Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

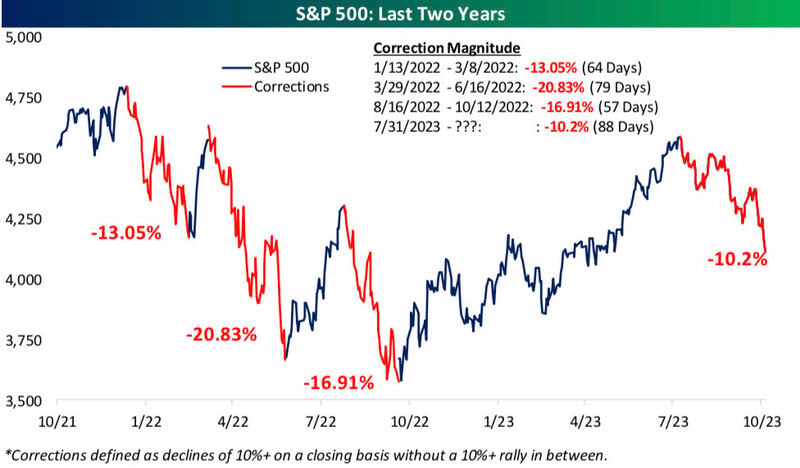

Here’s a look at the four 10%+ corrections we’ve had in the last two years

Just registered 4 last week. How deep will this one end up being? Source: Bespoke

The S&P 500 is now down over 10% from its high in late July, the largest drawdown thus far in 2023

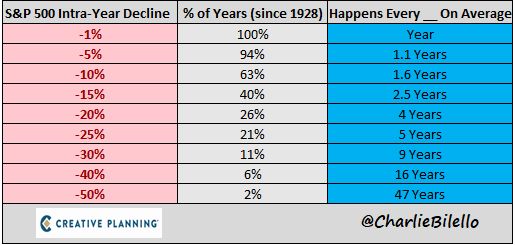

Is such a decline unusual? Not at all according to Charlie Bilello. A 10% intra-year drawdown has happened every 1.6 years on average.

4 of Wall Street's biggest banks have recently plummeted to levels not seen since the devastating March Banking Crisis

YTD losses are staggering, with 📉 ranging from -15% to -24% causing significant concerns for investors & overall market Source: The Coastal Journal

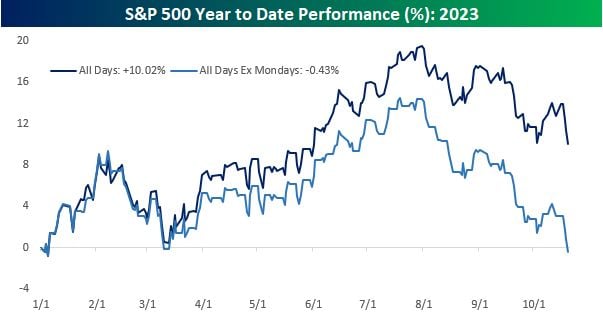

Magnificent Seven? How about Magnificent Mondays?

While the S&P 500 is up over 10% YTD, without Mondays it would be fractionally lower. Source: Bespoke

In case you missed it...

Citigroup $C closed at its lowest price in more than 3.5 years Source: Barchart

LVMH vs Novo Nordisk gap is getting extreme. Is there cross asset logic here, or is it just hot money switching from one ex hot asset to another "must have" asset?

Source: TME, Refinitiv

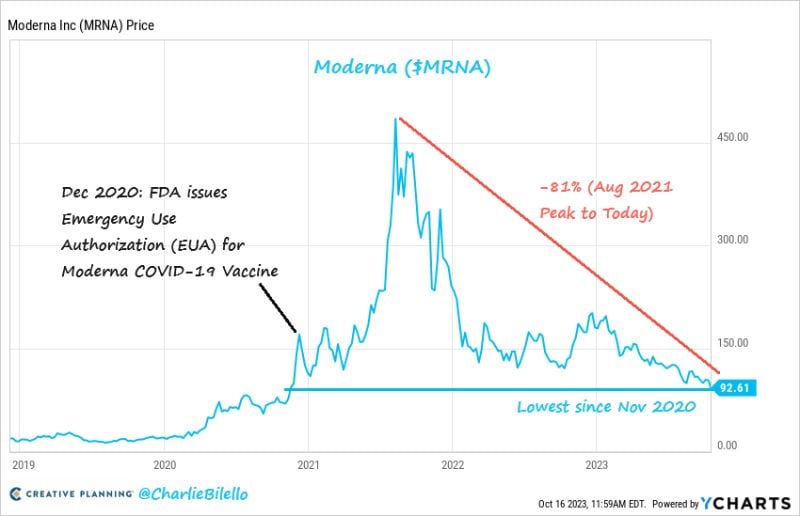

Moderna's stock is now down 81% from its peak and below the price it was trading at when the FDA issued an EUA for its Covid-19 vaccine back in December 2020

$MRNA Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks