Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

$RSP (S&P Equal-weight) vs. $SPX (S&P 500) just broke key support level

Source: Ian McMillan

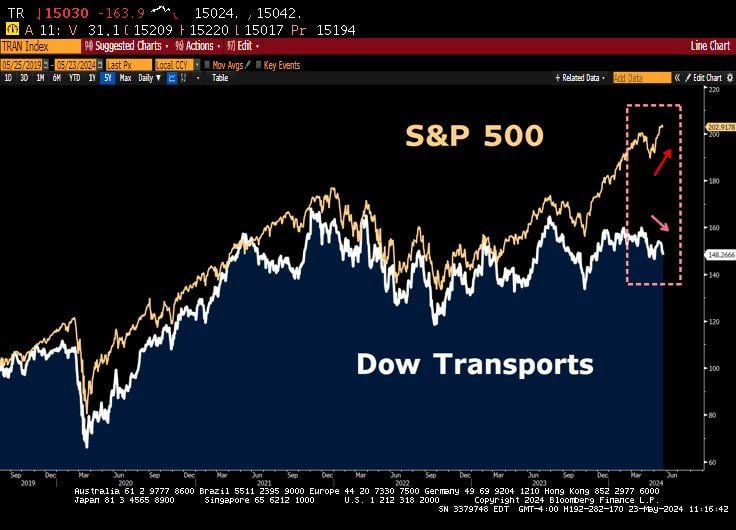

Divergence between DJ Transports and S&P500 is something to watch.

The former is seen as a reliable indicator of domestic activity Source: Lawrence McDonald, Bloomberg

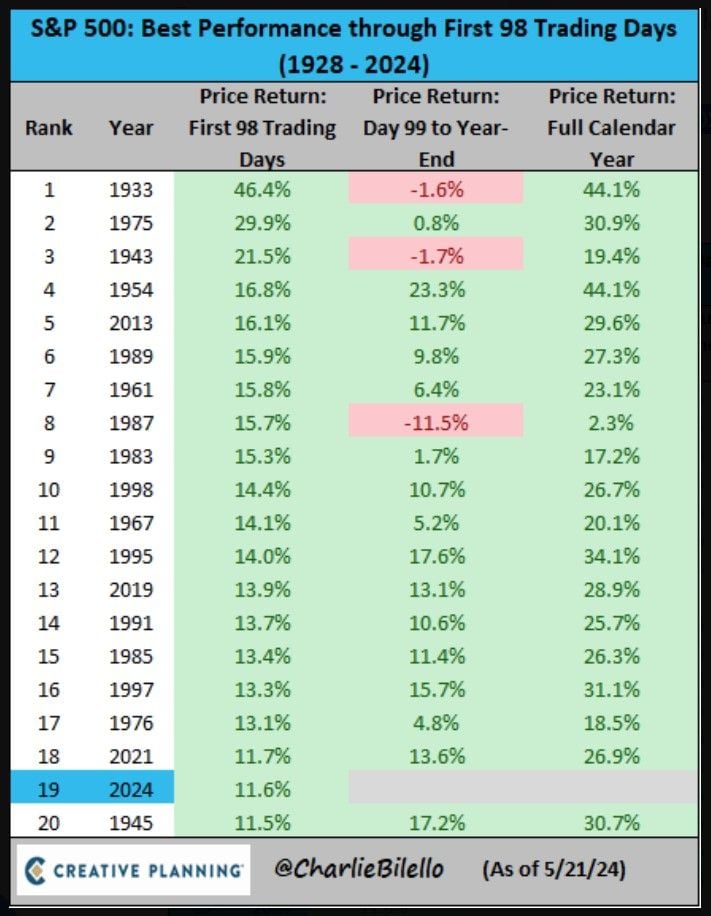

S&P 500 is up 11.6% in the first 98 trading days of 2024, the 19th best start to a year going back to 1928.

$SPX Source: Charlie Bilello

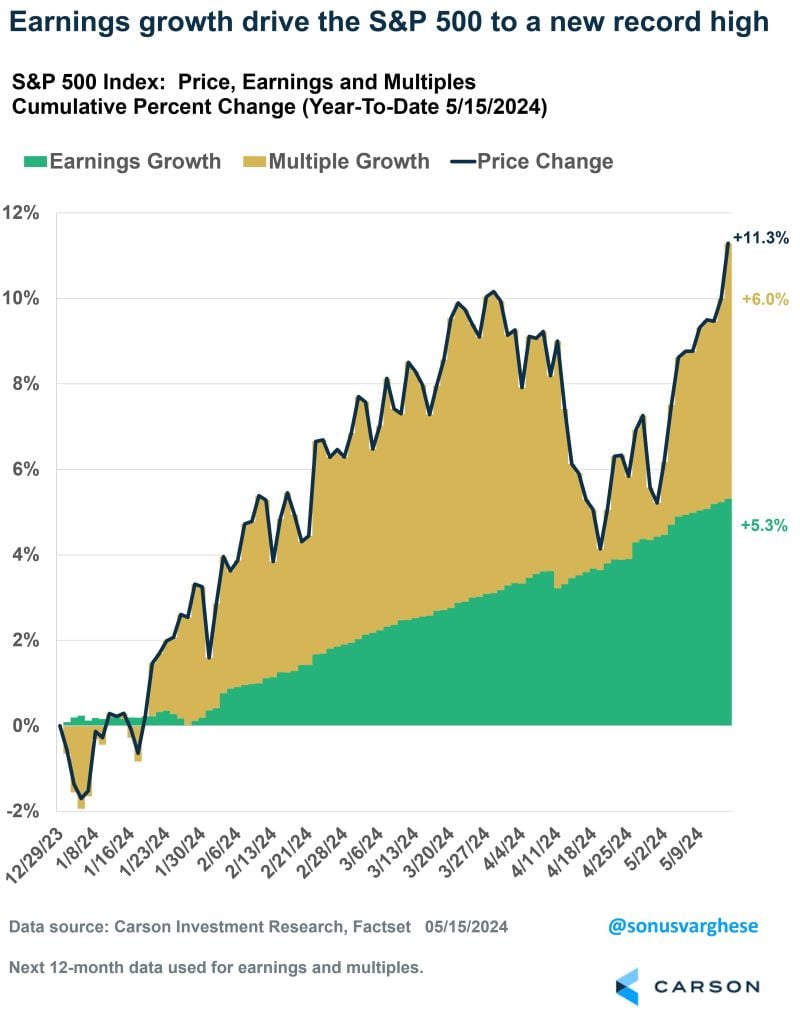

Not all new highs are the same.

Awesome chart from @sonusvarghese thru Ryan Detrick here. End of March, SPX up 10.2% YTD. Only 3.1% from EPS growth and the rest (7.1%) was from multiple expansion. On 5/15, SPX up 11.1% YTD. Now 5.3% from EPS growth and 6.0% from multiple expansion.

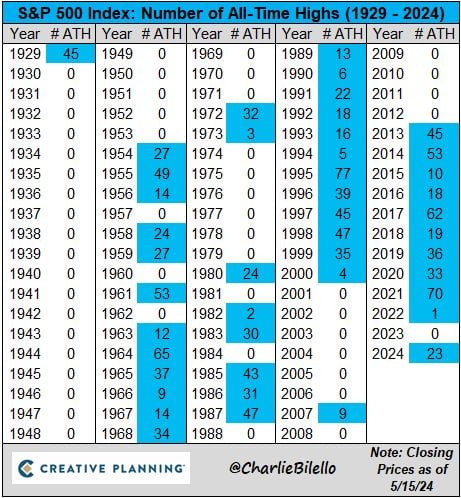

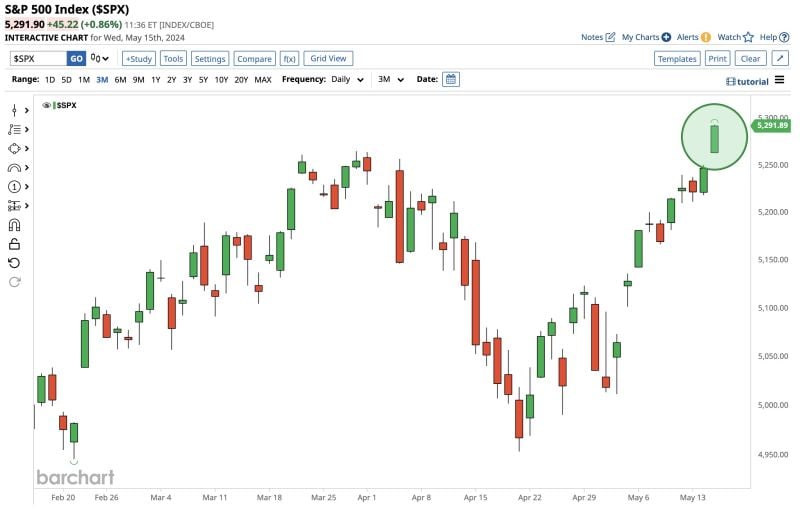

BREAKING: The S&P 500 has just hit its 23rd all time high this year and is now up 29% since October 2023

This means that the S&P 500 has officially added $10 TRILLION in market cap since its October 2023 low. The index is now up 11.5% in 2024 even as a total of four interest rate cuts have been priced-out since January. We are on track to see the most all time highs in a year since 2021. Over the last 12 years, the S&P 500 has hit 370 all-time highs, which is more than any 12-year period in history. $SPX Source: Charlie Bilello, The Kobeissi Letter

Positive market breadth ALERT

77% of S&P 500 stocks are now trading above their 200-day moving average, one of the highest levels in the last 2 years Source: Barchart

Positive market breadth ALERT >>>

77% of S&P 500 stocks are now trading above their 200-day moving average, one of the highest levels in the last 2 years Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks