Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

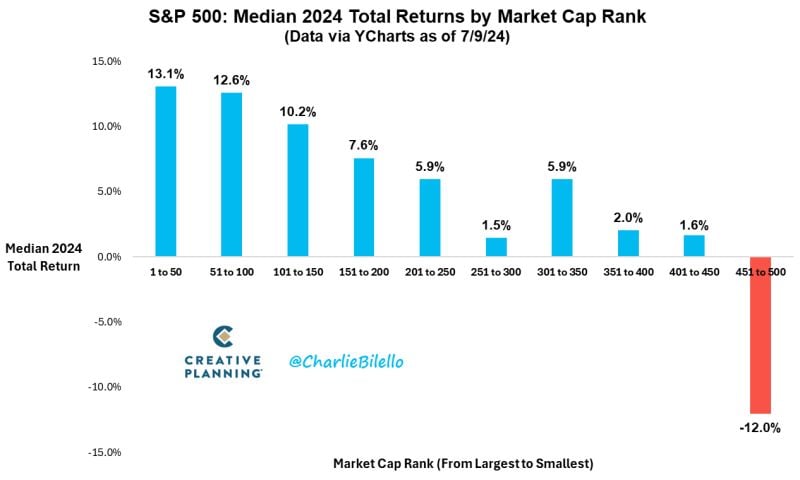

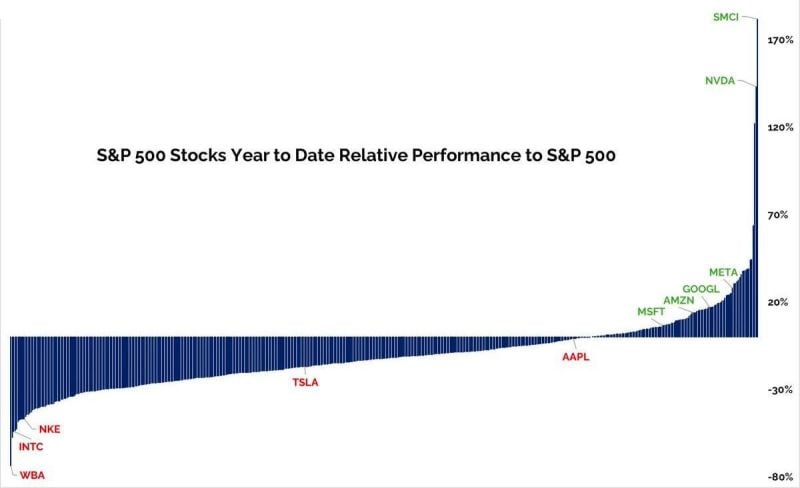

The 50 largest stocks in the S&P500 have a median return of +13% this year while the 50 smallest stocks in the index are down 12%.

$SPX Source: Charlie Bilello

The S&P 500 climbed Wednesday to a fresh record, breaking above 5,600 for the first time, as a sharp rise in semiconductor stocks led the market higher.

The broad market index jumped 1.02%, closing at 5,633.91, and notching a seventh straight day of gains.

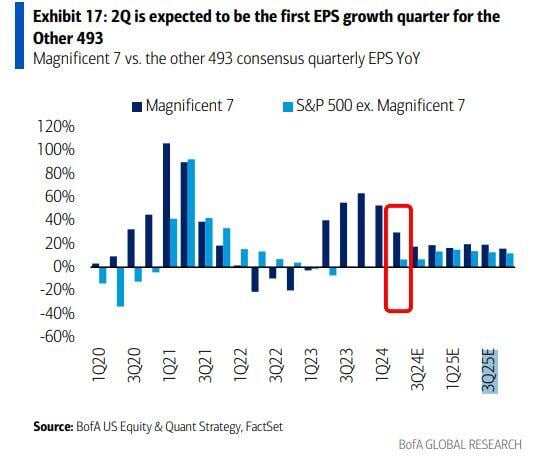

The S&P 493 earnings have been flat to down for the past five quarters.

2Q is expected to mark the first growth quarter for the Other 493. Could it lead to a more balanced market? Source: BofA

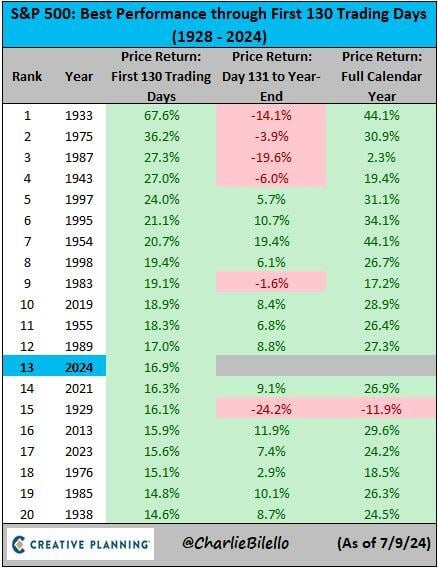

The S&P 500 is up 16.9% in 2024, the 13th best start to a year going back to 1928 and the best start to a presidential election year in history.

$SPX Source: Charlie Bilello

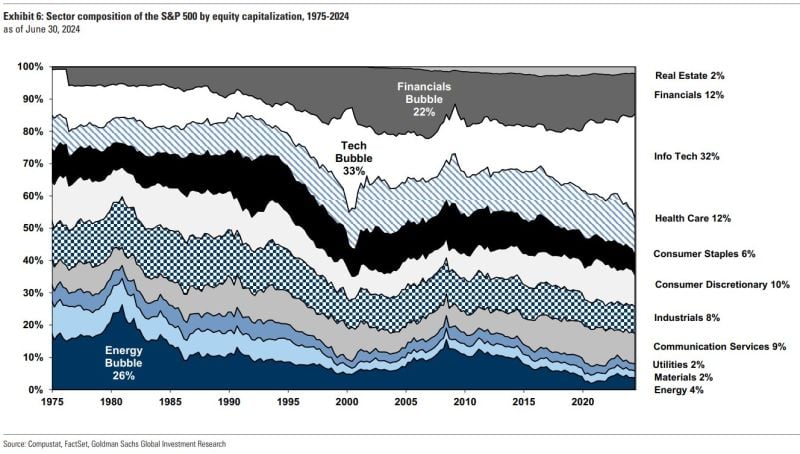

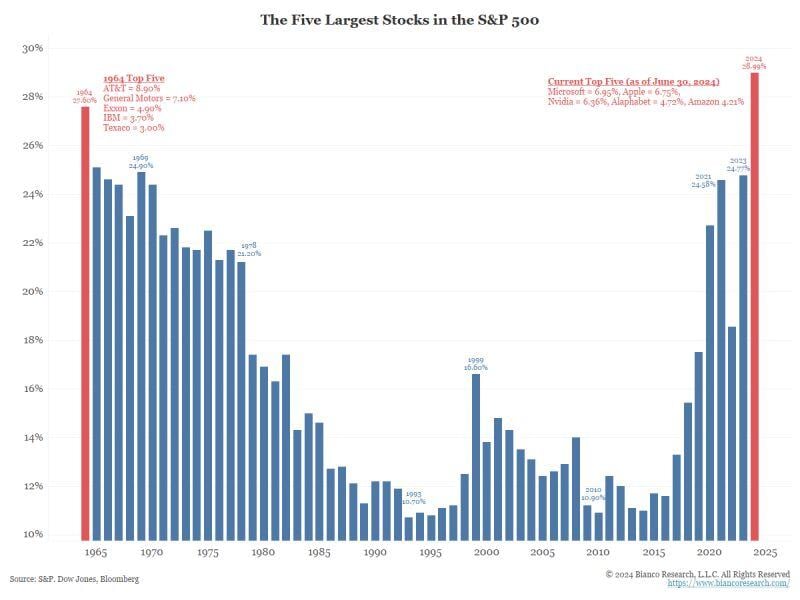

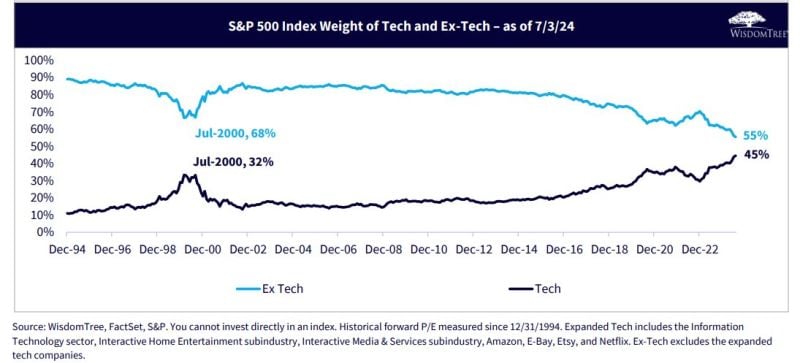

S&P500 concentration at the highest level in at least 60 years: 5 largest stocks within S&P 500 = 28.99%

As mentioned by Jim Bianco: The risk of the current S&P500 concentration is that one day the opposite happens: five stocks could kill the index funds while everything else outperforms... "Restated, one buys an index fund to get diversification. But with record concentration, they are not getting it". Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks