Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Out of 56 SP500 $SPX 10% corrections since 1928, 22 became bear markets and 34 recovered...

Source: Special Situations 🌐 Research Newsletter (Jay) @SpecialSitsNews

No matter what happens in this world, the markets will always reach all-time highs every single time.

Keep investing. $SPY Source: StockWhale @thestockwhale

The seven most influential names in the market are testing a 1.5 year uptrend.

Source: TrendSpider

Monday was the worst day of the year for the S&P 500 at -2.7%.

It turns out even the best years usually have a bad day. @Ryan Detrick found 22 times >20% for the year and the average worst day in those years was -3.5%. 1997 had a 6.9% worst day and still gained 31% for the year in fact. Source: Carson

The forward PE of the Big Six: Alphabet $GOOGL now trades at 18.6x, below any other member.

Source: Koyfin

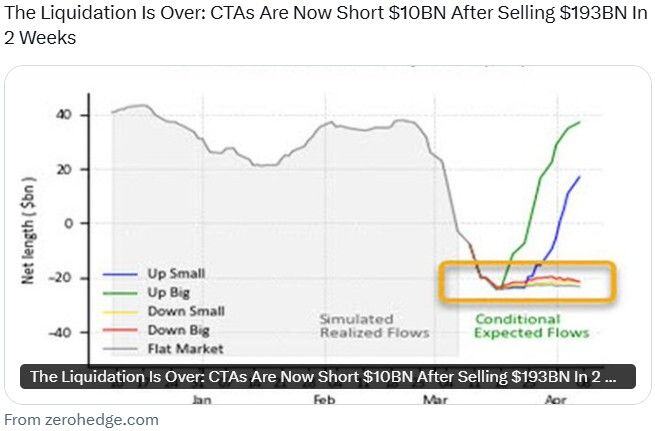

Is the liquidation over?

According to Goldman, CTAs are now short $10BN after selling $193BN in 2 weeks? Source. Goldman, www.zerohedge.com

Behold your new volatility regime...

VIX curve is now inverted: Source: Bloomberg, Tracy Alloway @tracyalloway

Investing with intelligence

Our latest research, commentary and market outlooks