Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

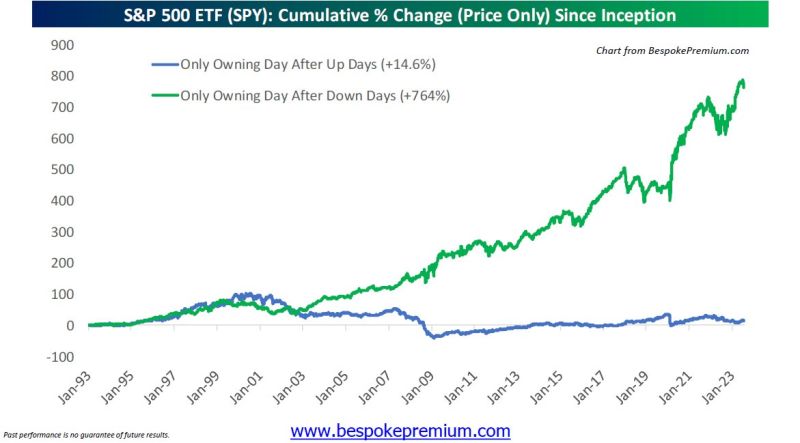

Remember, nearly all of the S&P 500 ETF's $SPY gains since its inception have come from the day after down days. A good reminder after the two red days we've seen to start the year

Source: Bespoke

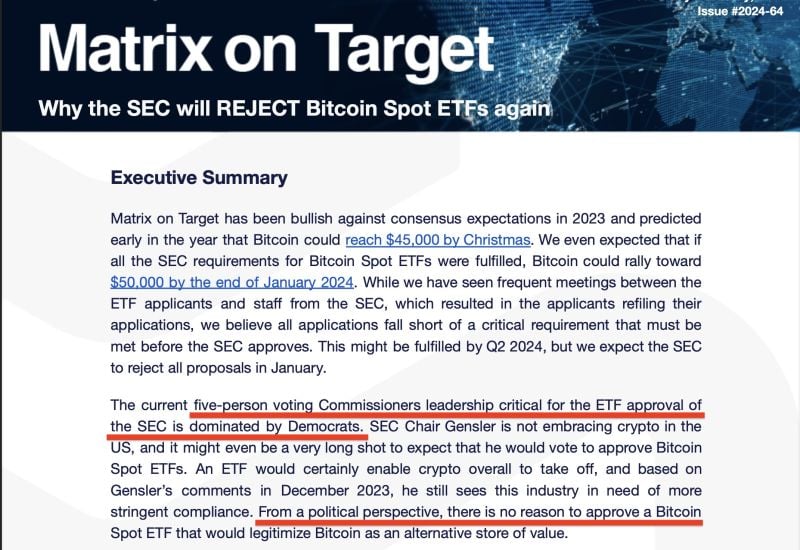

UPDATE -> Bitcoin $BTC price dumped 9% in 1 hour on the basis of a report by Matrixport predicting an SEC rejection of ALL Bitcoin ETF applications

Their justification? Politics. - 5 voting commissioners are Democrats. - Democrats don't like 'crypto'. - Applicants haven't satisfied the SEC's requirements. - There is not political justification to approve a Bitcoin ETF. Eric Balchunas continues to give a +90% chance of approval due to a number of factors, especially the SEC's significant change in behaviour by way of engaging with applicants and providing them with guidance on updating their applications. Source. Bitcoin Archive

Yesterday Apple $AAPL suffers largest drop since September 6

Source: Barchart

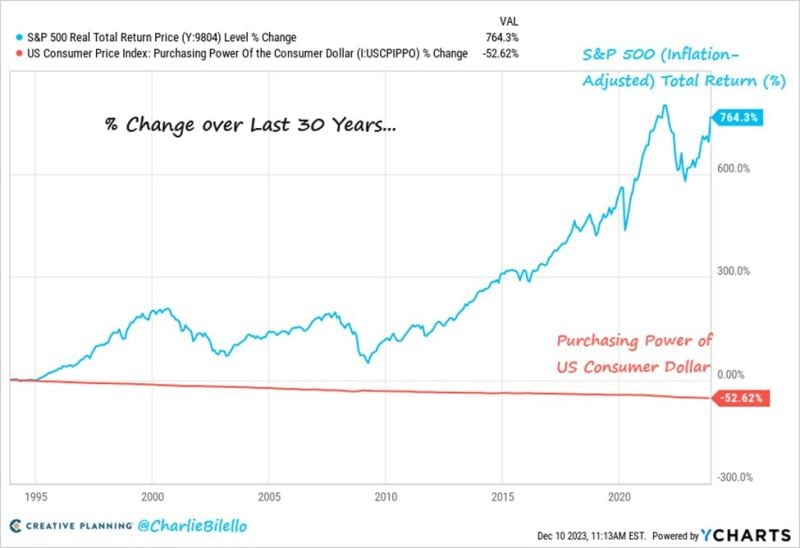

Investing in stocks is one of the best options available to protect your wealth against money debasement

Over time, the purchasing power of the dollar declines, while the stock market increases. That means you need more dollars to buy the same things. If you want to protect your purchasing power, invest in stocks for the long run. Source: Charlie Bilello thru Peter Mallouk

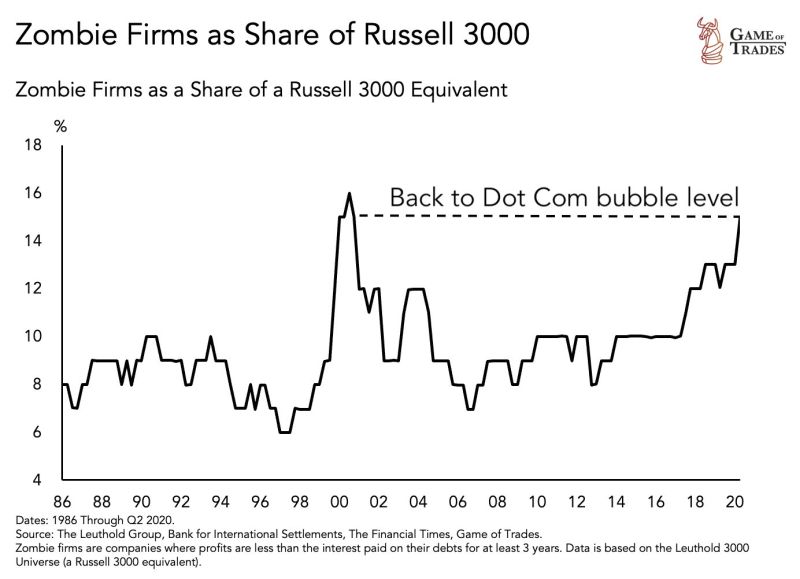

Zombie firms as a % of Russell 3000 is now back to Dot Com bubble levels

Source: Game of Trades

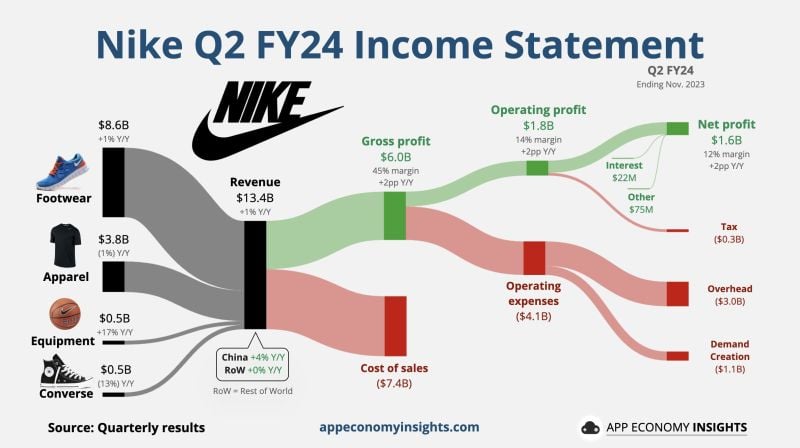

Nike sinks 10% after it slashes sales outlook, unveils $2 billion in cost cuts

Nike on Thursday unveiled plans to cut costs by about $2 billion over the next three years as it lowered its sales outlook. Nike now expects full-year reported revenue to grow approximately 1%, compared to a prior outlook of up mid-single digits. In the current quarter, which includes the second half of the holiday shopping season, Nike expects reported revenue to be slightly negative as it laps tough prior year comparisons, and sales to be up low single digits in the fourth quarter. Below details by App Economy Insigths: $NKE Nike Q2 FY24 (ending Nov. 2023). • Revenue +1% Y/Y to $13.4B ($40M miss). • EPS $1.03 ($0.18 beat). • Inventory -14% Y/Y to $8.0B. • Direct sales +6% Y/Y to $5.7B. • New restructuring to cost ~$0.4B. • FY24 revised revenue outlook +1% Y/Y. Source: App Economy Insigths, CNBC

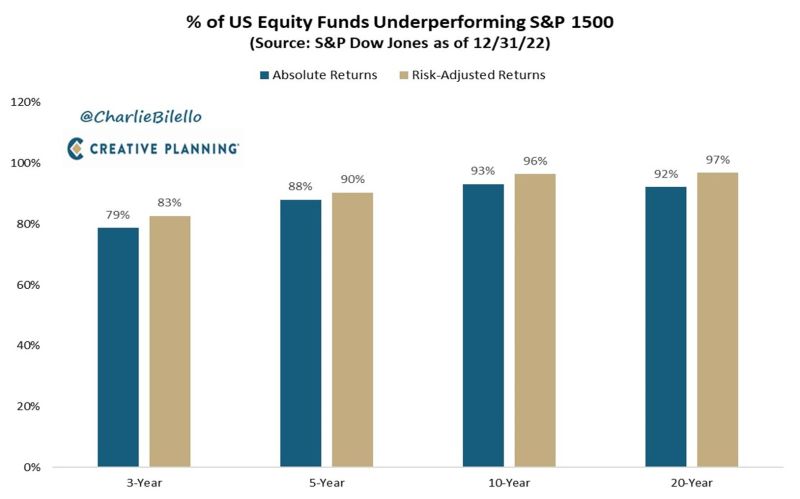

The longer you own an actively managed mutual fund, the more likely you are to underperform the market, especially on a risk-adjusted basis

Source: Peter Mallouk

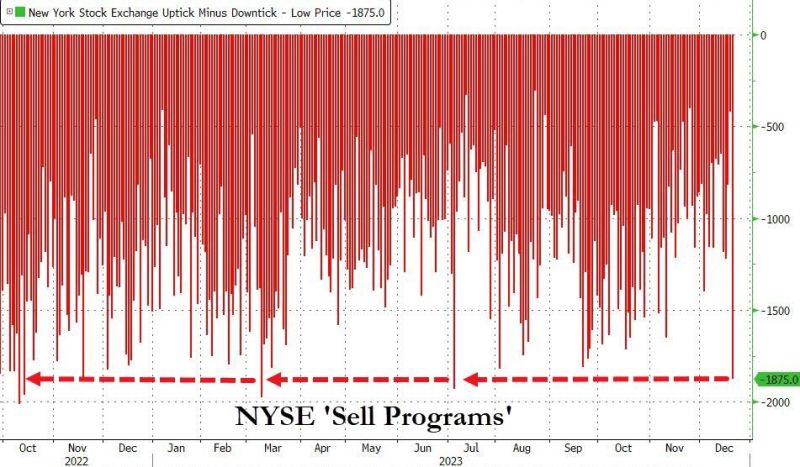

The Dow plunged by 470 points yesterday amid what seems to be a massive sell-program

Indeed, starting around 1430ET yesterday, the biggest sell-program since July smashed Wall Street. For context, this size of selling pressure is unusual... Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks