Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

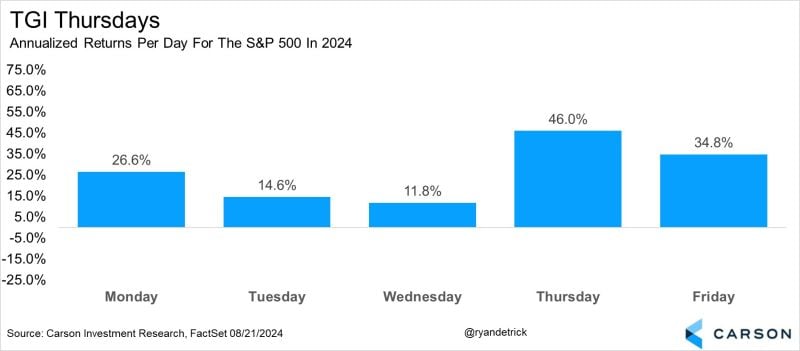

TGI Thursdays

The S&P 500 is up an annualized +46.0% on Thursday so far in 2024. This would be the best return for Thursday since '21 (+51.5%) and best for any day since Friday last year (+53.0%). Bottom line, in bull markets you tend to see strength ahead of the weekend. ✔☑✅ Source: Ryan Detrick, CMT @RyanDetrick on X, Carson research

Here's a look at the 30 best performing S&P 500 stocks over the last 20 years since Alphabet $GOOGL IPO'd

NVIDIA $NVDA is on top followed by Apple $AAPL, Netflix $NFLX and then Monster Beverage $MNST. Alphabet ranks 11th just behind Salesforce $CRM. Source: Bespoke

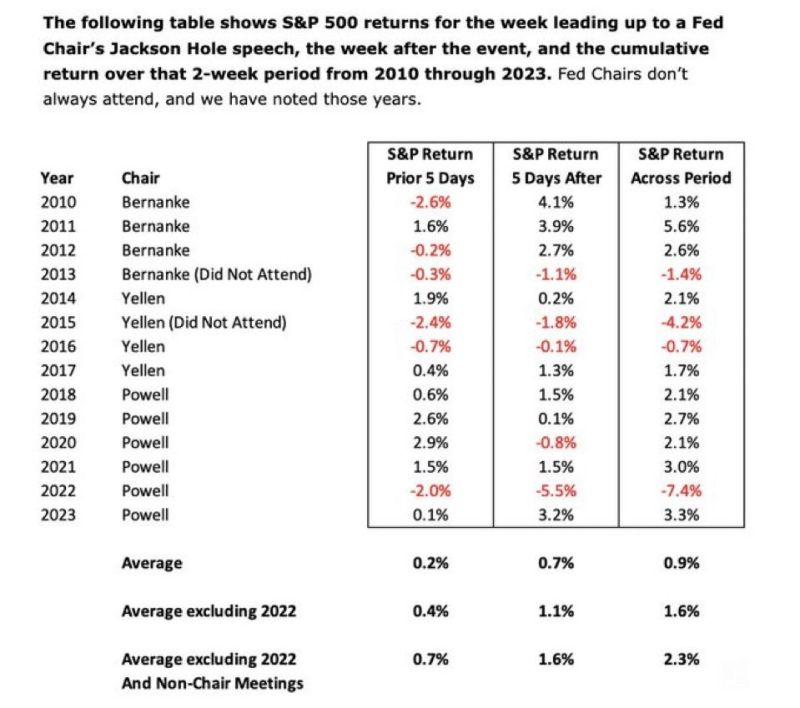

All eyes on Jackson Hole this week

Looking at historical returns, it is rarely a big deal for markets. Will this time be different? Source: The Transcript

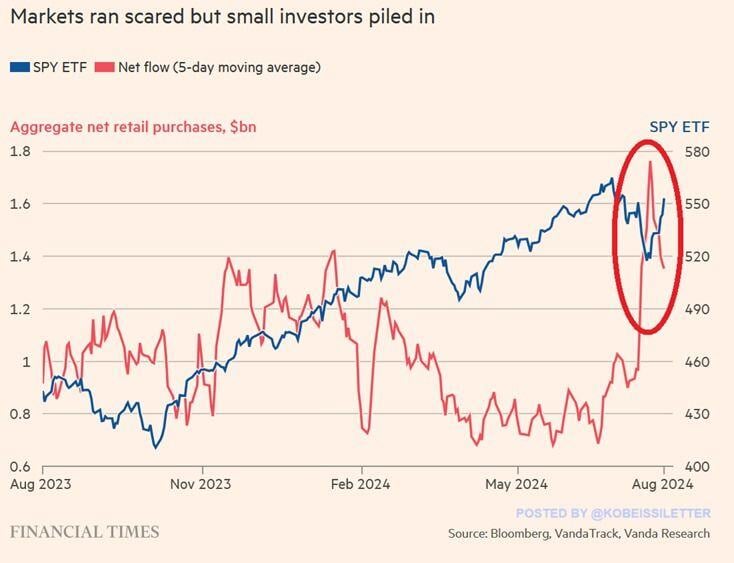

Retail investors are all in

Retail investors' inflows into U.S. stocks jumped over the last 2 weeks to their highest levels in at least 12 months. Aggregate net retail 5-day moving average purchases have more than DOUBLED in a month and hit~$1.7 billion last week. This comes after the S&P 500 fell ~7%, providing what proved to be a buying opportunity. Following the inflows, the S&P 500 surged over 8% from its low and is now 1.5% away from a new all time high. The risk appetite for stocks is still strong. Source: FT, The Kobeissi Letter

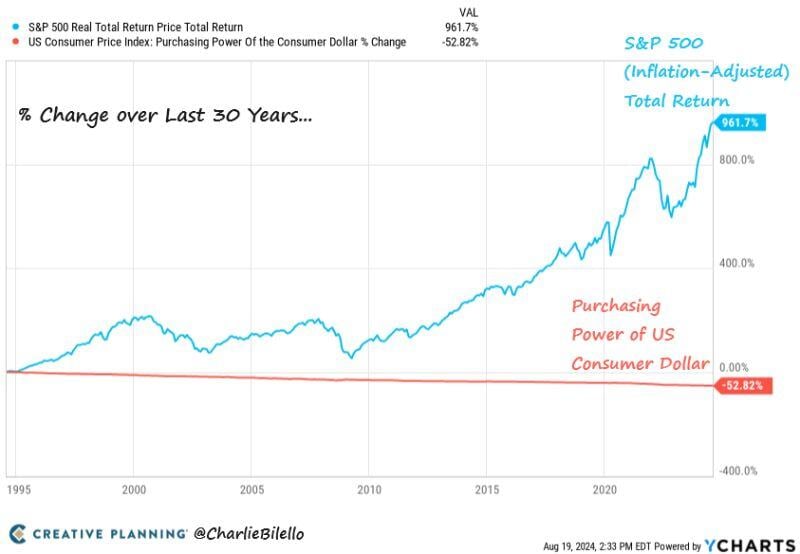

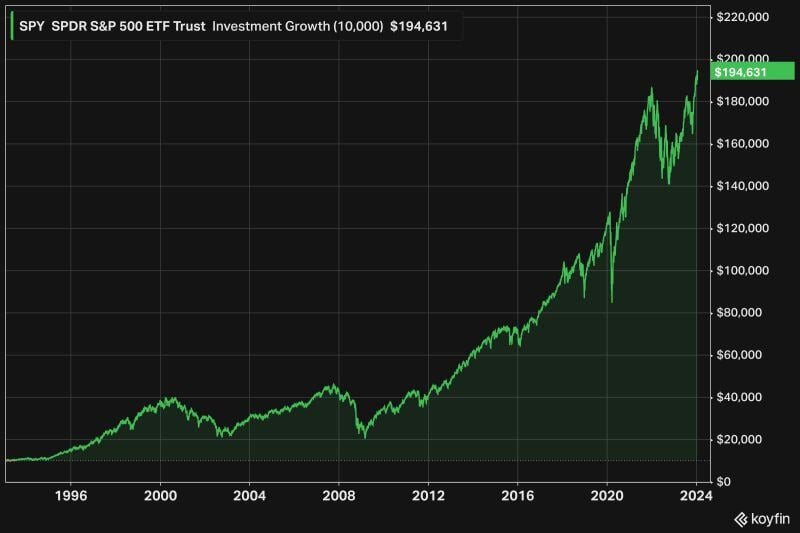

A person who invested $10k in the S&P 500 $SPY in 1993 would have faced:

• Asian Crisis, 1997 • Dotcom bubble, 2000 • GFC, 2007 • EU debt crisis, 2010 • Global pandemic, 2020 • Numerous recessions Yet, their initial investment would be worth $195k today (10% CAGR). Source: @KoyfinCharts

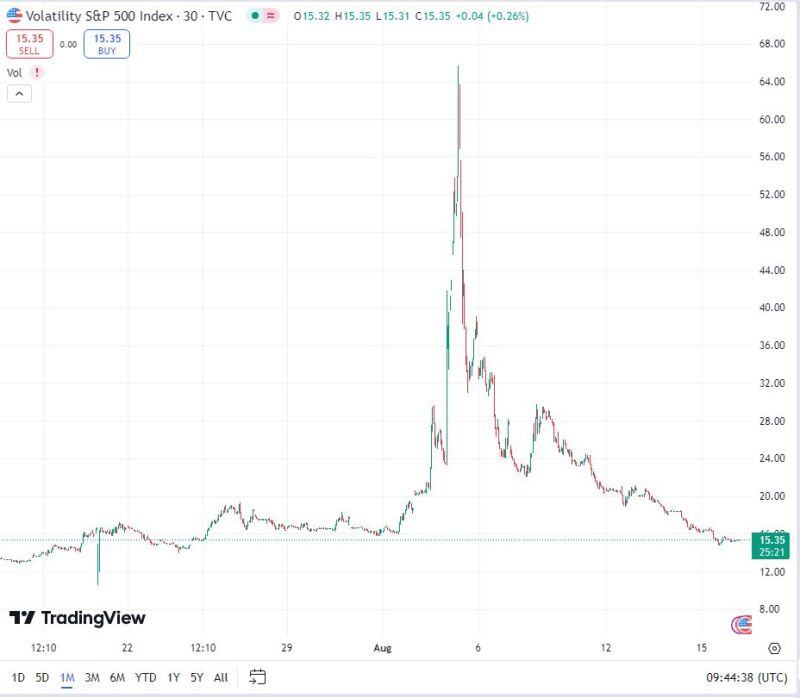

The VIX is now LOWER than it was before August 1st.... what a round trip...

Source: TradingView

Investing with intelligence

Our latest research, commentary and market outlooks