Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- china

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

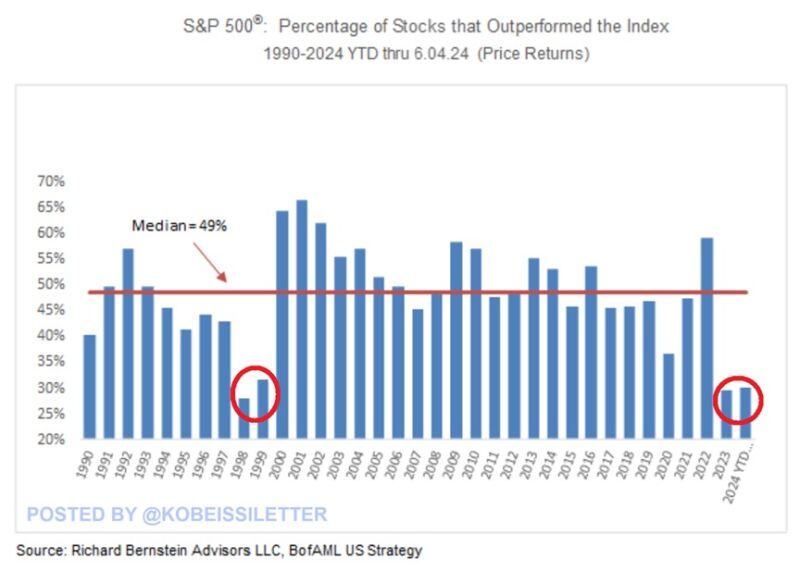

Only 30% of the SP500 stocks have outperformed the index year-to-date.

This is slightly higher than the 29% that occurred in 2023. Since 1990, a streak of 2 consecutive years with such a low percentage has happened only during the 2000 Dot-com bubble. By comparison, the historic median is 49% which typically implied healthy market breadth. The S&P 500 has rallied 12% year-to-date largely driven by just a few tech stocks. A few stocks are driving the entire market. Source: The Kobeissi Letter, Richard Bernstein Advisors

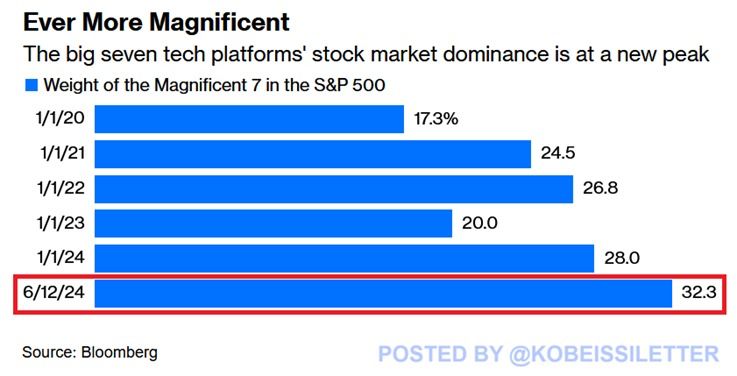

The Magnificent 7's share of the SP500 just hit another all-time high of 32%.

This is 12 percentage points higher than at the beginning of 2023. The weight of these 7 stocks in the index has almost DOUBLED in just over 4 years. This comes as the 3 largest stocks, Apple, Microsoft, and Nvidia, are all officially worth over $3 trillion. Meanwhile, the technology sector just hit another all-time high relative to the S&P 500. Tech is becoming even more dominant. Source: Bloomberg, The Kobeissi Letter

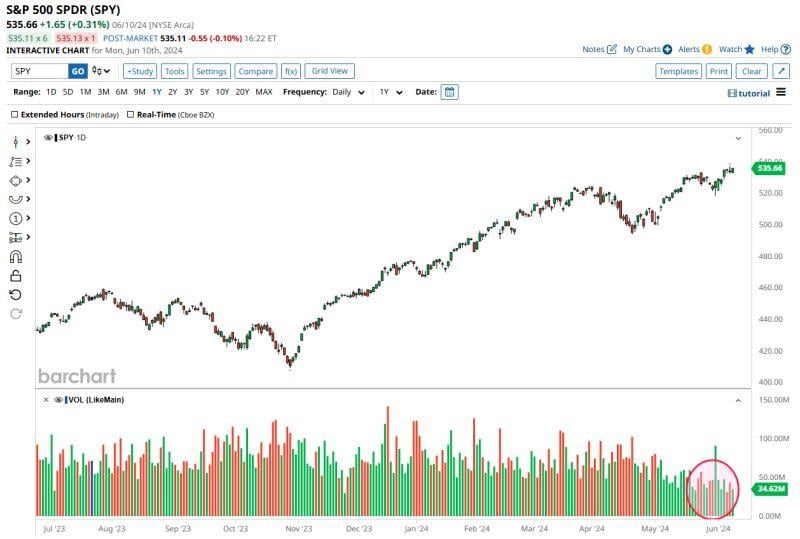

The SP500 closed the week at new all-time highs.

And a whopping 33 stocks on the NYSE closed at new highs. That's only 1.4% of stocks on the most important exchange in the world hitting new highs. Source: J.C. Parets @allstarcharts

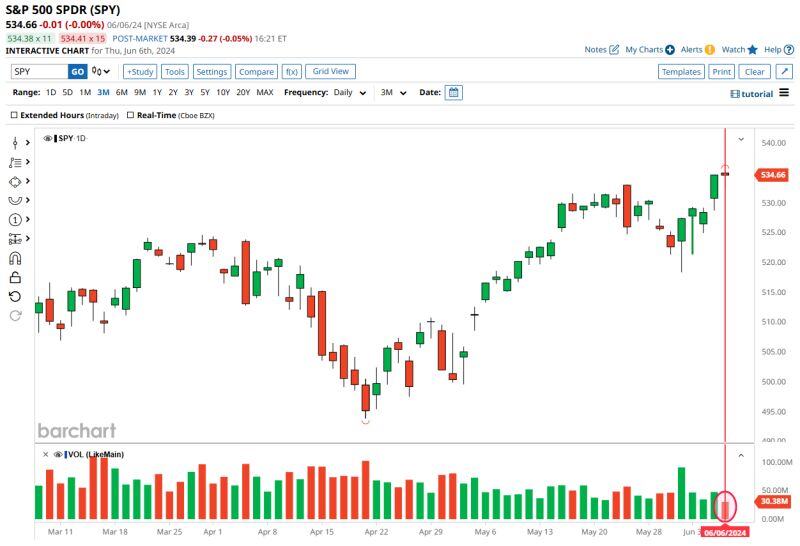

S&P 500 continues to hit record highs on EXTREMELY low volume.

Today was the 4th lowest volume day of the year for $SPY. Three of this year's four lowest volume days have come in the last week. All 4 of the lowest volume days have come in the last 3 weeks. Source: Barchart

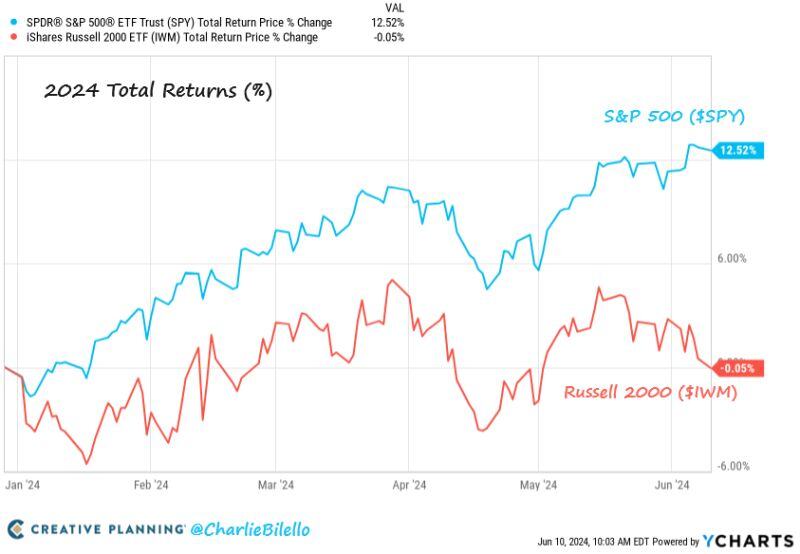

Small cap stocks are now down on the year while Large caps are still up 12.5%. $SPY $IWM

Source: Charlie Bilello

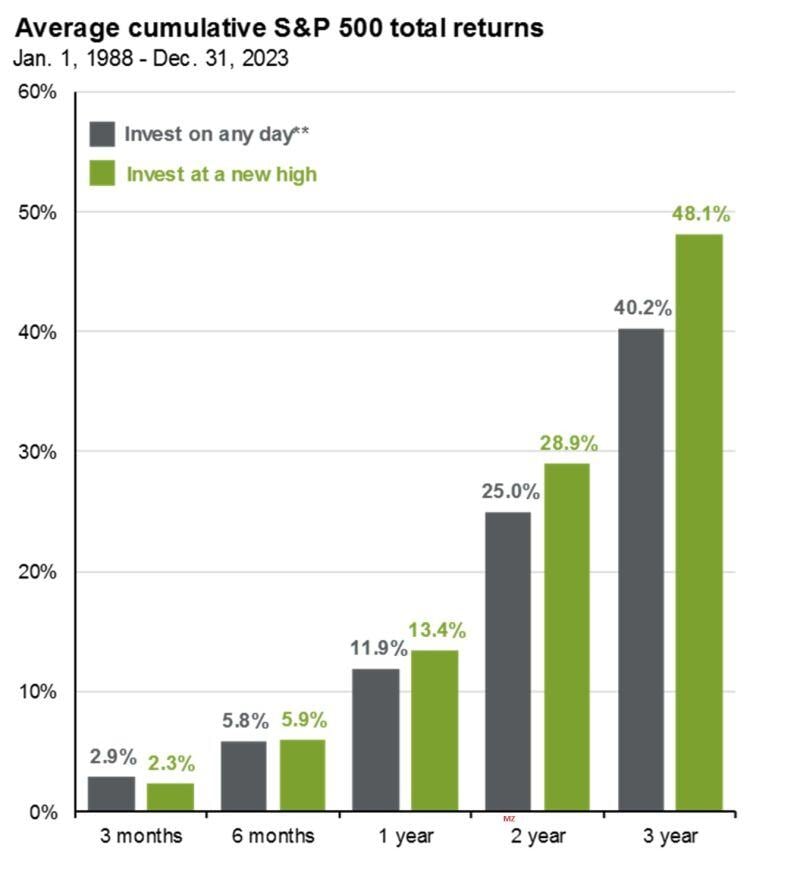

Reminder: investing at all-time highs is safer than investing during drawdowns $SPY

Source: Mike Zaccardi

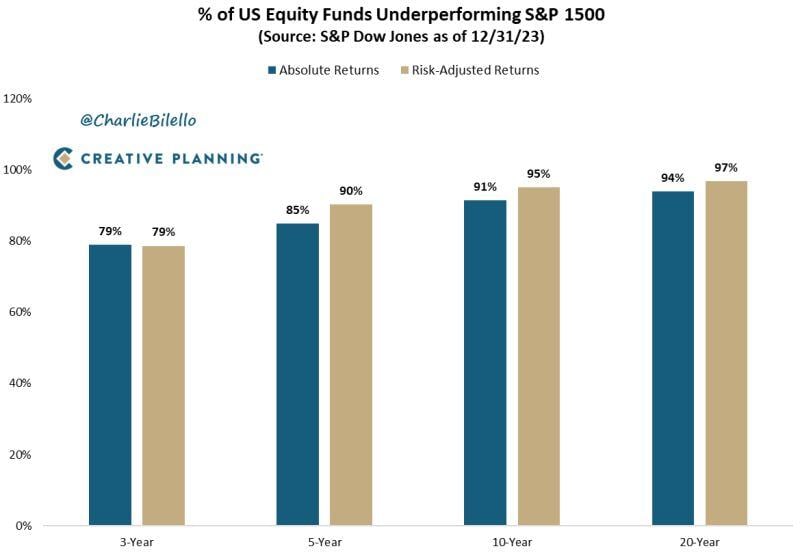

A staggering percentage of US equity funds are underperforming the S&P 1500.

The longer the time period the higher the percentage of underperformers. Source: Charlie Bilello

🚨: S&P 500 $SPY finished with its lowest volume in 18 years (excluding holiday-shortened trading days)

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks