Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

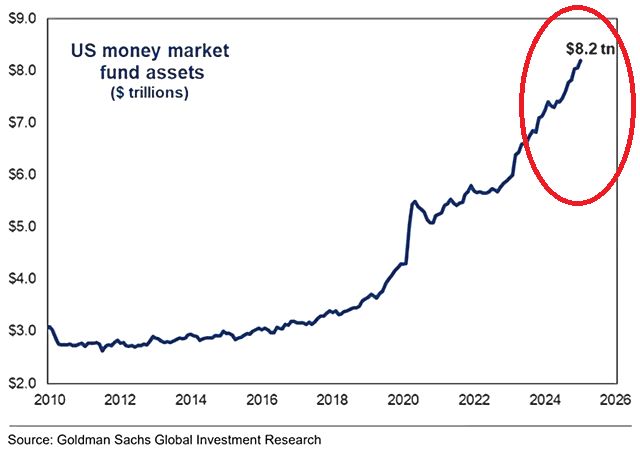

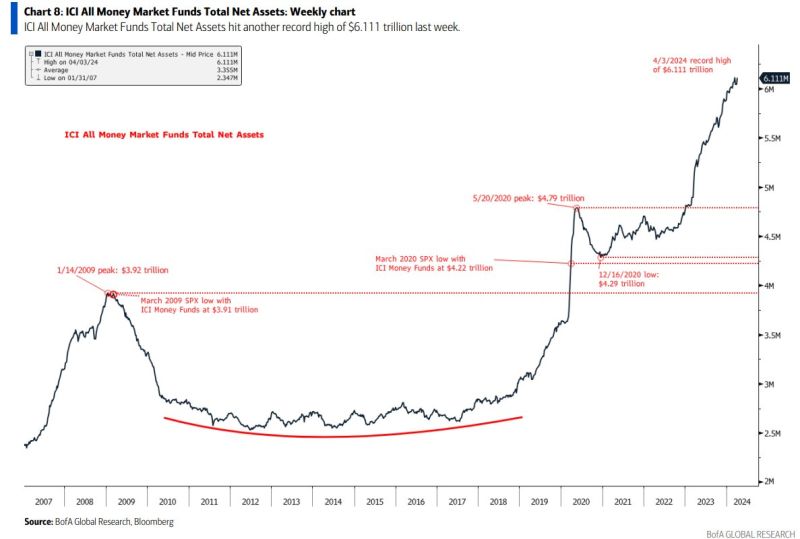

⚠️US money market fund assets jumped to a record of $8.2 TRILLION.

This comes as people expect the Fed to pause rate hikes for a few months. We have to remember, this is not money on the sidelines. Moreover, most of this cash has never been in and never will go to stocks. Last but not least, while the ABSOLUTE number is at record high, the RELATIVE number (cash as a percentage of total assets) is near record low. Source: Global Markets Investor, Goldman Sachs

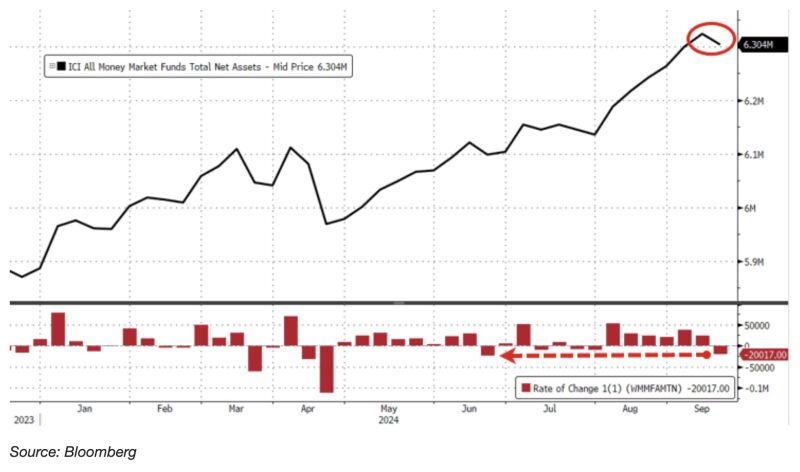

Money Market Funds saw a weekly outflow of $20 billion, the largest weekly outflow since June

