Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

The gap between the Magnificent 7 and the S&P 493 (remaining 493 companies) is now 63%

This year, the Magnificent7 is up a massive 75% while the remaining 493 companies are up just 12%. Combined, the S&P 500 is up ~25%, more than doubling the S&P 493's total return. In other words, the Magnificent 7 is up 3 TIMES as much as the S&P 500 and ~6 TIMES as much as the S&P 493. Just 7 weeks ago, the S&P 493 was DOWN 2% this year. Source: The Kobeissi Letter

Long-Dated Treasuries have officially entered a bull market after $TLT surged higher by more than 20% from the 16-year low it hit on October 23

Source: Barchart

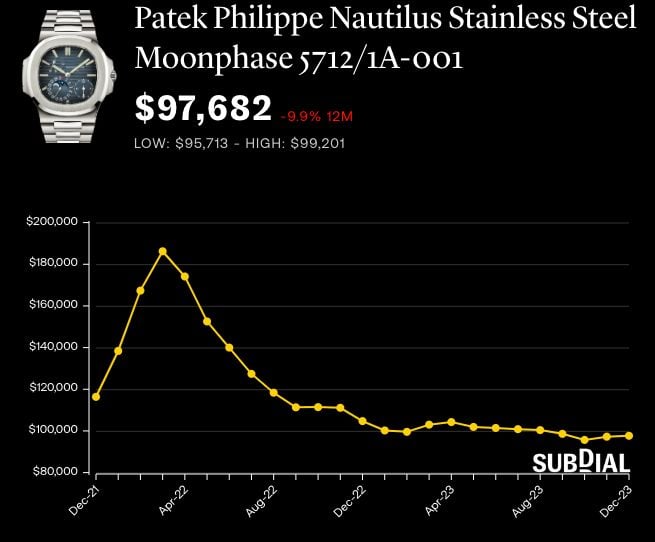

Bottom? Will the Turmoil In Used Rolex and Patek Market End After Fed's Pivot?

Extract from a zerohedge article: The secondary market for pre-owned Rolex and Patek Philippe watches has been spiraling down since peaking in early 2022, mainly because the Federal Reserve ended helicopter-dropping trillions of dollars in stimulus checks and was forced to begin the most aggressive interest rate hiking cycle in a generation to curb inflation. Now, the Fed's bizarre, unexpected pivot this week has spurred hope that a bottom nears for the luxury watch market. Bloomberg spoke with Christy Davis, a co-founder of Subdial, a UK-based secondary watch market dealer and trading platform, who believes the turmoil in the secondary luxury watch market is ending. "As we look toward 2024, the potential for a soft landing of stable and eventually declining rates is reason for optimism in the watch market," Davis said. Source: www.zerohedge.com

Uranium 16-Year High 🚨: Uranium has now surged past $85 per pound for the first time since January 2008

Source: Barchart

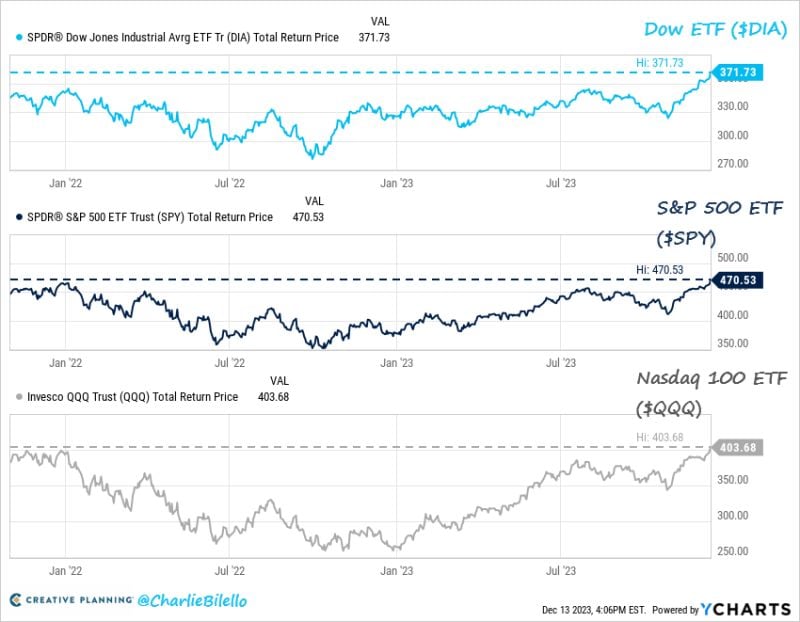

The Dow, S&P 500, and Nasdaq 100 ETFs all closed at a new total return high yesterday

Last time that happened: November 5, 2021. $DIA $SPY $QQQ Source. Charlie Bilello

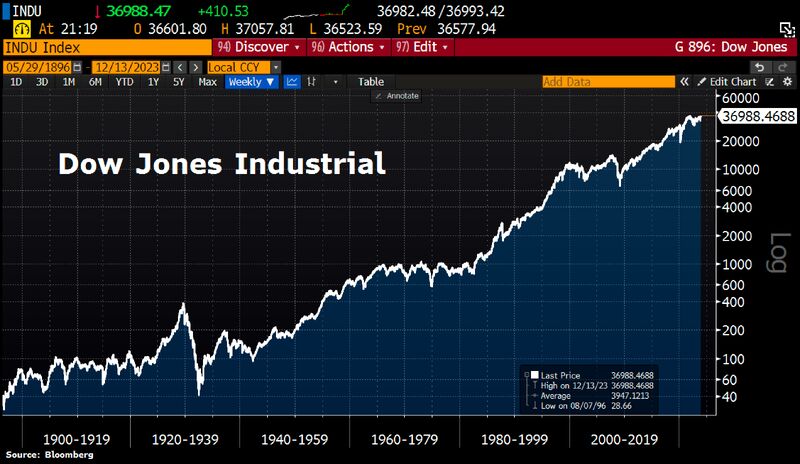

BREAKING: an ATH for the Dow > 37k !

The Dow Jones rose to its highest level ever following latest Fed meeting—which left rates unchanged & predicted 3 possible cuts in the coming year—as cheer continues to flood equities markets at year’s end. Breaking its prior ATH of nearly 37,000 set in January 2022 Dow rose >37k. Source: Bloomberg

BREAKING >>> bitcoin prices just fell over 5% in a matter of minutes, hitting as low as $41,500

After its eight straight green week, Bitcoin is finally taking a breather. The decline comes at a time of low volume and liquidity. Source: Kobeissi Letter

Bloomberg Commodity Index drops to 2-year low as investors grow increasingly nervous about demand

Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks