Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Crude Oil closed below $70 a barrel today for the first time since last December and is now down 3% on the year.

Source: Charlie Bilello

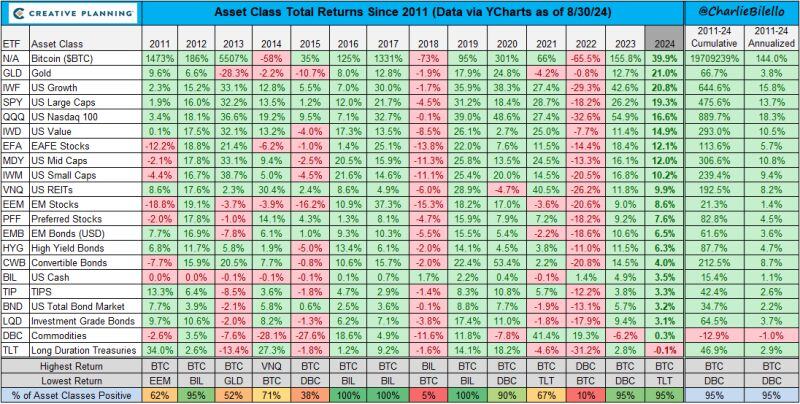

Asset class returns as of end of August and since 2011

Source: Charlie Bilello

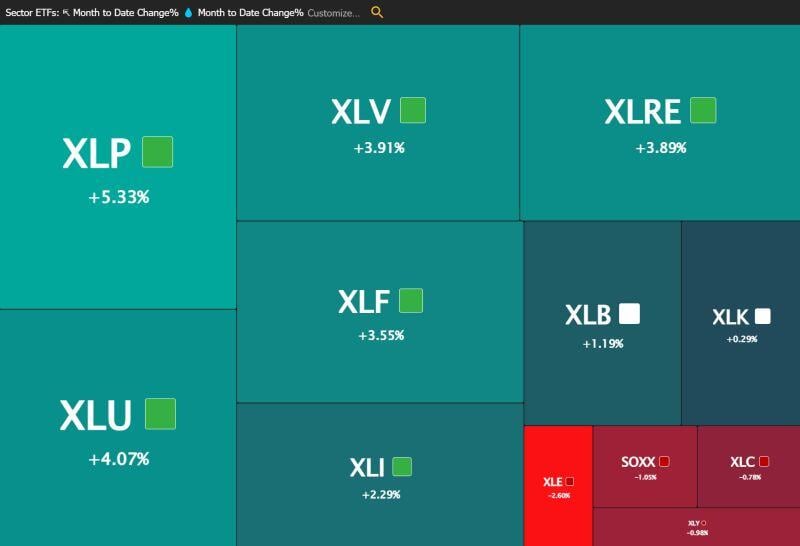

Sector Heatmap Performance for August 🔥

📈 Consumer Staples were the biggest winners $XLP 📉 Energy was the biggest loser $XLE Source: Trend Spider

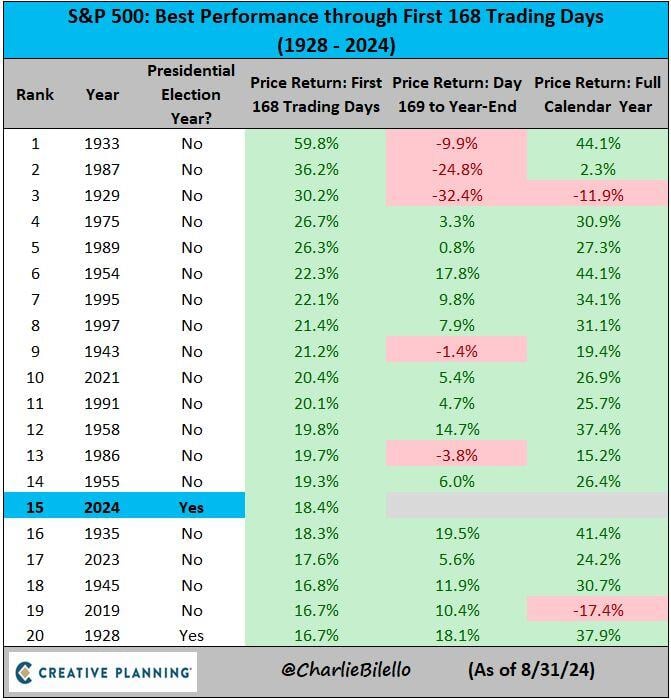

The S&P 500 is up 18.4% in the first 168 trading days of 2024, the 15th best start to a year going back to 1928 and best start to a presidential election year ever.

Source: Charlie Bilello

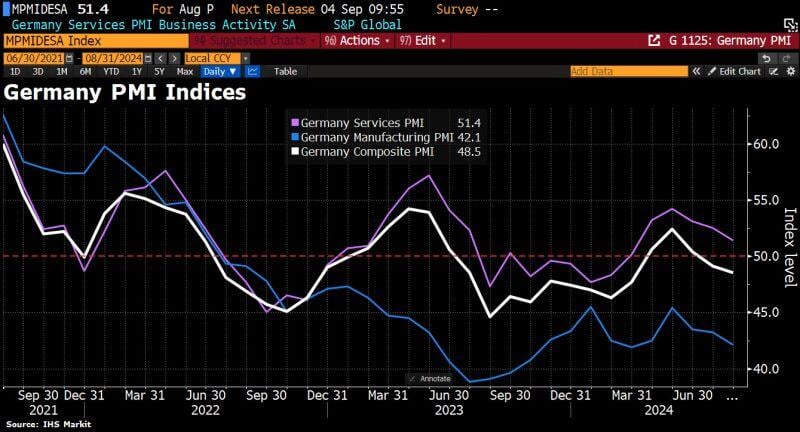

Economic malaise deepens in Germany

German private sector falls deeper into contraction, flash PMI shows. German Composite PMI Index dropped to 48.5 in August, a 5mth low, down from prior 49.1 and below the expected 49.2. Manufacturing PMI fell to 42.1 from 43.2, below the consensus estimate of 43.5. On the services side, the PMI also hit a 5mth low of 51.4, compared w/prev reading of 52.5 and analysts forecast of 52.3. The report adds to evidence that Germany's recovery has fizzled out. GDP unexpectedly contracted by 0.1% in Q2, and analysts polled by Bloomberg predict barely any expansion at all over the whole of 2024. Source: Bloomberg, HolgerZ

Here's a look at the 30 best performing S&P 500 stocks over the last 20 years since Alphabet $GOOGL IPO'd

NVIDIA $NVDA is on top followed by Apple $AAPL, Netflix $NFLX and then Monster Beverage $MNST. Alphabet ranks 11th just behind Salesforce $CRM. Source: Bespoke

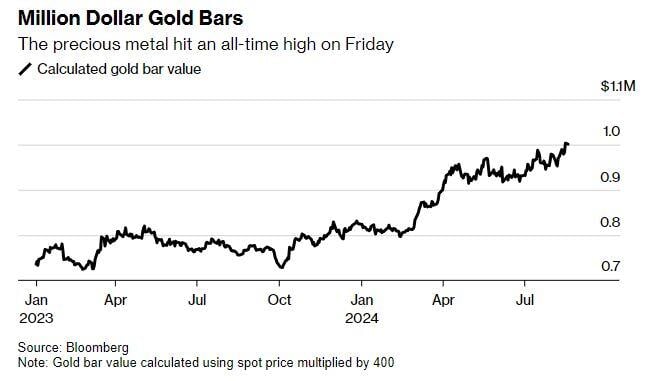

One Million dollar baby... For the first time in history, a Gold Bar is worth $1 million

Source: Barchart, Bloomberg

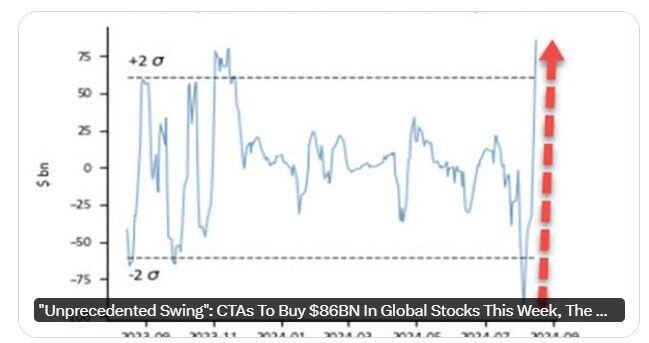

"Unprecedented Swing": CTAs To Buy $86BN In Global Stocks This Week, The Most On Record

Source: zerohedge, Goldman

Investing with intelligence

Our latest research, commentary and market outlooks