Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

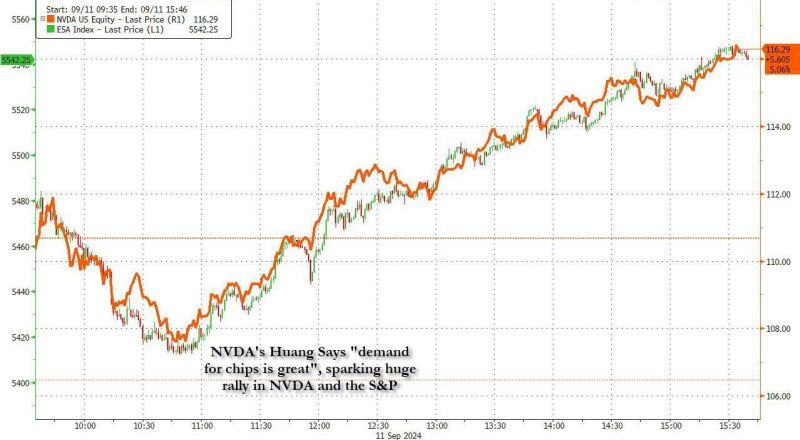

All it took was 5 words... Nvidia's Huang says "demand for chips is great", sparking huge rally in $NVDA and the S&P...

NVIDIA CLOSED THE DAY UP 8%. NVDIA ADDED $220 BILLION DOLLARS TODAY FOR CONTEXT INTEL IS WORTH JUST $80 BILLION NOW THAT MEANS NVIDIA ADDED ALMOST 3 INTELS JUST TODAY 🤯 Source: www.zerohedge.com, GURGAVIN

$ALLY tumbled 17.5% yesterday as auto loan repayments see rising delinquency rates spook investors

More evidence that a growing portion of consumers are increasingly struggling. Source: Markets & Mayhem

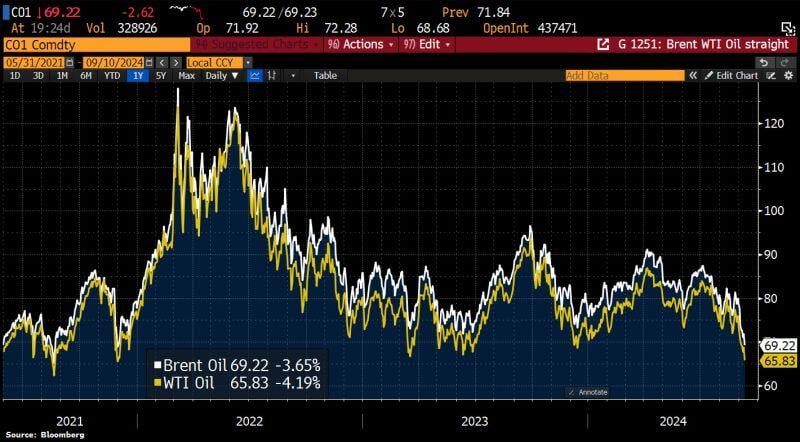

Oil prices tumble to their lowest level since December 2021 on global growth worries.

Brent crude dropped <$70/bbl after the Saudi-led OPEC cut its growth projections for the world's appetite for oil. Source: HolgerZ, Bloomberg

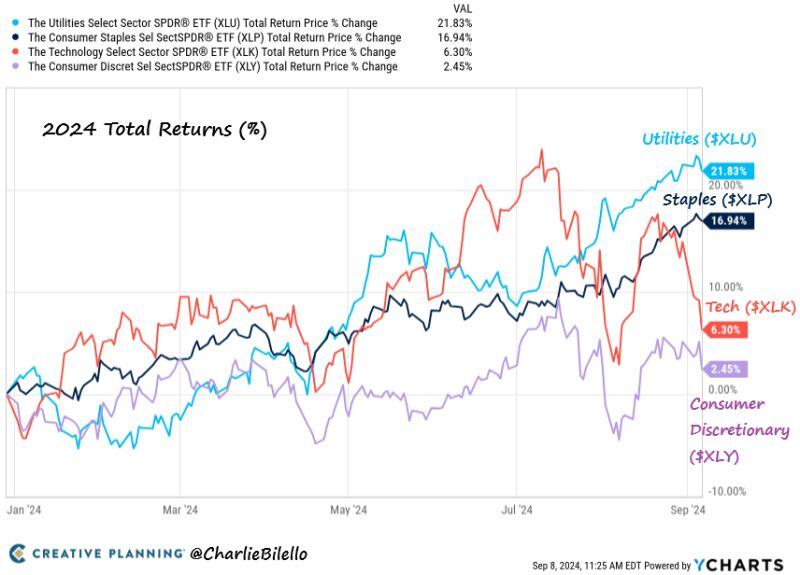

2024 S&P Sector Returns...

Utilities $XLU: +22% Consumer Staples $XLP: +17% Tech $XLK: +6% Consumer Discretionary $XLY: +2% Leadership has turned. This is a big shift from 2023.

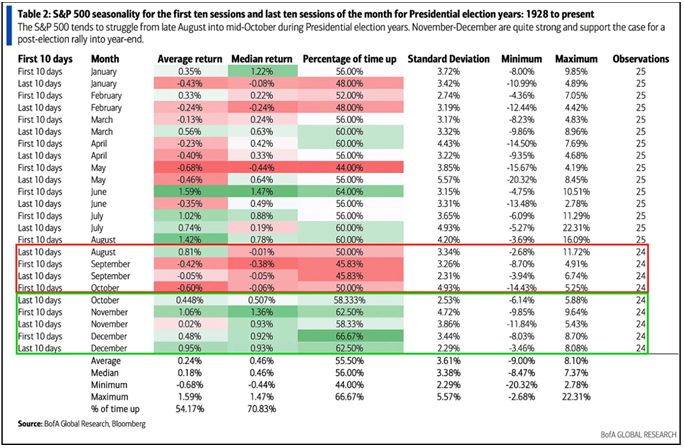

Markets tend to struggle from now until mid-October during Presidential election years

BofA

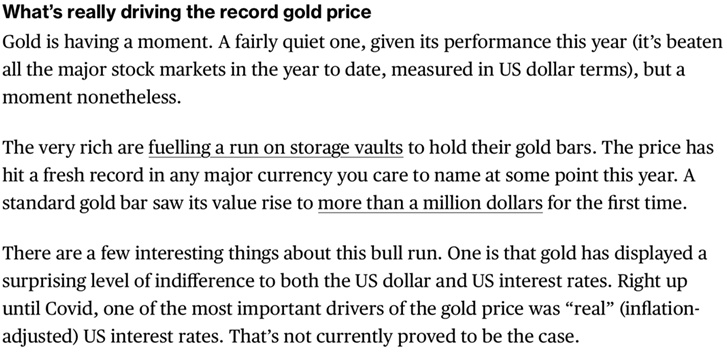

Gold is rising because of demand for "fallback money"

Source: Bloomberg

The current drawdowns across the Magnificent Seven:

• $AAPL Apple: 5.0% • $META Meta: 5.2% • $AMZN Amazon: 11.9% • $MSFT Microsoft: 12.3% • $GOOGL Alphabet: 17.7% • $NVDA Nvidia: 20.3% • $TSLA Tesla: 48.6% Source: Koyfin

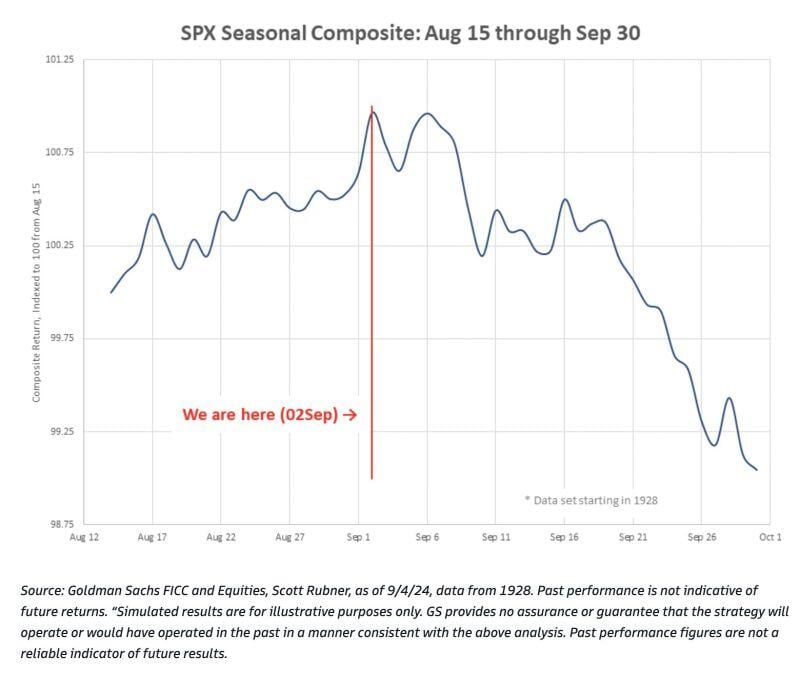

This Goldman chart shows that September is historically weak for global equities and risk assets w/avg return at -2.31%.

Sept 16th has been a seasonal turning point, w/2H Sept being the worst performing 2 weeks of the year, BUT maybe this seasonality gets pre-traded by market participants this year. Goldman says flow-of-funds, such as the quarter-end pension rebalancing can explain the annual weakness in September. Source: HolgerZ, GS

Investing with intelligence

Our latest research, commentary and market outlooks