Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

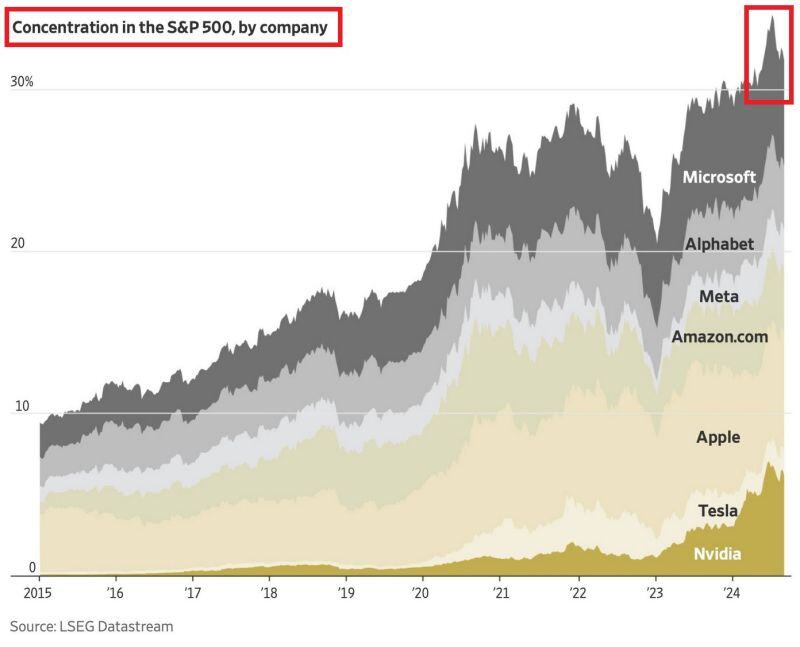

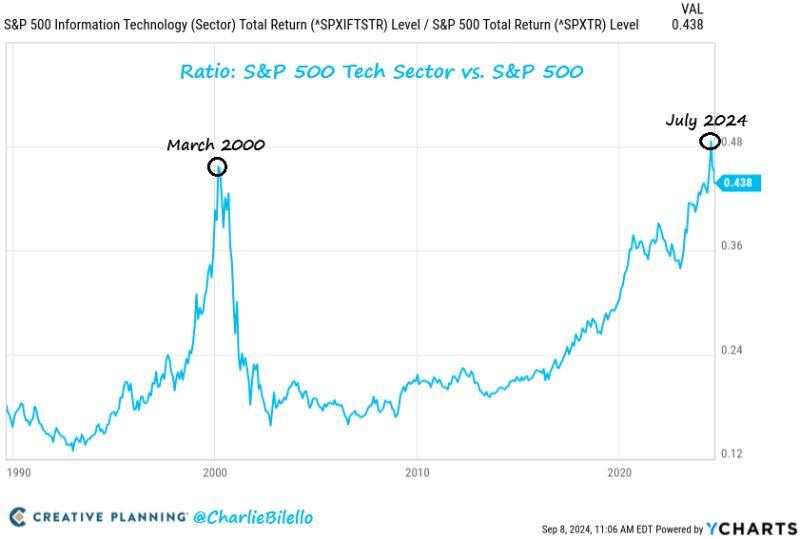

🚨IS THIS THE BIGGEST CONCENTRATION BUBBLE IN HISTORY?🚨

Magnificent 7 stocks now account for ~32% of the S&P 500, near the all-time high. This share has increased by 10 percentage points in just 1.5 years. This is even 10 percentage pts HIGHER than in the 2000 DOT-COM BUBBLE. Source: LSEG Datastream, Global Markets Investor

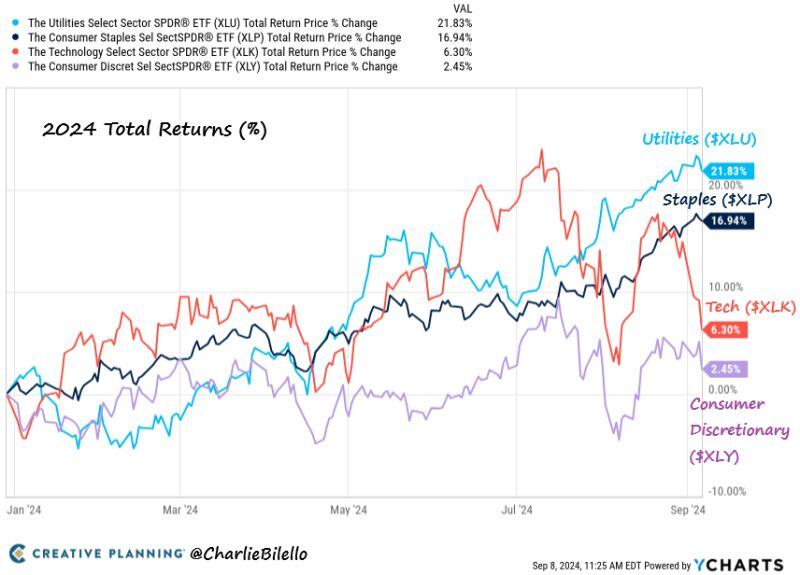

2024 S&P Sector Returns...

Utilities $XLU: +22% Consumer Staples $XLP: +17% Tech $XLK: +6% Consumer Discretionary $XLY: +2% Leadership has turned. This is a big shift from 2023.

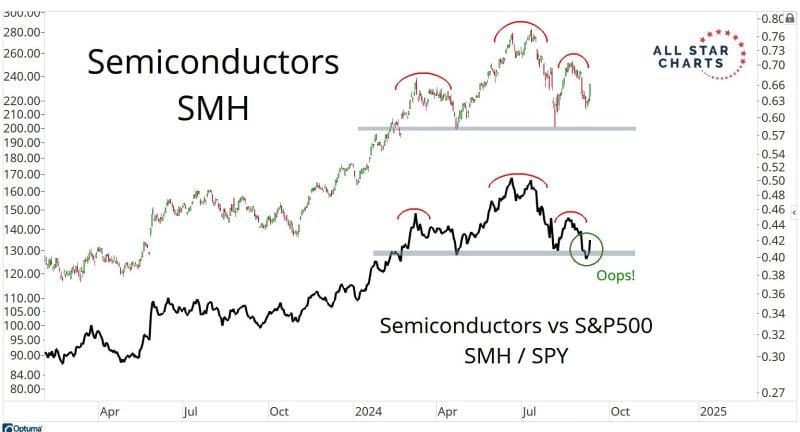

An important chart by J-C Parets >>> High Beta outperforming Low Volatility stocks is usually something we see in healthy market environments.

This year, however, High Beta has been struggling to make any progress vs their Low Volatility counterparts. "Beta" is essentially how volatile a stock is relative to its benchmark. So High Beta think $SMCI, $NVDA, $AMD, etc.. You have half the S&P500 High Beta Index in Technology and another 17% in Consumer Discretionary. In contrast, for Low Volatility think Berkshire Hathaway, Coca-Cola, Visa, Procter & Gamble. You'll find a lot of Financials, Consumer Staples, Utilities and Industrials in this group. Source: J-C Parets

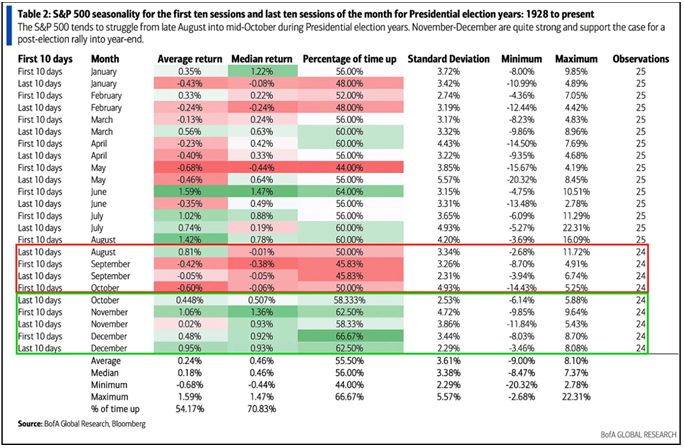

Markets tend to struggle from now until mid-October during Presidential election years

BofA

Investing with intelligence

Our latest research, commentary and market outlooks