Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- china

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

There's the rest of the market .. and then there's $NVDA

Source: Markets & Mayhem

After posting its worst and best day in over a year, the S&P 500 just closed the week down 2 POINTS.

That's a 0.04% decline in a week when the $VIX hit 65... Source: The Kobeissi Letter, Bloomberg

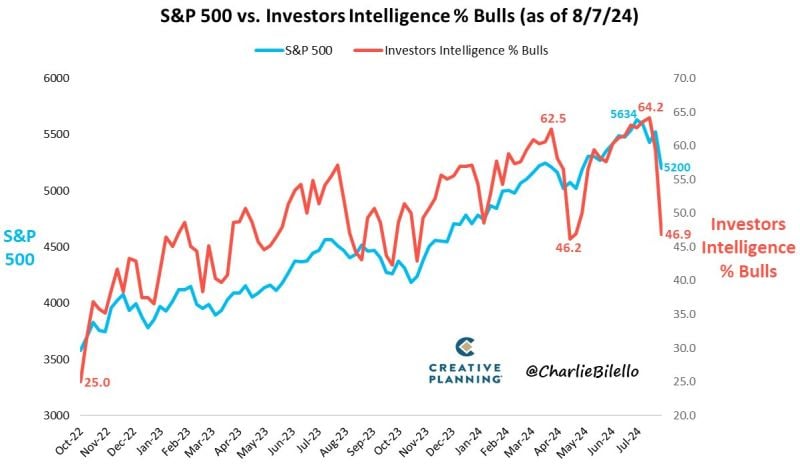

The % of Bulls in the Investors Intelligence Sentiment Index moved down over 17% in the past 2 weeks (from 64.2% to 46.9%)

That's the biggest 2-week % drop in Bulls since the October 1987 crash. Source: Charlie Bilello

The S&P 500 officially posted its best day since November 2022.

Source: Bloomberg, The Kobeissi Letter

China’s imports grew faster-than-expected in July, while export growth came in below forecasts, according to customs data released Wednesday.

U.S. dollar-denominated imports rose in July by 7.2%, far more than the forecast of 3.5%, according to the poll. China’s imports from the U.S. surged by 24% year-on-year in July, according to CNBC calculations of official data. Source: CNBC

NASDAQ FUTURES CLOSE TO TRIGGERING CIRCUIT BREAKER.

The limit-down level for the current $NQ contract is at 17,265.25, or a 6.9% drop from Friday's close. This has not happened since the COVID selloff in March 2020. Source: Trend Spider

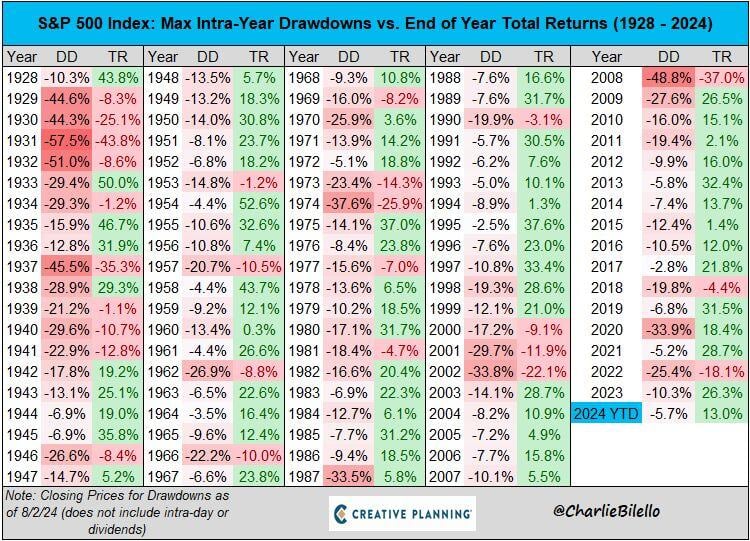

The S&P 500 is down 5.7% from its closing high on July 16, the largest drawdown of the year.

The index is still up 13% year-to-date including dividends. No risk, no reward. $SPX Source. Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks