Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

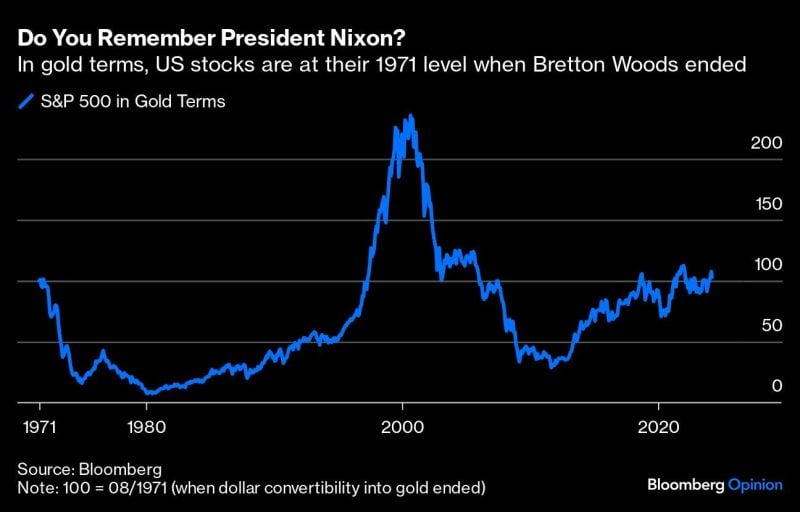

If one ignores dividends gold has been able to keep up with equities since Nixon ended things in 1971.

Source: Michel A.Arouet, Bloomberg

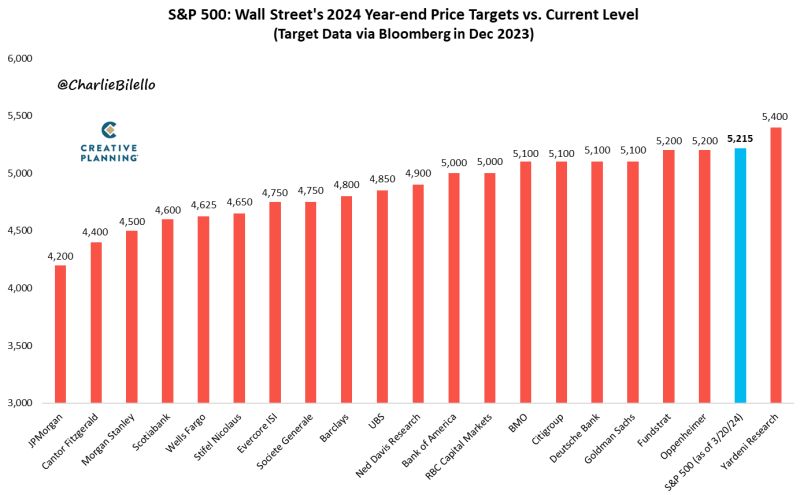

At 5,215, the S&P 500 is already 7.3% above the average 2024 year-end price target from Wall Street strategists (4,861). $SPX

Source: Charlie Bilello

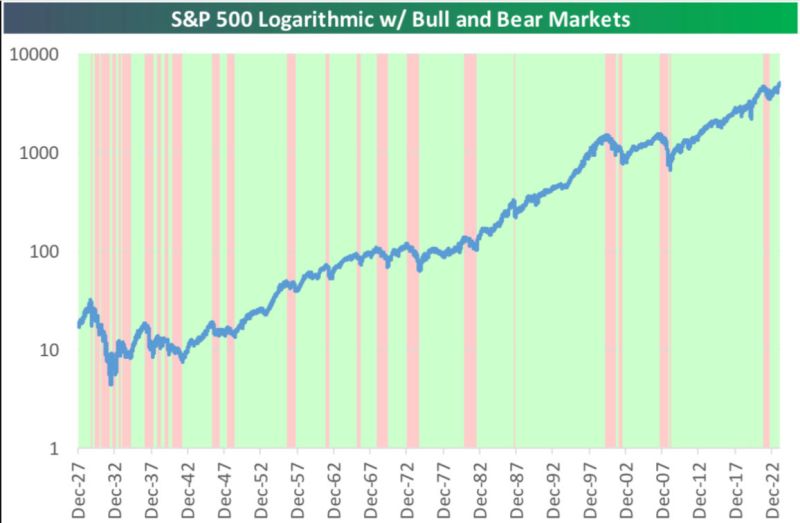

A little History in a Chart.

Green=Bull Markets 🐂 Red=Bear Markets 🐻 source : bespoke

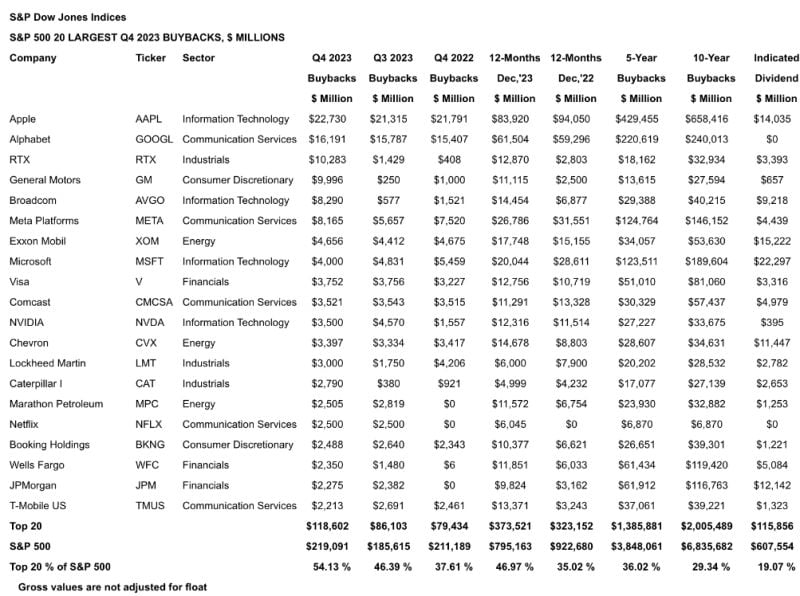

Here's the S&P 500 stocks that bought back the most shares in Q4 2023

1 Apple $AAPL: $22.7B 2 Google $GOOGL: $16.2B 3 Raytheon $RTX: $10.3B 4 General Motors $GM: $10B 5 Broadcom $AVGO: $8.3B 6 Facebook $META: $8.2B 7 Exxon Mobil $XOM: $4.7B 8 Microsoft $MSFT: $4b 9 Visa $V: $3.8B 10 Comcast $CMCSA $3.5B source : StockMKTNewz

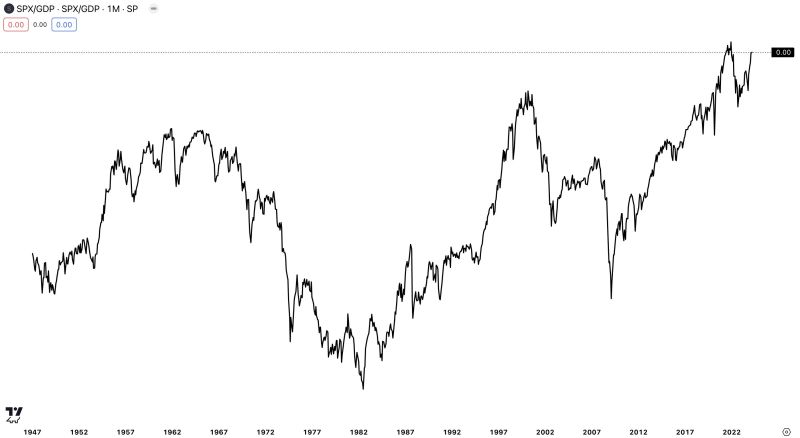

$SPX/GDP, the 'Buffet' indicator, is back near the 2021 highs

Source: Swordfishvegetable

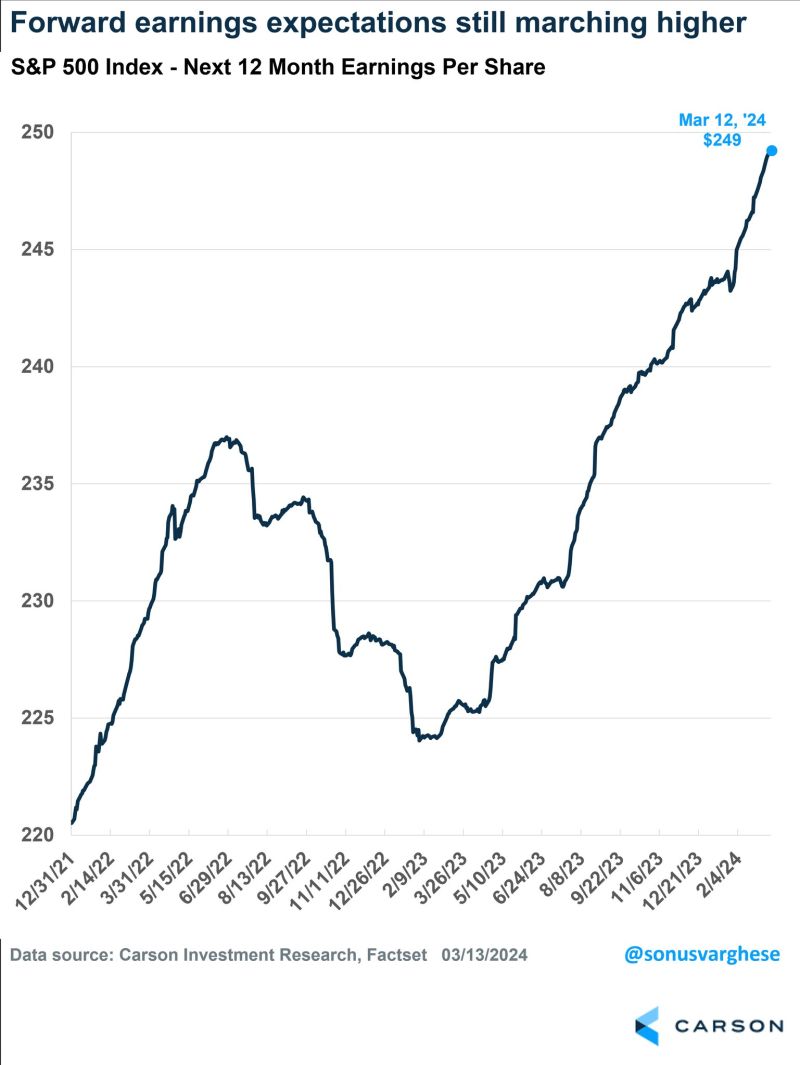

Why has the sp500 been moving higher despite rate cuts expectations being revised downward?

It is as simple as EPS 12 month estimates have soared. Up another 2% the past 12 months. Source: Ryan Detrick

Investing with intelligence

Our latest research, commentary and market outlooks