Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

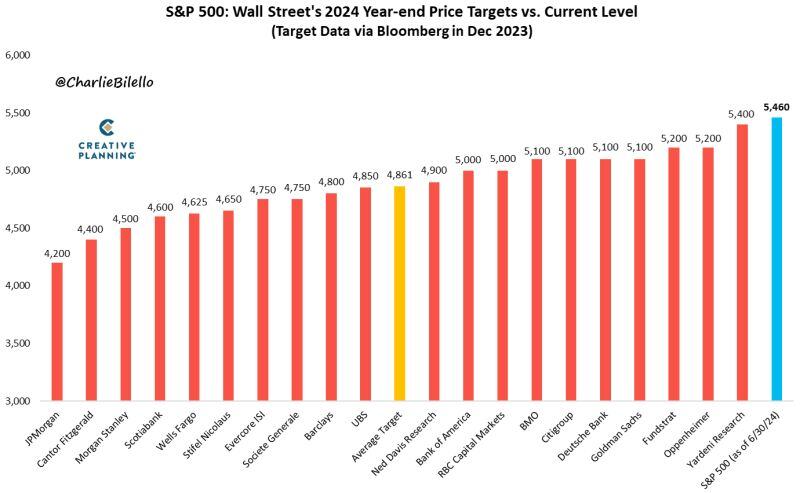

At 5,460, the S&P 500 ended the first half above every 2024 year-end price target from Wall Street strategists

We're 12% higher than average target price of 4,861. $SPX Source: Charlie Bilello

$SPY We are halfway through 2024.

Let's see the best 10 and worst 10 performers in the S&P 500 so far: The Best 10: 1. $SMCI - Supermicro - 188.2% 2. $NVDA - Nvidia - 149.5% 3. $VST - Vistra - 123.2% 4. $CEG - Constellation Energy - 71.3% 5. $LLY - Eli Lilly - 55.3% 6. $MU - Micron - 54.1% 7. $NRG - NRG Energy - 50.6% 8. $CRWD - Crowdstrike - 50.1% 9. $ANET - Arista Networks - 48.8% 10. $TRGP - Targa Resources - 48.2% The Worst 10: 1. $WBA - Walgreens Boots -53.7% 2. $LULU - Lululemon -41.6% 3. $INTC - Intel -38.4% 4. $EPAM - Epam Systems -36.7% 5. $WBD - Warner Bros Discovery -34.6% 6. $ALB - Albemarle -33.9% 7. $GL - Globe Life -32.4% 8. $MKTX - Marketaxess -31.5% 9. $PAYC - Paycom -30.8% 10. $NKE - Nike -30.6% Source: The Future Investors

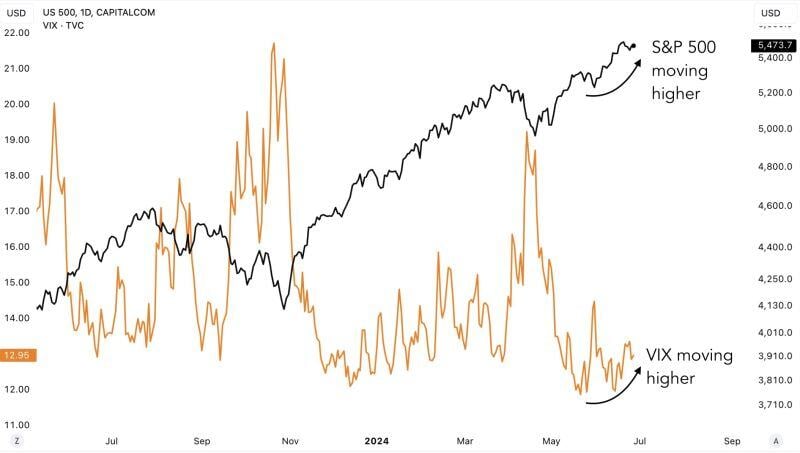

Major divergence spotted:

The VIX has been trending higher since mid-May. But even the SP500 has been moving higher. This is an anomaly. Source: Game of Trades

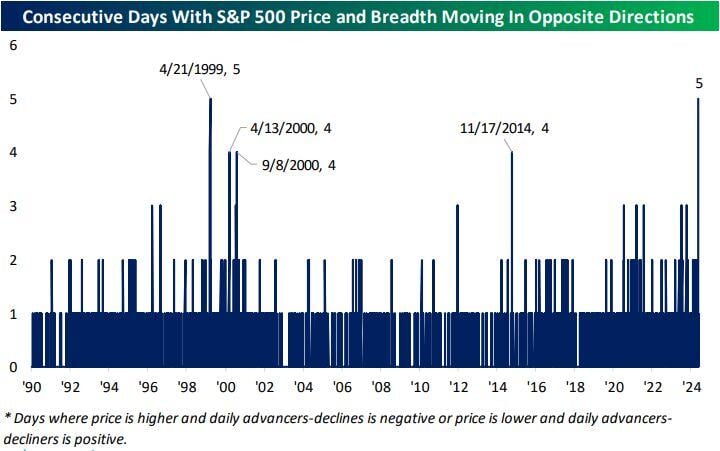

Yesterday the SP500 managed to rise on negative breadth.

It's now been five days in a row where price has gone in one direction and breadth has gone in the other. That ties the record streak from April 1999. Source: Bespoke

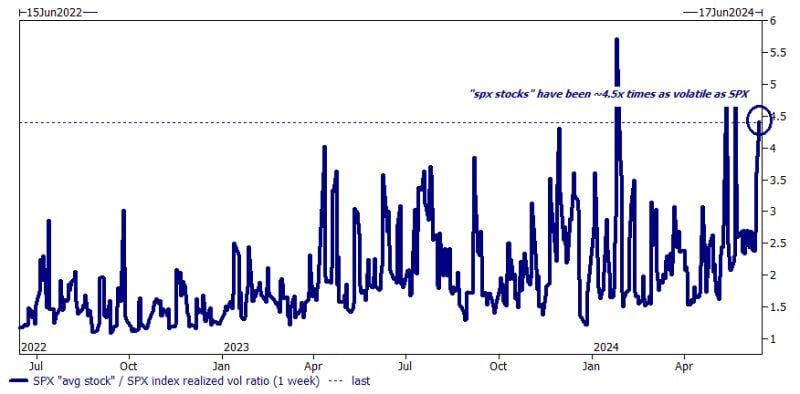

Wow. The average S&P500 stock has been on average 4.5x as volatile as the broader index!

Chart: Goldman Sachs Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks