Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

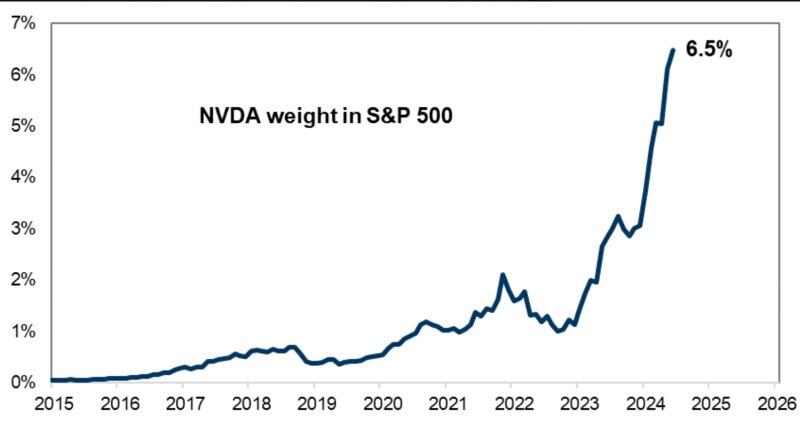

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- china

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

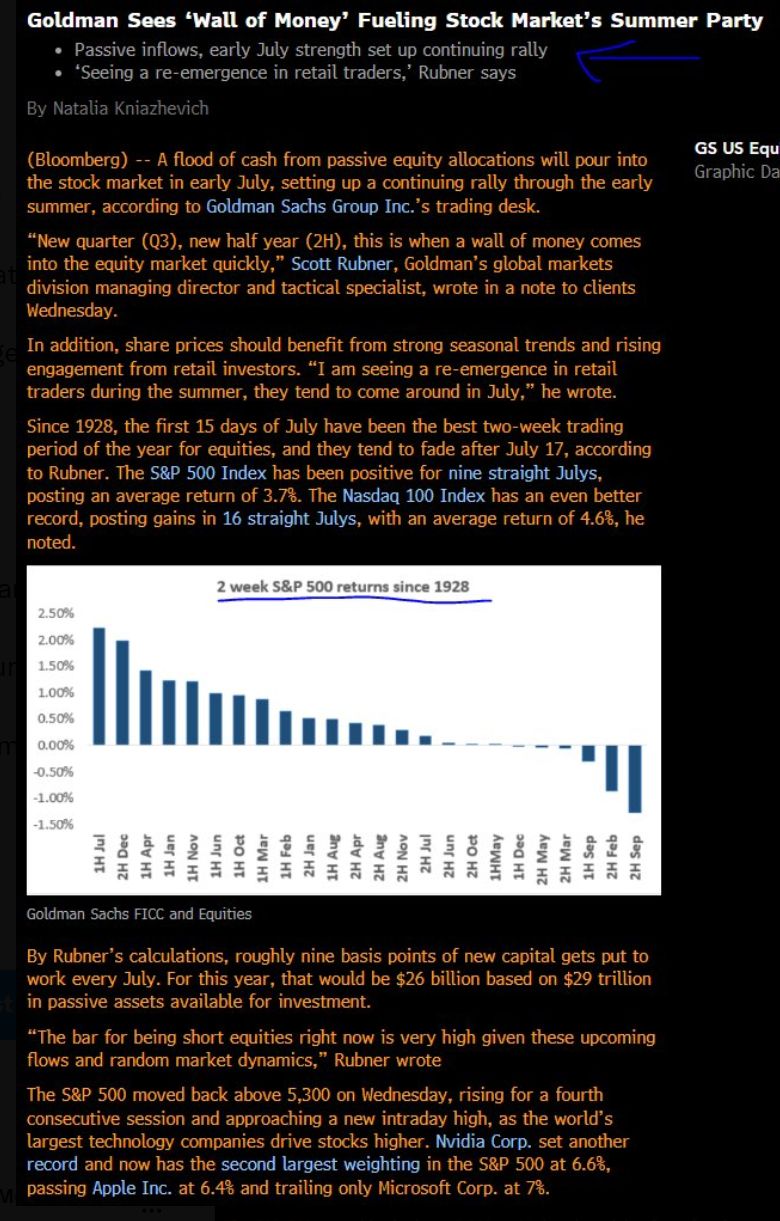

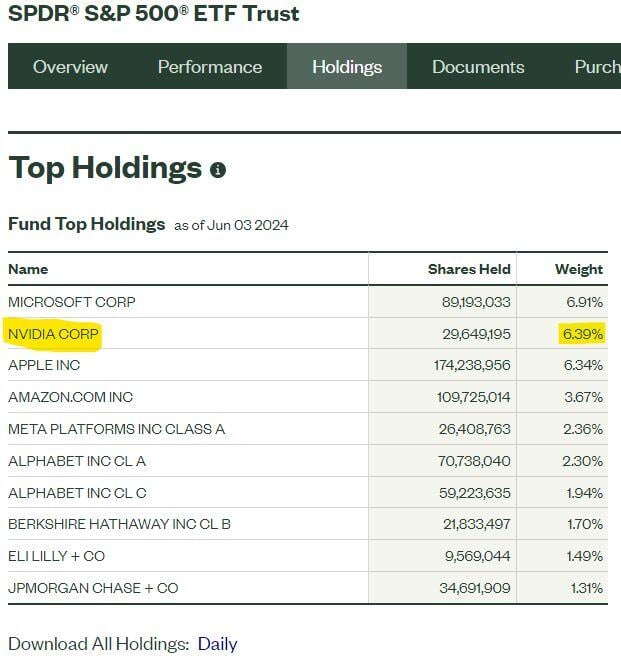

* Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

Source: Carl Quintanilla, Bloomberg

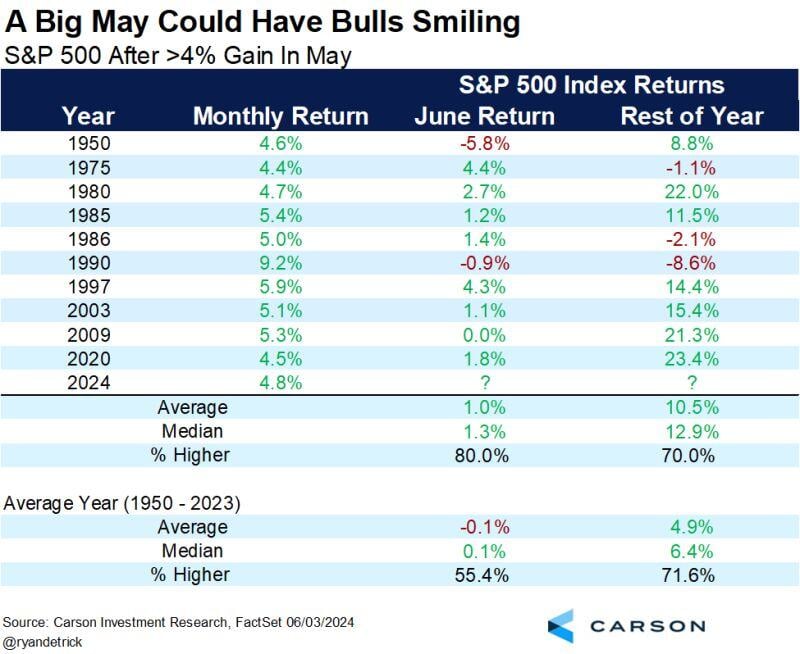

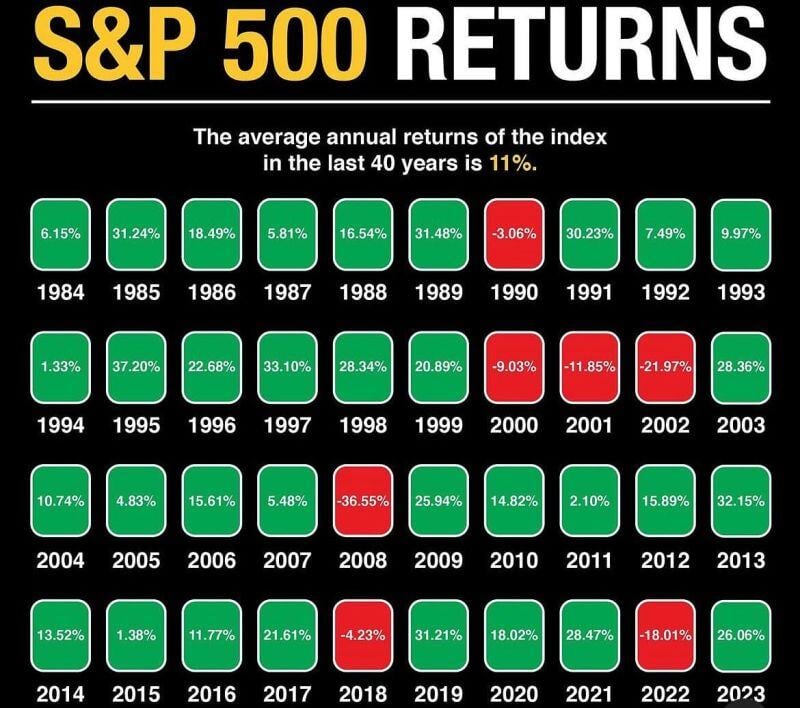

Best May for the S&P 500 in 15 years.

Looking at the 10 best monthly returns ever in May showed the future returns were quite impressive. When May return was above 4%, the rest of year up was double the average year (10.5% vs 4.9%) and June was up 1.0% on average vs negative. Source: Carson, Ryan Detrick

