Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

China shows signs of stabilization after a long period of slowdown and disappoitning data over the spring

China’s Q3 growth exceeds forecast, buoyed by consumer spending and industrial production. China posted 4.9% growth in the July to September quarter from a year earlier, stronger than the median forecast for 4.6%. Quarter on quarter, China’s GDP grew 1.3% in the third quarter, helped by a downward revision for Q2 from +0.8% to 0.5%.

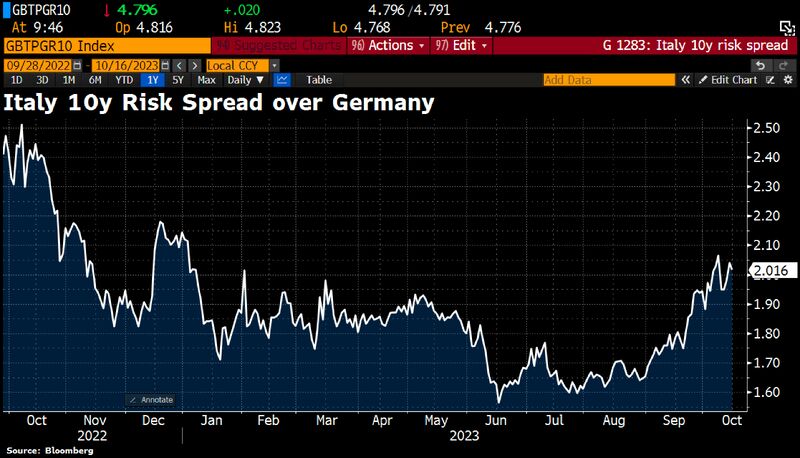

There is a different culture of public debt in Germany than in France

Nevertheless, French Finance Minister Le Maire hopes to find a compromise for new budget rules w/Germany. “We will continue to work w/Christian Lindner in the coming weeks to try to reach a Franco-German accord that could serve as a basis for a wider deal,” Le Maire said ahead of a meeting with his EU peers in Luxembourg. Source: HolgerZ, Bloomberg

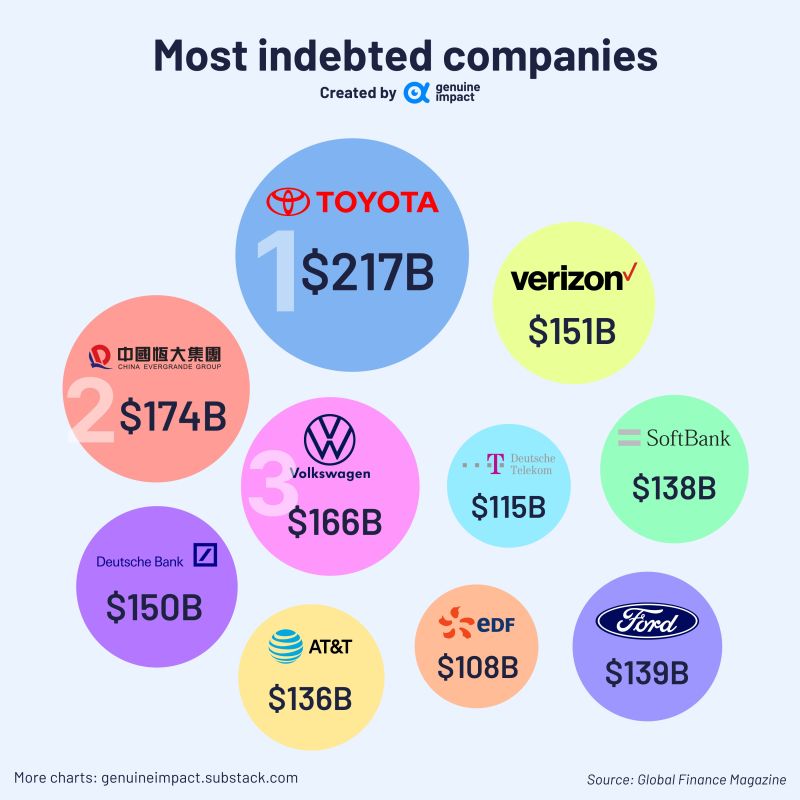

At the time of rising bond yields, here's a list of teh most indebted companies in the world by Genuine Impact

🚗Toyota Group is the most indebted company globally in 2023. 🏠While Evergrande Group, one of China’s biggest property developers, has lower debt than Toyota, its performance is significantly inferior to Toyota. It recently faced a debt crisis and is on the verge of collapse.

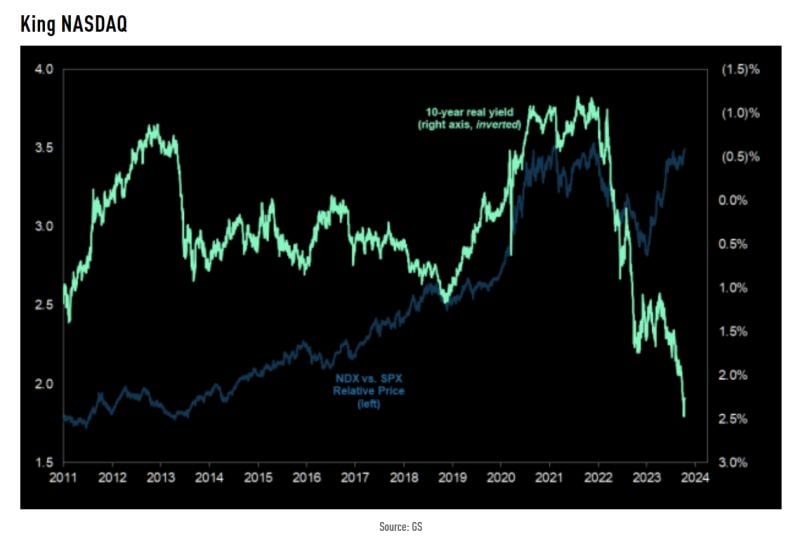

Wondering why high interest rates hasn't hurt sp500 performance so far?

Just have a look at the chart below courtesy of Linas Beliūnas. The S&P 500 heavy weights are full of cash and have been benefiting from the higher yield paid on short-term deposits. E,g Apple is making $1 billion on their cash holdings doing absolutely nothing...

Investing with intelligence

Our latest research, commentary and market outlooks