Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

The big names were the biggest losers this week

Even if other segments of the market are moving higher, it is tough for the main index to make progress of the big names continue to lose ground. Since July 10th, the market cap of the Magnificent 7 stocks has dropped a mind-numbering $2 trillion... Source: Trend Spider

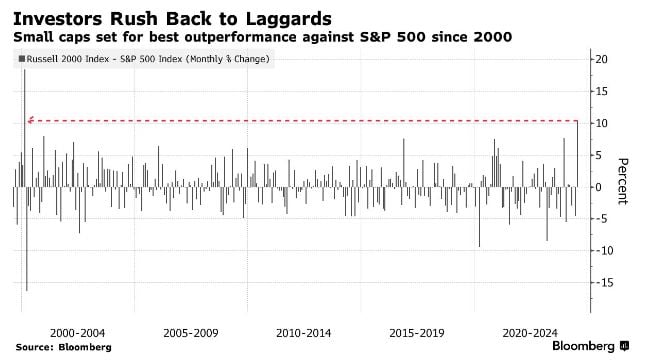

Small Cap Stocks $IWM are on track to outperform the S&P 500 $SPX in July by the biggest margin in 24 years

Source: Barchart, Bloomberg

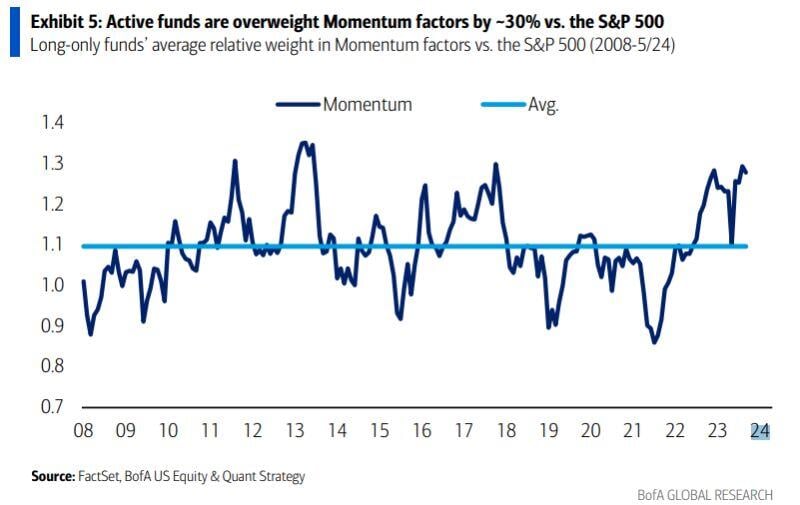

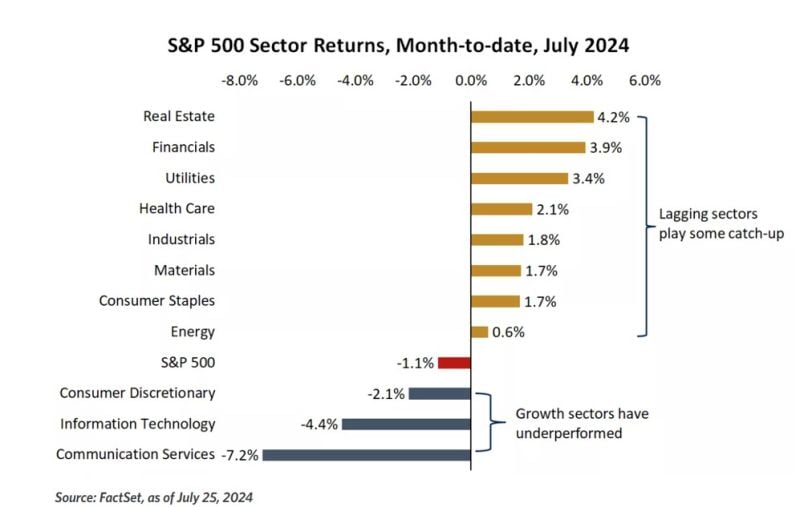

This week equity markets continued the rotation that began earlier this month, with small-cap stocks and value and cyclical sectors all outperforming mega-cap technology and growth sectors.

Source: Edward Jones

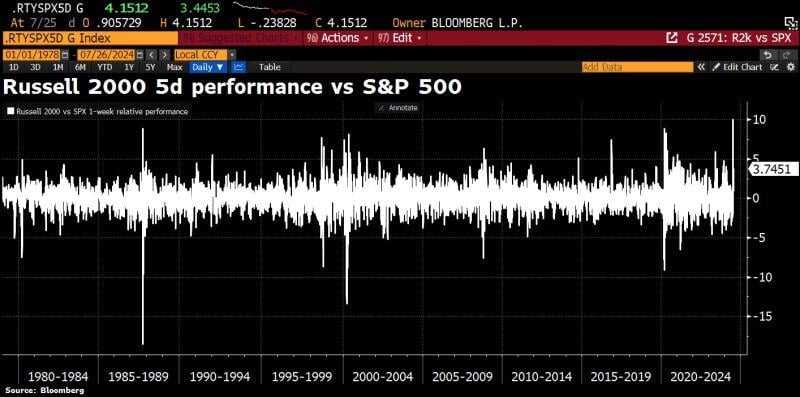

Russell 2000 Outperformance vs S&P 500 continues.

RTY vs SPX break out is at its widest levels since Feb 2000, > +9% MTD Source: Bloomberg, HolgerZ

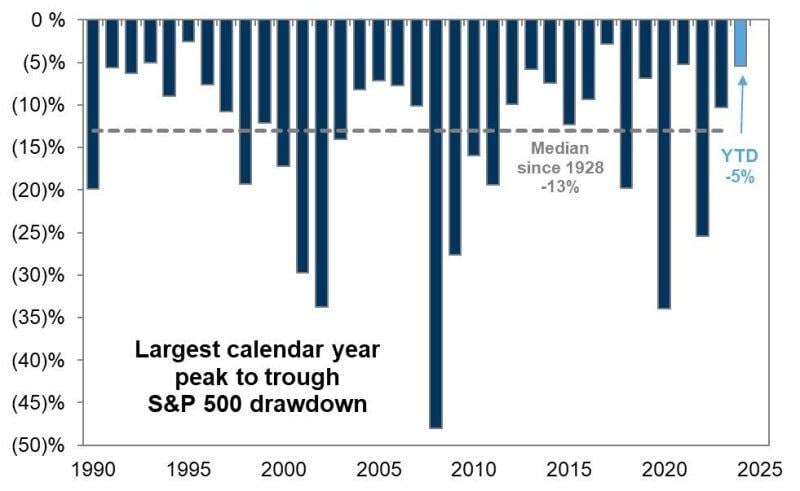

Is there more drawdown ahead for the S&P500?

Over the last ~100 years, median year has a SPX peak to trough drawdown of 13%. Believe it or not current drawdown has only been 5%... Source: GS

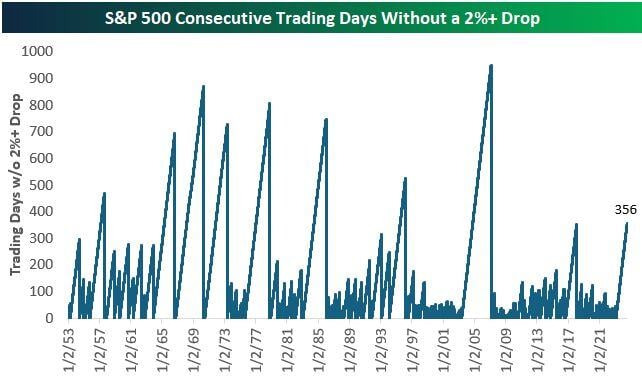

The S&P 500 yesterday ended a streak of 356 trading days going back to February 2023 without experiencing a one-day drop of 2% or more.

This was the longest streak since we went 949 trading days from May 2003-February 2007 without one! Source: Bespoke

WHAT A DAY...

🌩 Mag 7 stocks all finished in the red today and have erased erased over $500 BILLION of market cap today. ⚡ Nasdaq and S&P 500 had worst their day since 2022 ☄ The S&P 500 just fell over 2% for the first time in 356 trading sessions. It ended the longest stretch without a >2% pullback since 2007 Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks