Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- europe

- investing

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

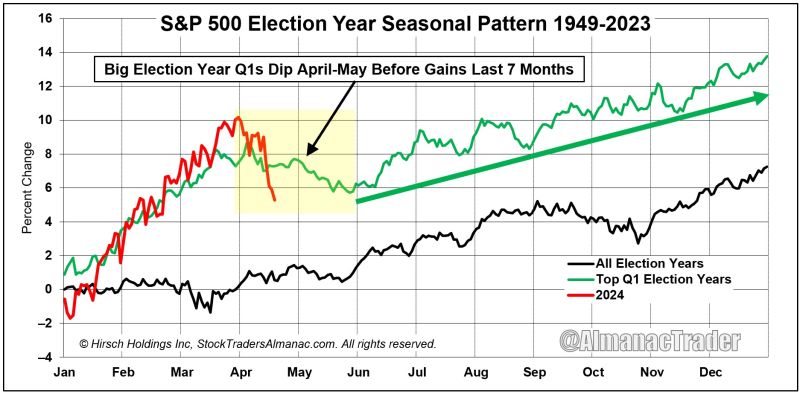

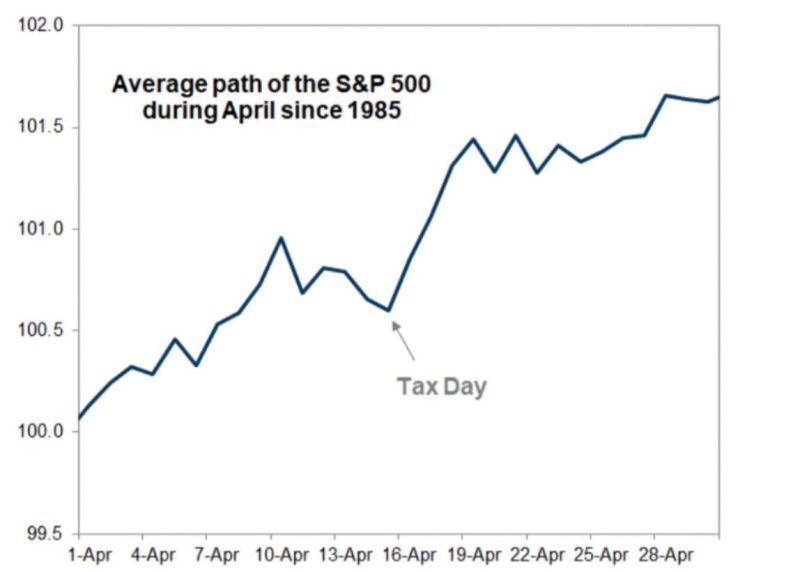

Big Election Year Q1s Dip April-May Before Gains Last 7 Months.

2024 is 3rd best Election Q1 since 1950 tracking. Historically, there is a dip in April-May before gains till year-ned. There was only 2 losses in the last 7 months of election years since 1950 (2000 & 2008) Source: Ryan Detrick, CMT, AlmanacTrader

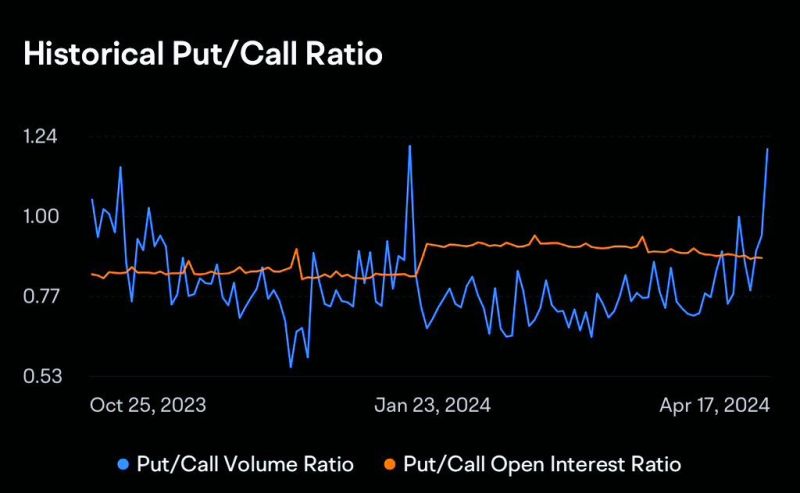

SP500 Put/Call Ratio has risen to multi-year highs amid the recent market sell off.

Source: David Marlin

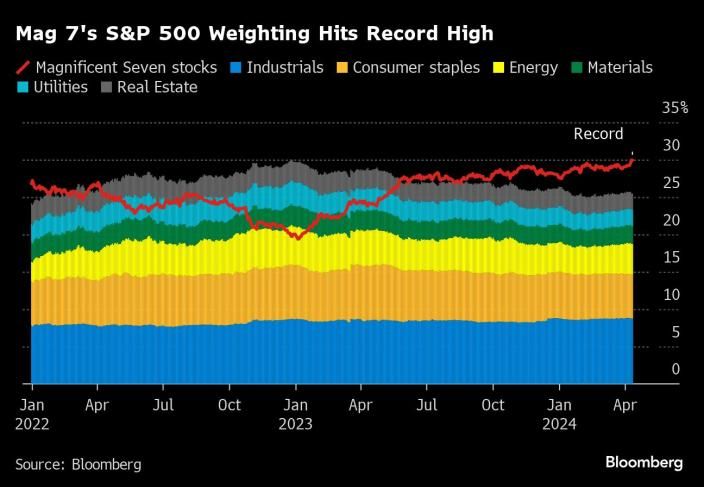

The Mag7's weighting in the SP500 just hit another new high

Source: Cheddar Flow

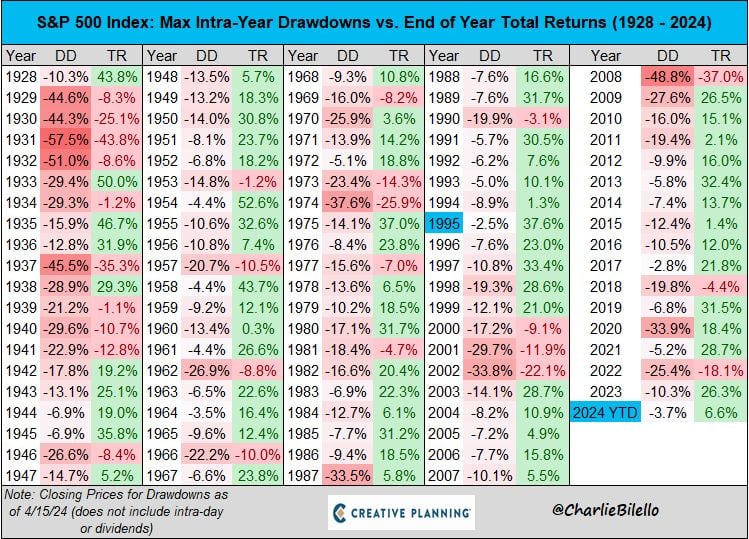

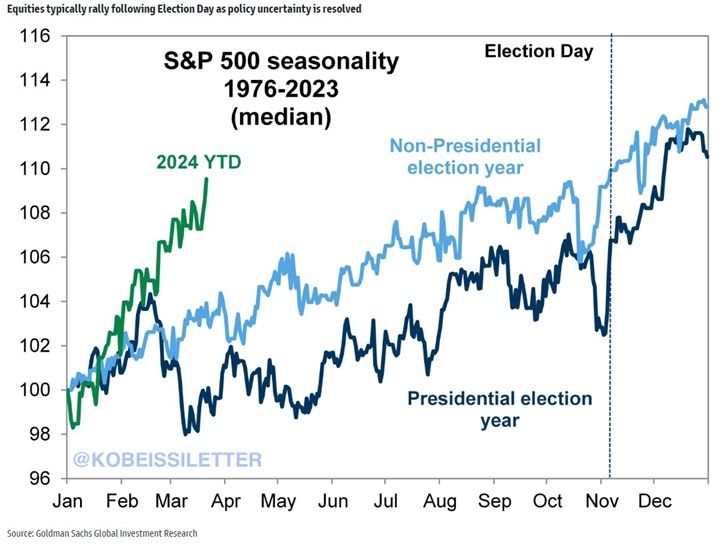

The S&P 500's performance has been truly outstanding this year.

The index is up 9% year to date which is more than DOUBLE the average YTD return in an election year. In the past, the median return during a US presidential election year was about 11%. There are still several months until the presidential election but the index is on track to significantly exceed its historical performance. Source: The Kobeissi Letter

Industrial Metals relative strength (vs. $SPX) ready to turn?

Source: Nautilus Research

Investing with intelligence

Our latest research, commentary and market outlooks