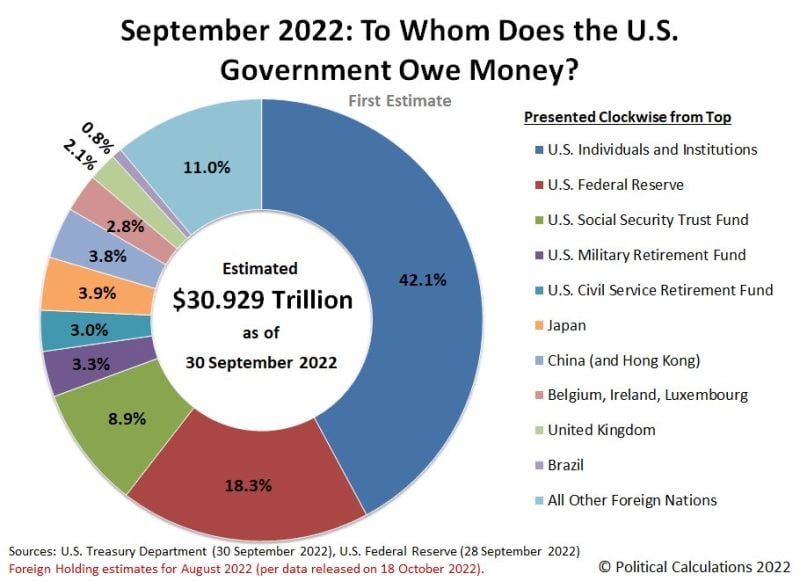

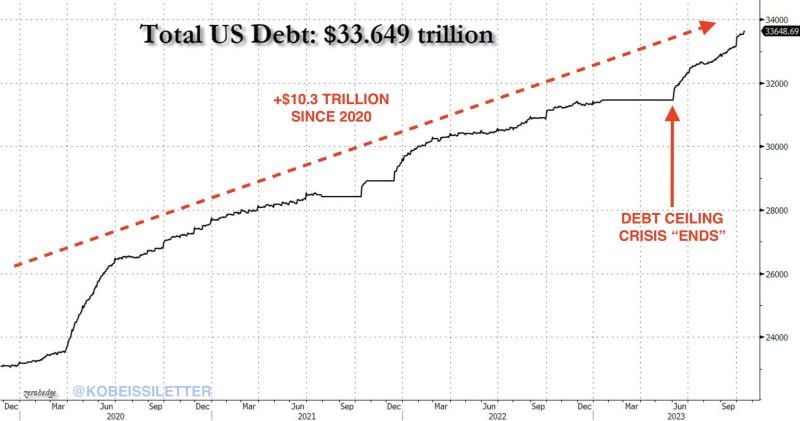

Total US debt is now up ~$650 BILLION since it crossed $33 trillion exactly 1 month ago, according to Zerohedge

Yesterday alone, total US debt jumped by another $58 billion. Total US debt has grown by ~$22 billion PER DAY for the last month. In other words, the US has added ~$915 million in debt every hour for the last month. Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion. Since 2020, total US debt is officially up more than $10 TRILLION. Source: The Kobeissi Letter

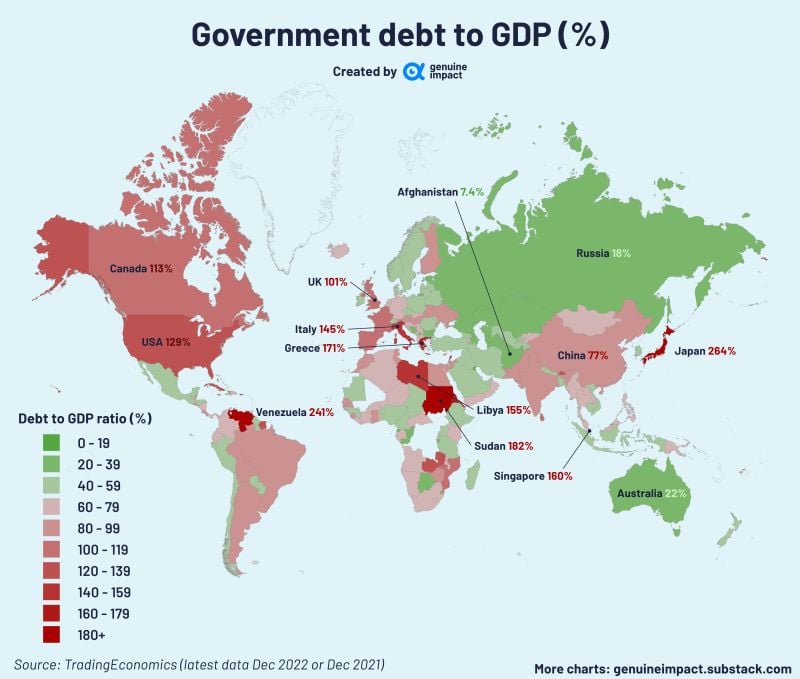

The US government has consistently shown fiscal irresponsibility

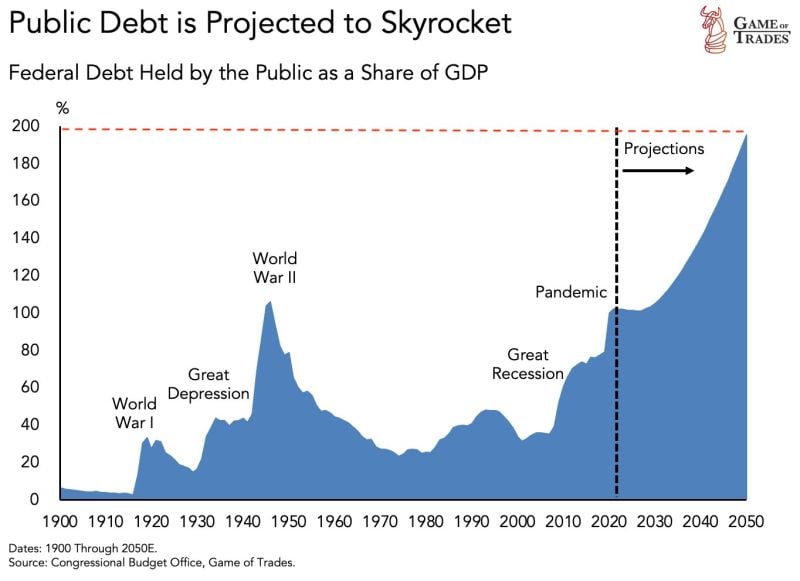

Debt-to-GDP is projected to reach 200% by 2050. The government is going to face a major problem with the amount of money they will have to pay in interest. Everybody, except the US government, seems to understand the unsustainability of this path. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks