Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

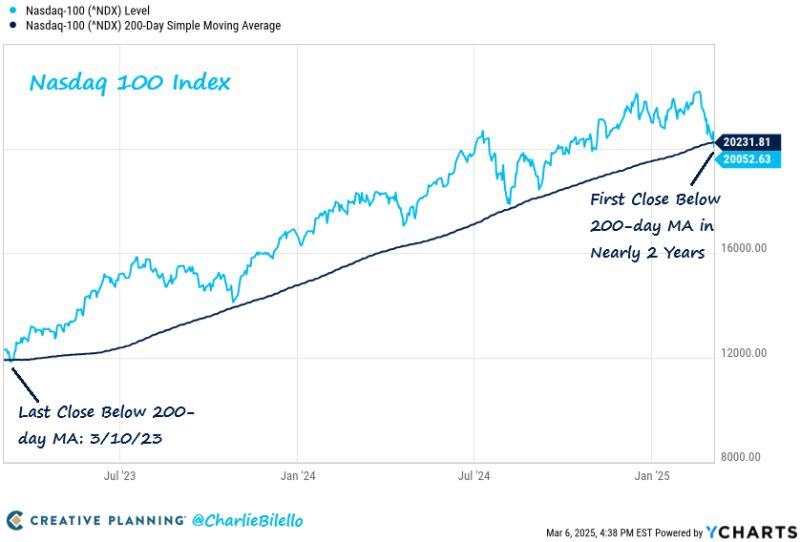

It's official: the 2nd longest uptrend in the history of the Nasdaq 100 Index has ended with the first close below the 200-day moving average in nearly 2 years

Source: Charlie Bilello

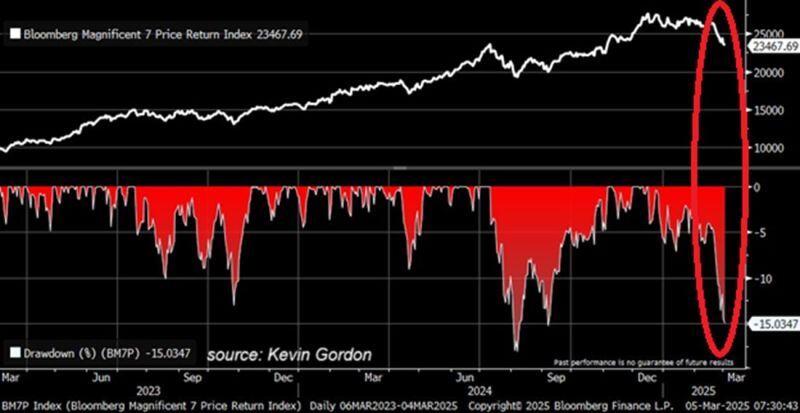

🚨This is getting SERIOUS:

The Magnificent 7 is down over 15% since the peak, nearly matching the early August crash drawdown. 10 days performance: $TSLA -25% $NVDA -21% $AMZN -10% $GOOGL -9% $AAPL -7% $MSFT -5% $AAPL -5% When will we see the capitulation? Source: Bloomberg, Global Markets Investor

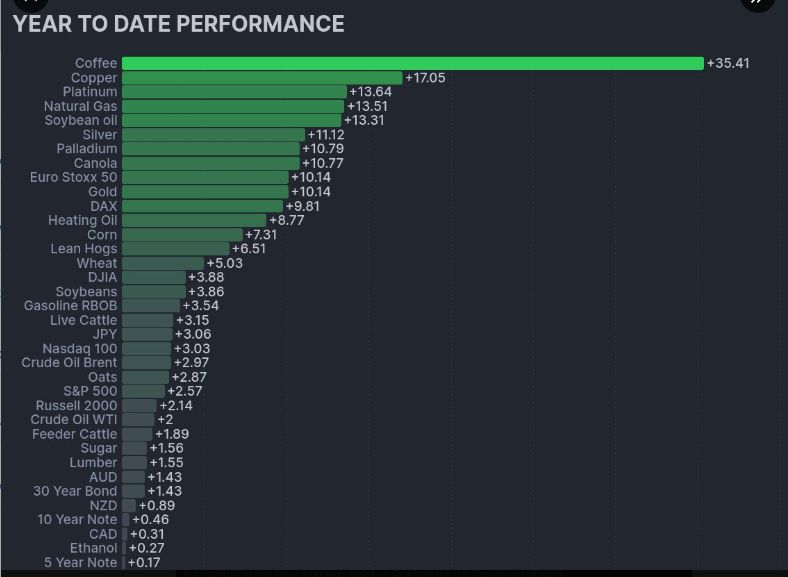

Commodities are enjoying a strong start to 2025

source : markets&mayhem

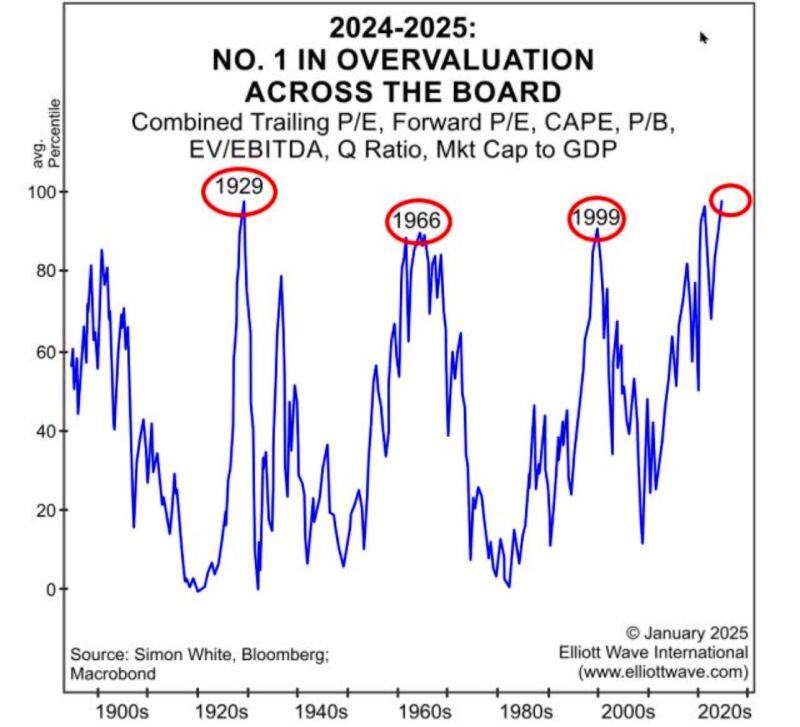

Market valuations are at their highest levels in history, when taking into account multiple methodologies

Source: MacroEdge Vision @MacroEdgeVision

Surprise surprise...

energy has been by far the best-performing sector during the Biden administration. Source: HolgerZ, Bloomberg

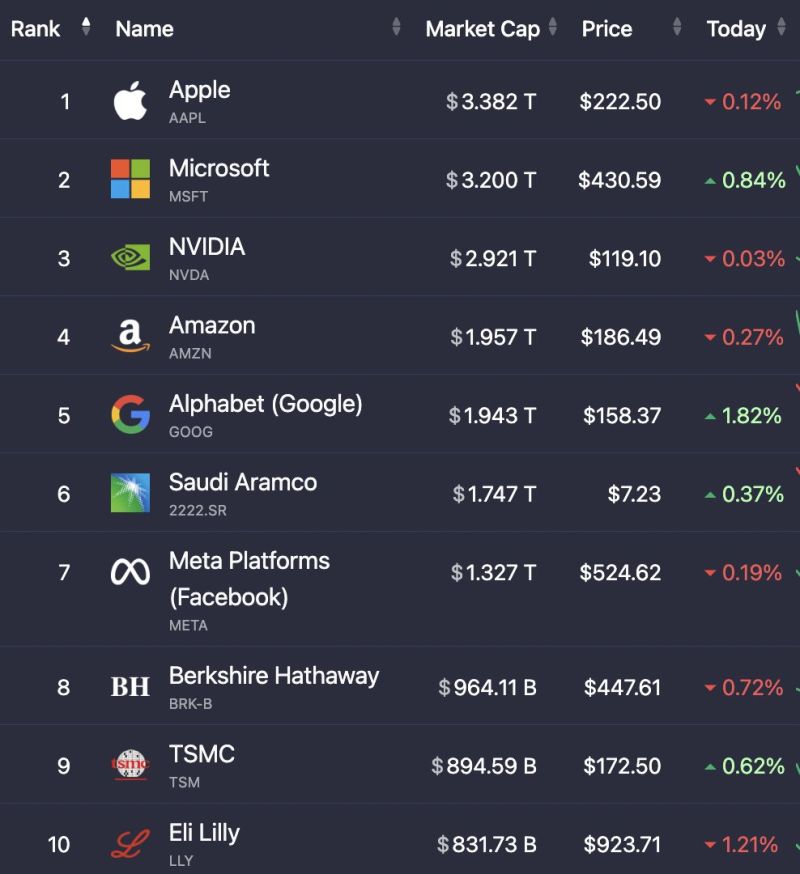

The top 10 largest stocks in the world are now worth a combined $19.17 Trillion up from $18.18T last week

Source: Evan

Goldman Sachs strategists say stocks unlikely to sink into bear market

Source: Bloomberg

$SPX The last two bullish engulfing patterns:

Today and May 31st. Source: Frank Cappelleri

Investing with intelligence

Our latest research, commentary and market outlooks