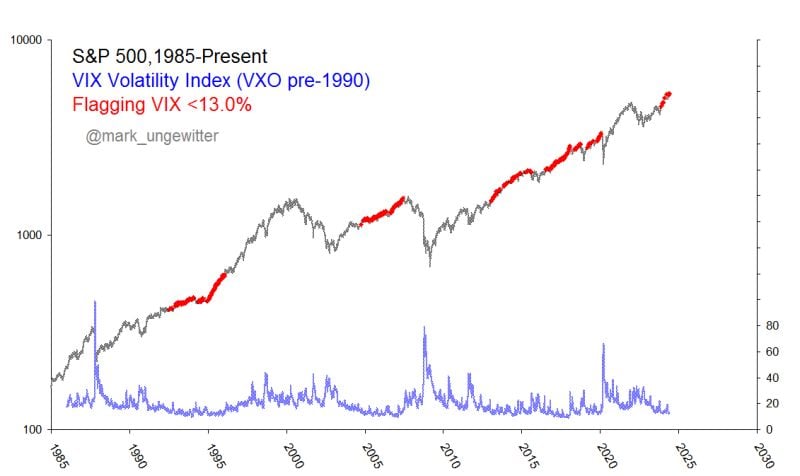

Low-volatility regimes can last longer than you think.

Source: Mark Ungewitter

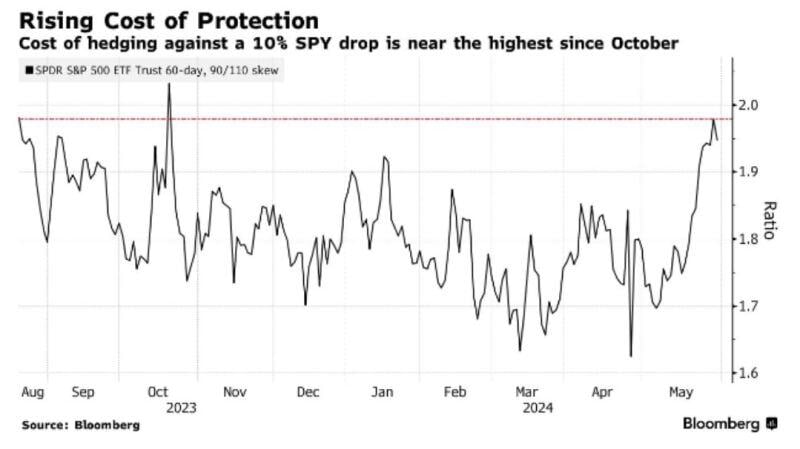

The cost to hedge a 10% drop in the S&P 500 reached its highest level since October

Source: Win Smart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks