Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

US Treasuries were bid this week due to the search of "safe havens" on the back of Middle East turmoil

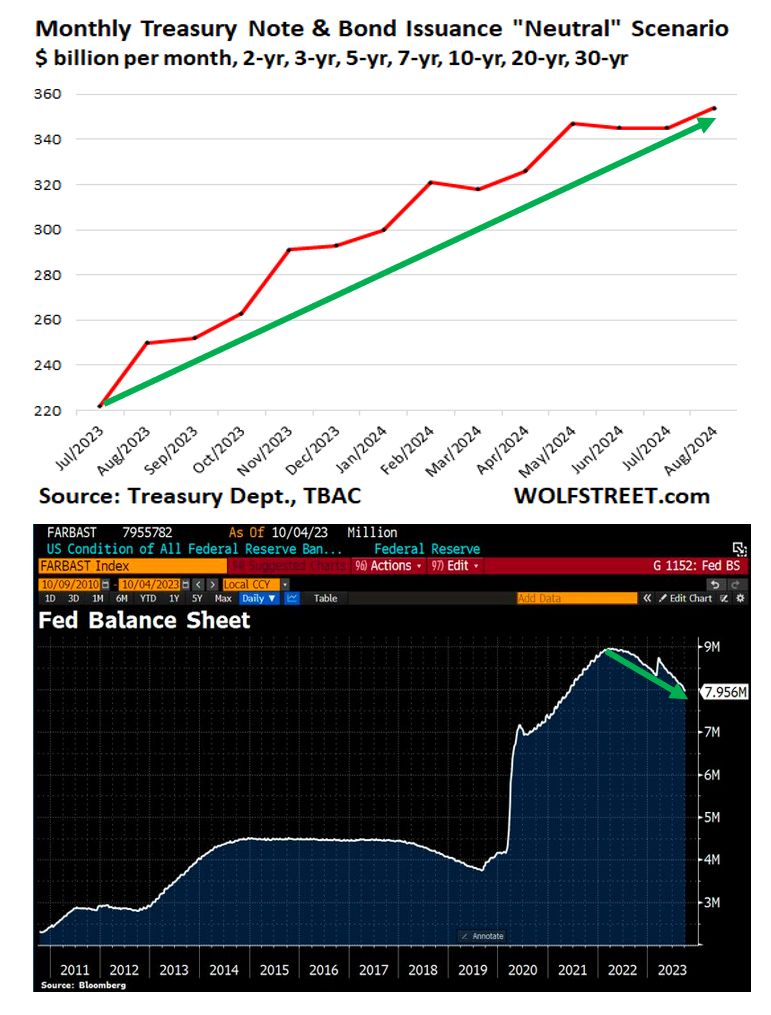

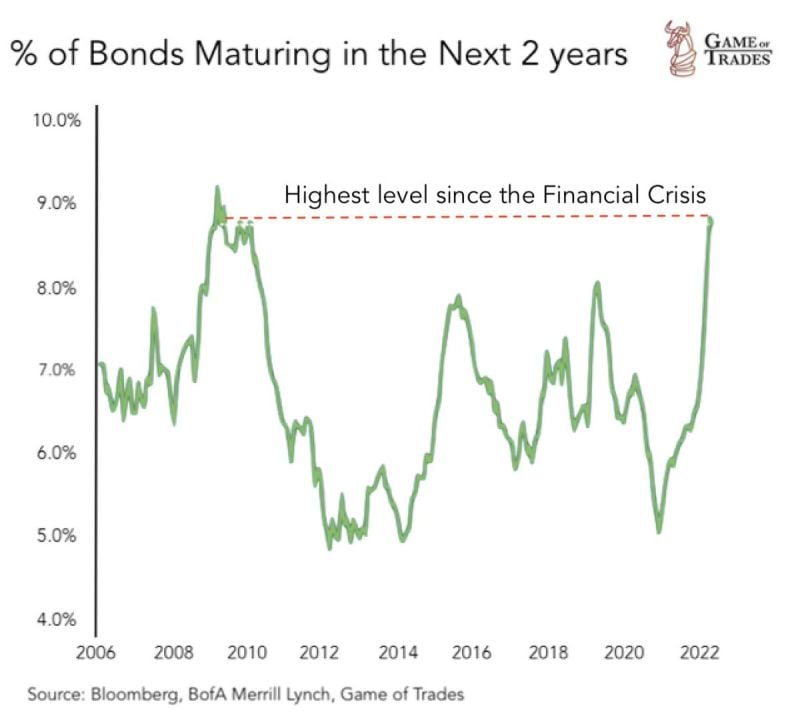

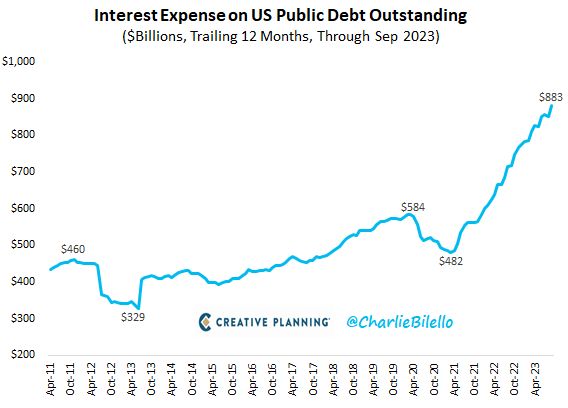

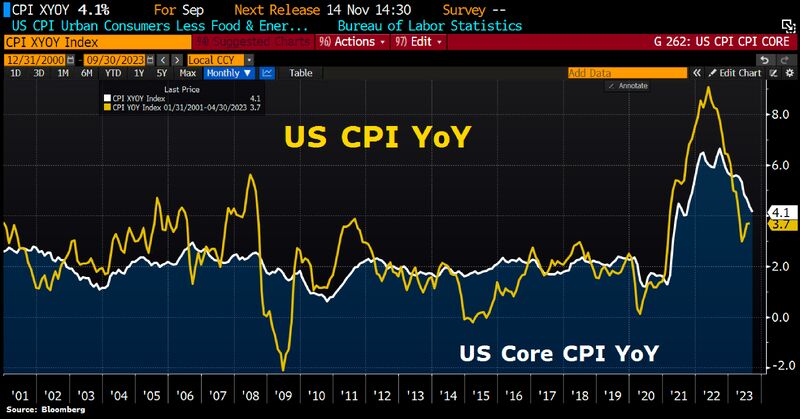

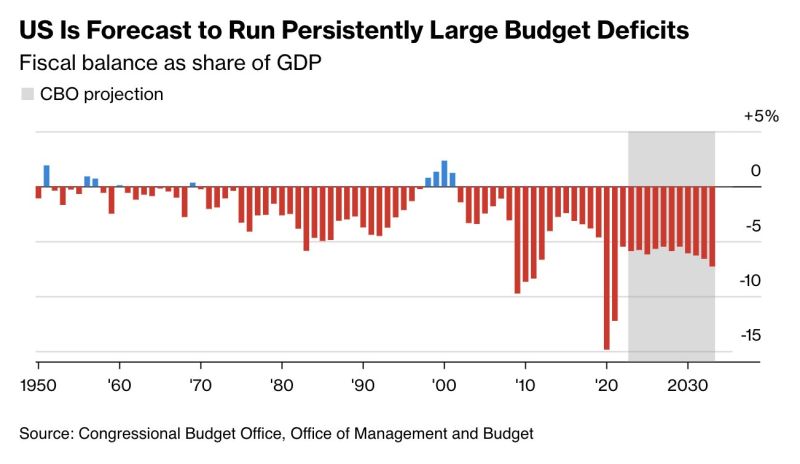

However, ugly auctions on Thursday came as a harsh remainder of the unfavourable supply/demand situation faced by US Treasuries. On the supply side, there is a tsunami of notes and bonds that is going to flood the market. And it is occurring while the Fed, under its QT program, is letting about $60 billion a month in maturing Treasury securities roll off the balance sheet without replacement. With the Fed reducing its holdings, that tsunami of notes and bonds being issued will have to find buyers, and those buyers will have to be enticed by yields. Unless inflation and growth slow down meaningfully, yields are unlikely to drop aggressively. Source: www.wolfstreet.com, Bloomberg

Big opportunities ahead for fixed income investors?

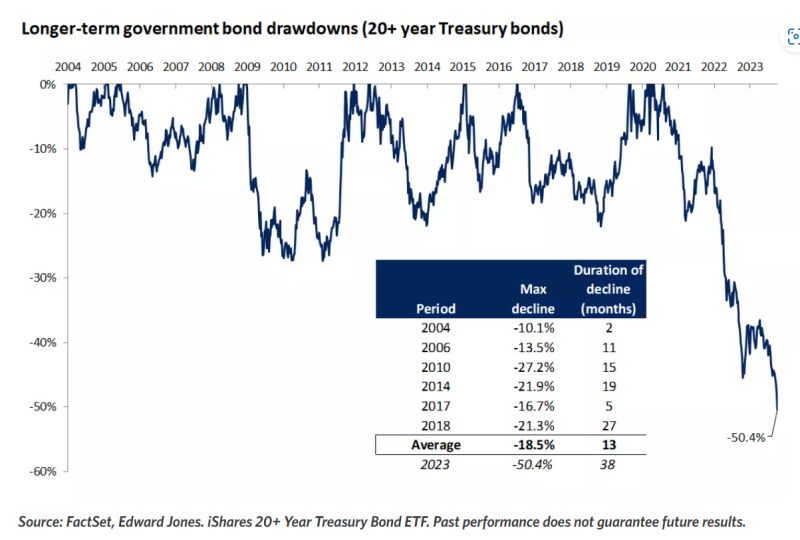

The past three years' pain in bonds could indeed be setting the stage for outsized gains ahead. To put the decline into perspective, long-term government bonds, with maturities greater than 20 years, have dropped 50% from their 2020 peak, a drawdown that is comparable to the 56% decline in stocks during the height of the Global Financial Crisis in 2008 Source: Edward Jones

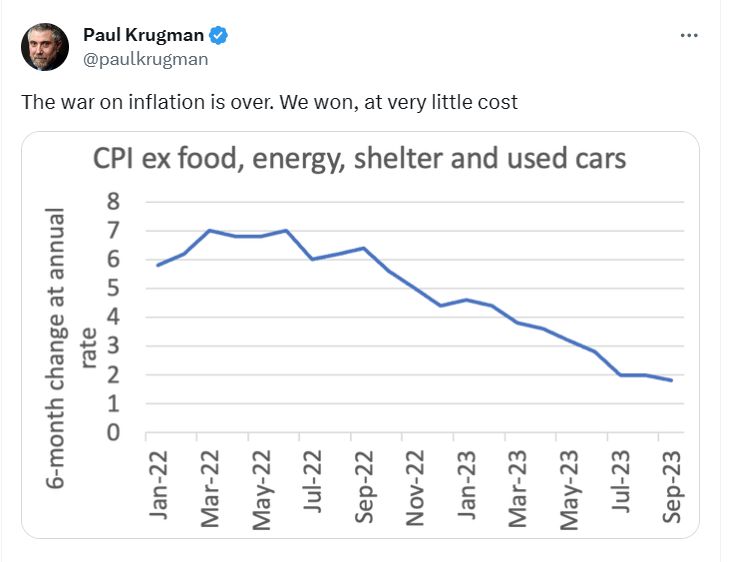

Good news :)

If you exclude everything you need from the basket, the war against inflation is won...

Investing with intelligence

Our latest research, commentary and market outlooks