Source: Barchart, Bloomberg

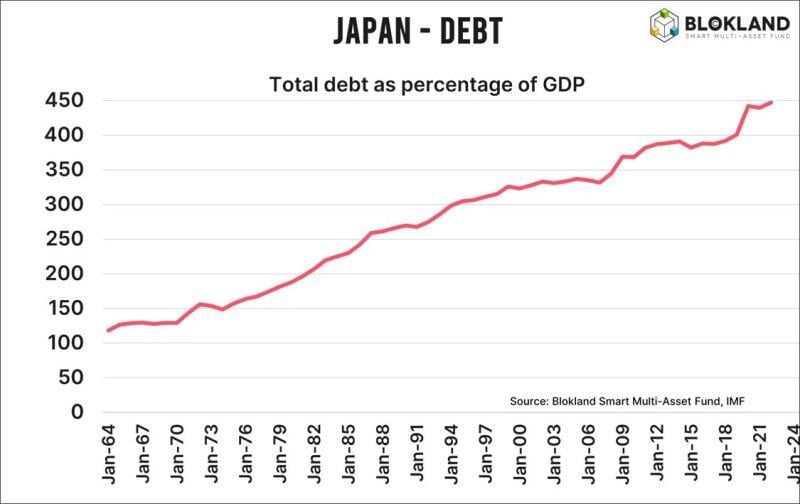

This is the ultimate reason why the Bank of Japan ‘needs to maintain monetary easing.’ DEBT

i.e the yen carrytrade is likely to resume sooner rather than later Source: Jeroen Blokland

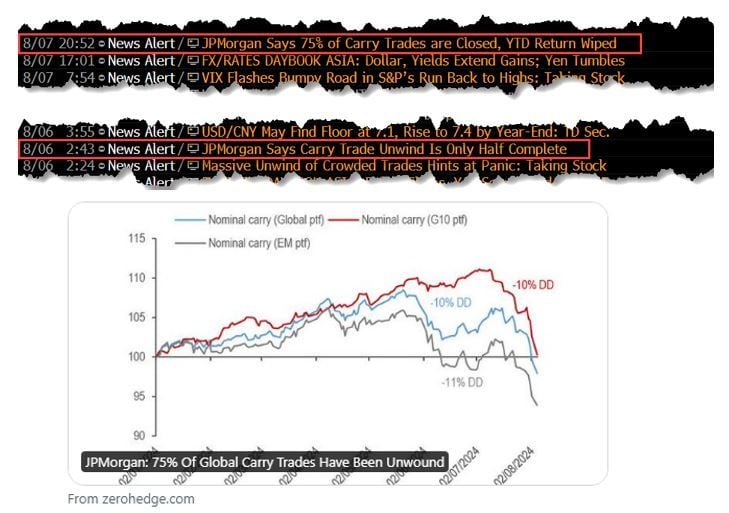

JPMorgan: 75% Of Global Carry Trades Have Been Unwound

(yesterday they said that the unwinding was only half completed...) Source: www.zerohedge.com

Money market fund levels to record high of $6.111 trillion

Source: WinfieldSmart

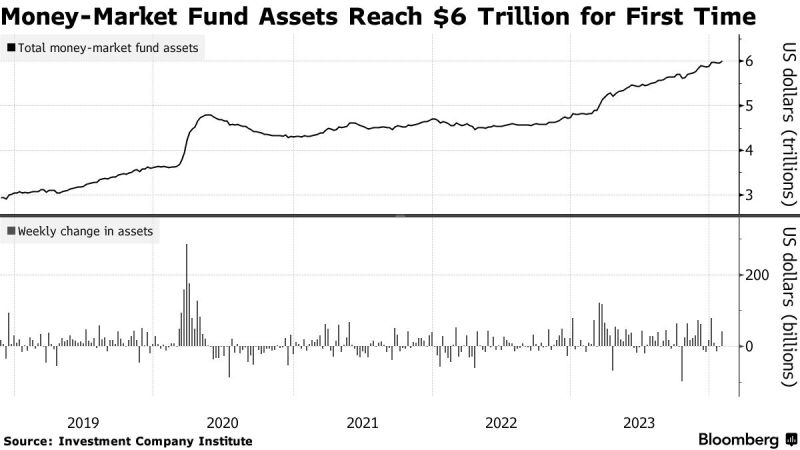

Money-market fund assets rose to a fresh record high on expectations short-term rates will remain elevated for longer.

Total assets rose to $6.108tn from $6.077tn the week prior. Source: HolgerZ, Bloomberg

Money-Market Fund Assets Reach $6 Trillion for First Time

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks