Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

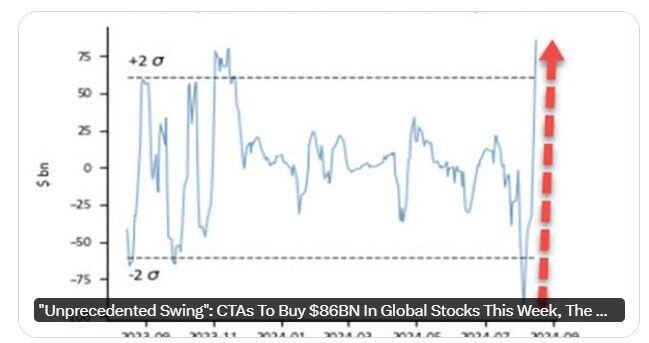

"Unprecedented Swing": CTAs To Buy $86BN In Global Stocks This Week, The Most On Record

Source: zerohedge, Goldman

If July is a great month for the Nasdaq, September is not

Source: Bloomberg, zerohedge

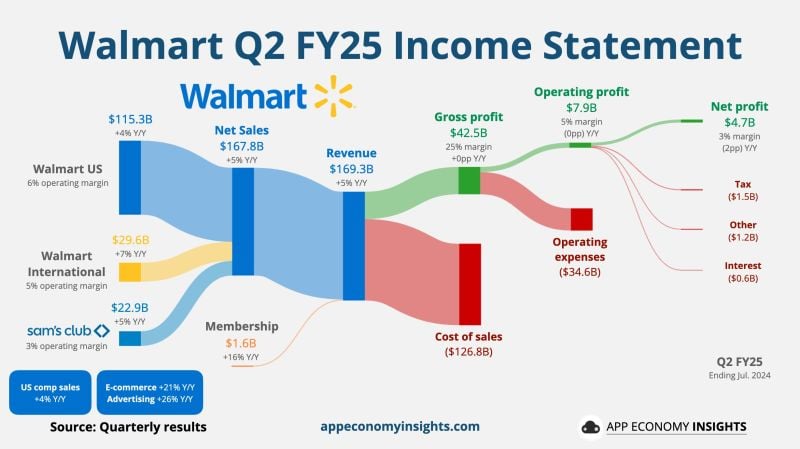

$WMT Walmart Q2 FY25 (ending in July):

• Revenue +5% Y/Y to $169.3B ($1.9B beat). • Non-GAAP EPS $0.67 ($0.02 beat). • Walmart US comp sales +4%. • E-commerce +21% Y/Y. • Advertising +26% Y/Y. FY25 Guidance: • Net sales +3.75% to 4.75% Y/Y (0.75% raise). Source: App Economy Insights

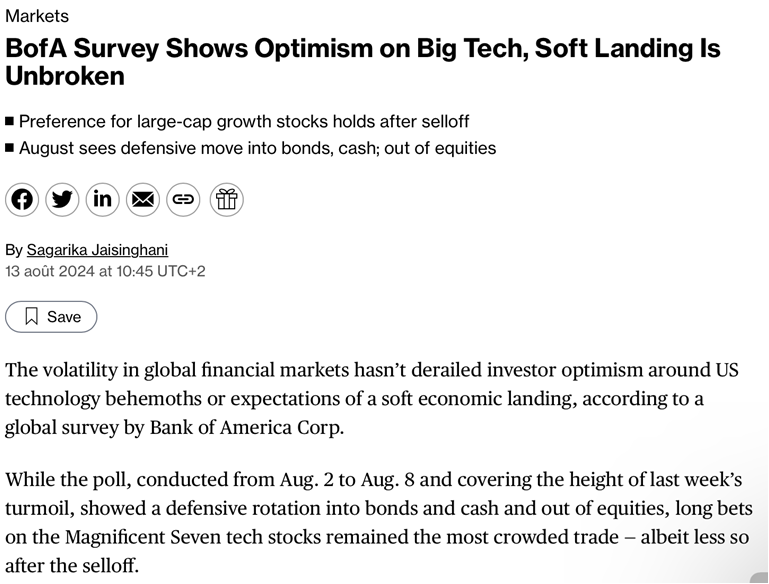

Bank of America survey shows continued optimism on Big Techs

Source: Bloomberg

There's the rest of the market .. and then there's $NVDA

Source: Markets & Mayhem

After posting its worst and best day in over a year, the S&P 500 just closed the week down 2 POINTS.

That's a 0.04% decline in a week when the $VIX hit 65... Source: The Kobeissi Letter, Bloomberg

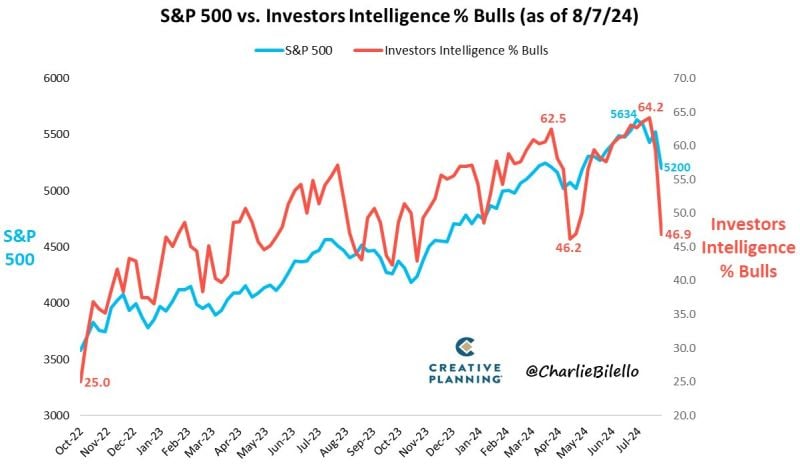

The % of Bulls in the Investors Intelligence Sentiment Index moved down over 17% in the past 2 weeks (from 64.2% to 46.9%)

That's the biggest 2-week % drop in Bulls since the October 1987 crash. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks