Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Mag7 stocks had their biggest overall marketcap decline ever ($3.3 trillion from its peak)...

Source: www.zerohedge.com, Bloomberg

MONDAY US STOCK MARKET PLUNGE —$1.75 TRILLION WIPED OUT IN A SINGLE DAY

Source: Mario Nawfal

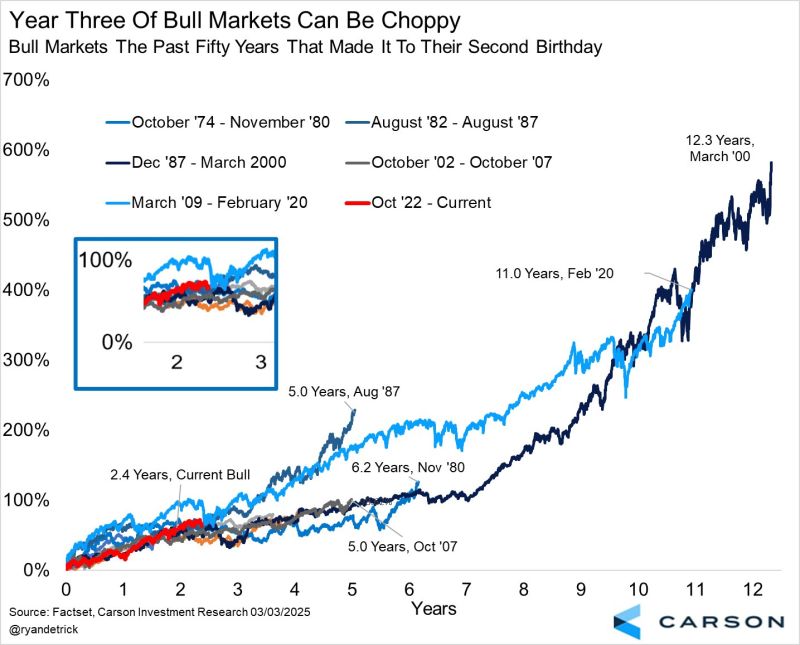

Not all bull markets make it to their third year, but when they do it is perfectly normal to see some chop and frustration.

Source: Ryan Detrick, CMT @RyanDetrick, Carson

Tesla $TSLA IS NOW TRADING -50% OFF ITS HIGHS as Musk says he’s running his businesses ‘with great difficulty,’

Source: CNBC, Trend Spider

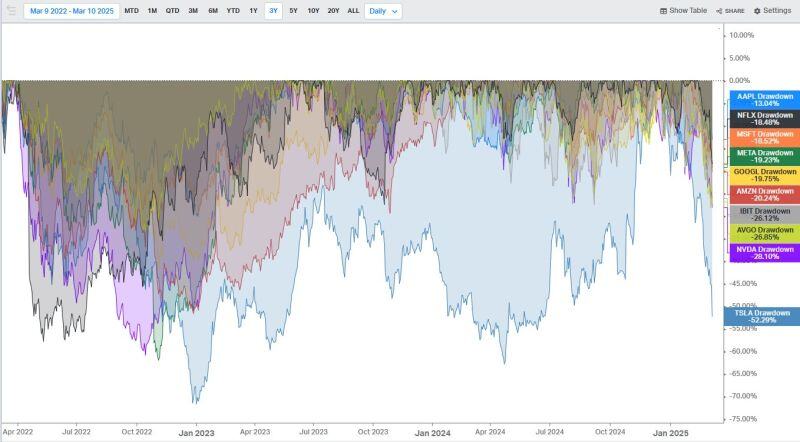

Magnificent drawdowns

$AAPL -13% $NFLX -18% $MSFT -19% $META -19% $GOOGL -20% $AMZN -20% $IBIT bitcoin -26% $AVGO -27% $NVDA -28% $TLSA -52% Source: Mike Zaccardi, CFA, CMT, MBA

Germany is becoming great again thanks to Donald Trump...

Thanks to the decoupling from America and the billions in infrastructure investment that this entails, German stocks are gaining new appeal. Their global stock market capitalization share has climbed to 2.3%, up from well below 2%. But still miles away where it used to be... Source: Bloomberg, HolgerZ

Is there a world where we revisit the COVID low trendline support in 2025?

Hard to imagine, but not impossible... 😶 $SPY Source: Trend Spider

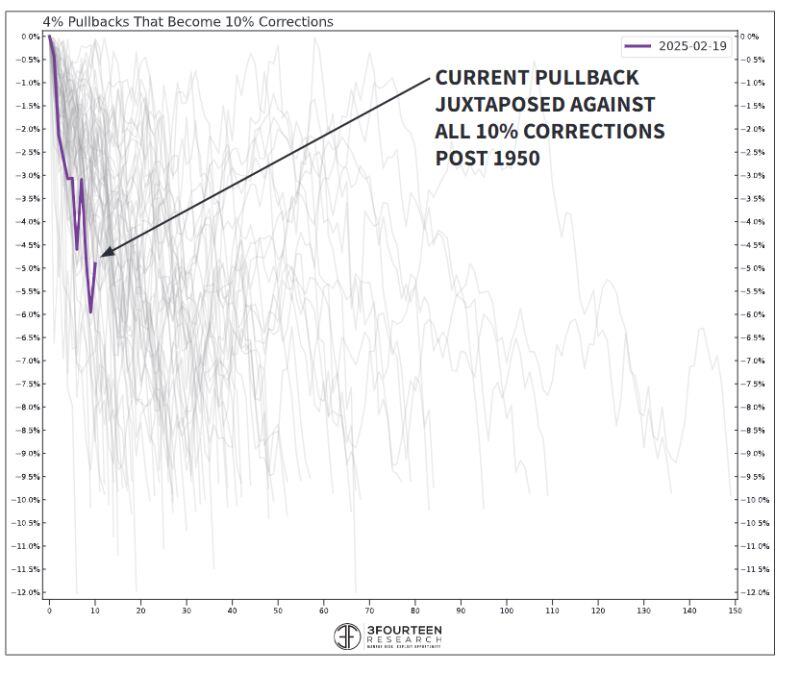

S&P 500 PULLBACK

If the current pullback is going to devolve into a correction, it should happen relatively quickly. Historically, 76% of S&P 500 corrections play out w/i a 60-day window (mid-April). About half are done in <40 days (late-March). Source: 3F Research Group, Warren Pies @WarrenPies on X

Investing with intelligence

Our latest research, commentary and market outlooks