Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

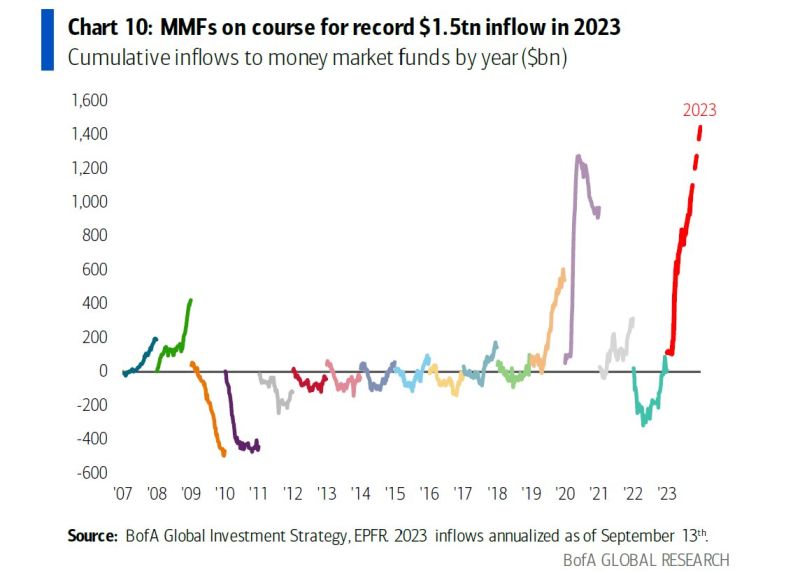

Money markets are on track for a record $1.5 trillion inflow in 2023

Source: BofA

US money-market assets have reached a new record of $5.5 trillion

US Treasuries are on course for a record year of inflows as investors chasing some of the highest yields in months pile into #cash and #bonds, according to Bank of America Corp. strategists. Cash funds attracted $20.5 billion and investors poured $6.9 billion into bonds in the week through August 9, strategists led by Michael Hartnett wrote in a note, citing data from EPFR Global. Meanwhile, US #stocks had their first outflow in three weeks at $1.6 billion. Flows into Treasuries have reached $127 billion this year, set for an annualized record of $206 billion, BofA said. The buoyant demand shows how alluring fixed-income markets remain even as the bond rally and economic slowdown many were predicting last year has failed to materialize. The yield on 10-year US Treasuries was trading at around 4.09% on Friday, up from a low of around 3.25% in April, and near a 15-year high touched last year. Source: Bloomberg, Lisa Abramowicz

The decoupling between US money market fund inflows (in green) and bank deposits (in red) continues.

Source: www.zerohedge.com, Bloomberg

The slow-motion US banking crisis is still not out of the woods...

Indeed, US Money Market funds saw a third straight week of inflows ($29 billion this past week) to a new record high of $5.15 trillion...Retail money-market funds saw inflows for the 15th straight week (and institutional funds also saw a second straight week of inflows)... Usage of The Fed's emergency bank bailout facility rose by $606 million to a new record high at $106 billion... And as highlighted on the chart below, the decoupling between money-market fund inflows and bank deposits continues.. Could the current bloodbath in bonds be the catalyst for another round of pain? Source: www.zerohedge.com, Bloomberg

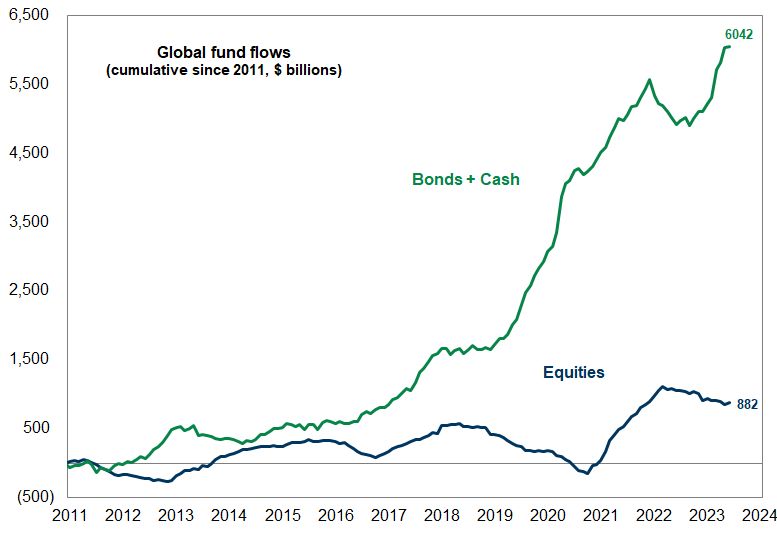

Is this the biggest risk for the equity "bears"

Is this the biggest risk for the equity "bears". As highlighted by Goldman, there is a $5 Trillion “wedge” between Money Market Funds and bonds vs. equities... As investors realize that the much feared recession is not happening, they might be willing to move from the sidelines back into risk assets. Goldman's Rubner calls it a "R.I.N.O market" (Recession In Name Only).

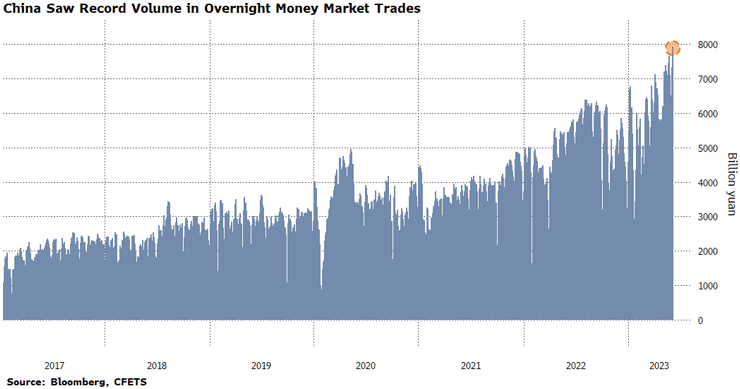

China traders are leveraging up the most on record fluch cash

A gauge of leveraged activity in China’s

money market has notched another record as onshore financial

institutions take advantage of ample liquidity to boost

borrowing.

Turnover of so-called overnight pledged repo trades surged

to an all-time high 7.9 trillion yuan ($1.1 billion) on Tuesday.

An increase in volume may be indicative of banks using cheap

funding costs to buy bonds, even if the transactions also

include the day-to-day financing needs of firms in the market.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks