Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Fund flows do not sound "risk-on" at all...

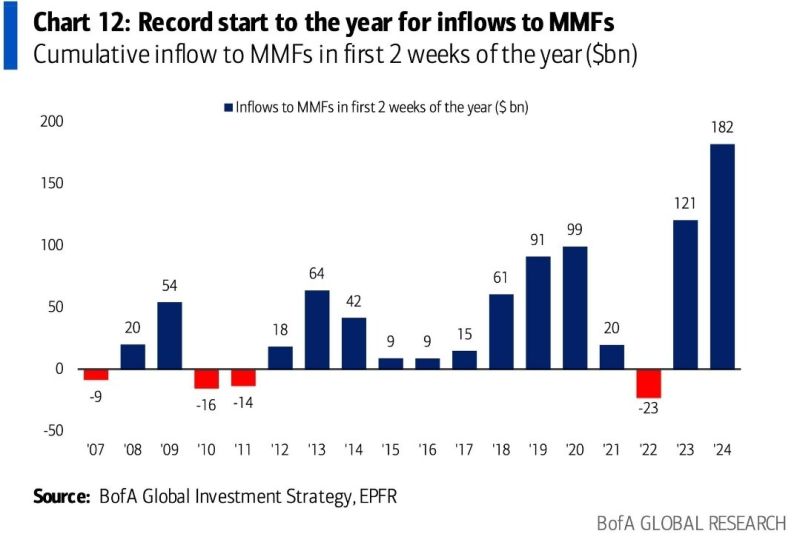

Money Market Funds have seen inflows of $163 billion over the first 2 weeks this year, the highest amount EVER 👇 Source: BofA, Win Smart

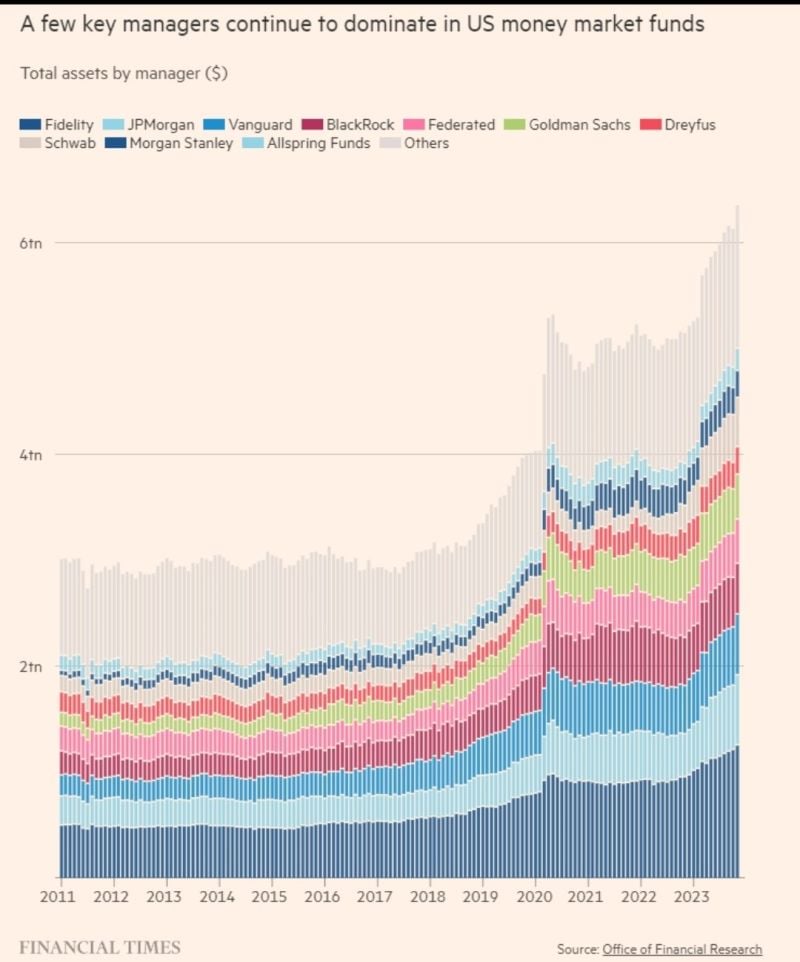

All-Time High $6.3 Trillion sitting in U.S. Money Market Funds

Source: Win Smart, CFA, FT

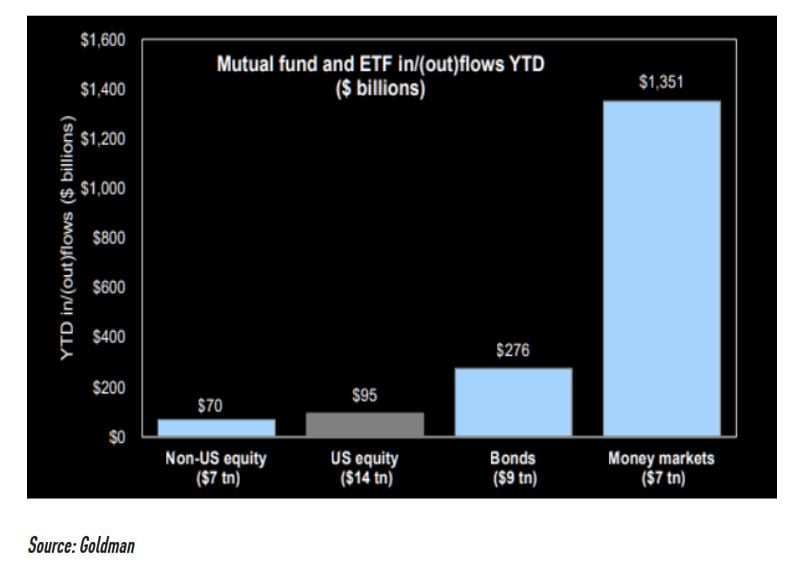

There is significant dry powder on the side line...

In 2023, we saw very limited US equity inflows vs. $1.4 trillion in money market inflows. If the gap starts to close for real now and gains momentum in 2024 it is needless to say a very good support for equities. Source: Goldman

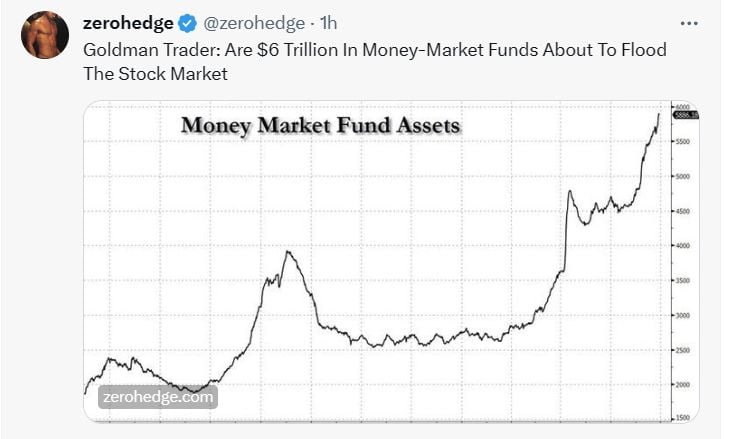

Goldman Trader: Are $6 Trillion In Money-Market Funds About To Flood The Stock Market

.

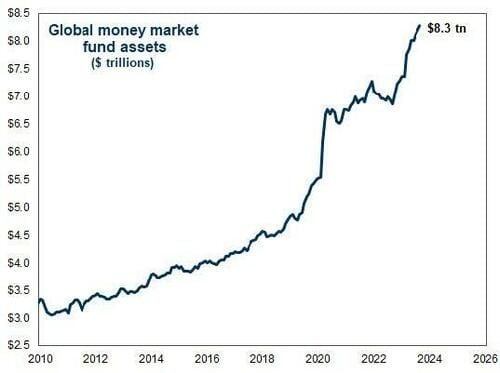

Global Money Market Funds All-Time High 🚨:

A record high $8.3 Trillion is parked in global money market funds according to Goldman Sachs. $5.73 Trillion of this are U.S. based funds. As global central banks cut rates, could this capital find its way back into equities? Source: Barchart

The growth rate of capital being poured into retail money market funds (MMFs) is at its highest level in several decades

Retail MMFs recently surpassed $1.6 trillion; a record high. Source: Koyfin @KoyfinCharts

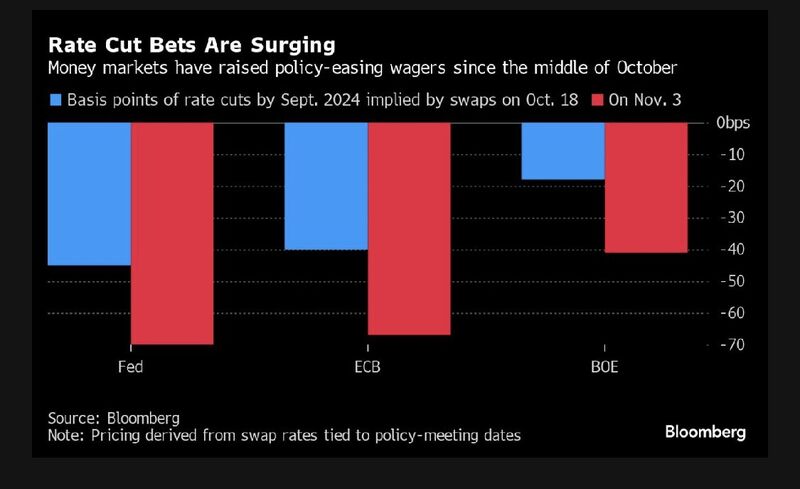

Markets are now betting on big rate cuts next year

This chart shows that money markets have raised policy-easing wagers since the middle of October: by September 2024, the FED should have cut by 70 basis points, the ECB by 65 basis points and the BoE by 40 basis points. (pricing is derived from swap rates tied to policy-meeting dates) Source: Bloomberg

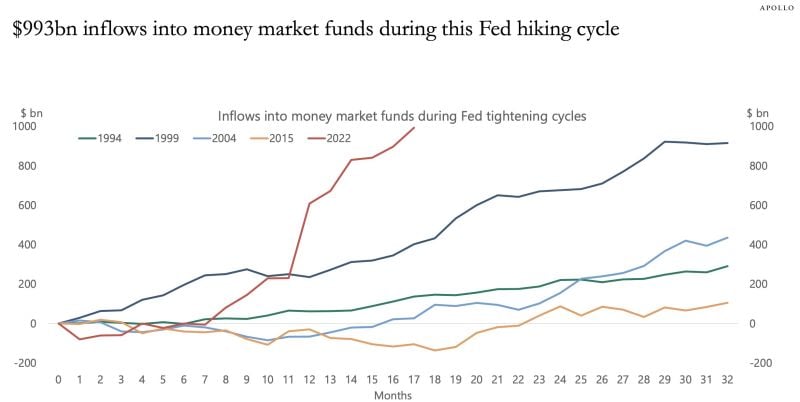

The new safety trade

-> An incredible $993 billion has gone into money market funds since the Fed started raising rates in March 2020. Inflows to money market funds are well ahead those seen in 2015, 2004, 1999 and 1994 rate hike cycles. Why take risk on your "safety" trade when you can make 5% risk-free? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks