Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

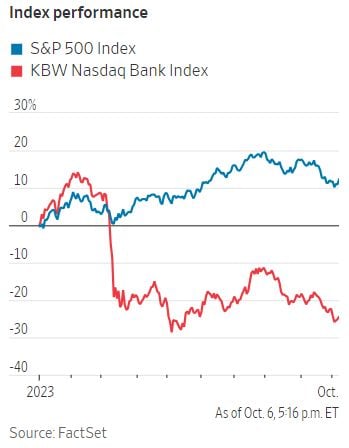

The SP500 has now lost $3.5 trillion in value since the Fed removed a recession from their forecast

The Fed marked the exact high in July 2023 with their "no recession" call. Since then, the S&P 500 is down 9% and just hit its lowest level since May 31st. We are also 1% away from entering correction territory just as earnings season begins. Source: The Kobeissi Letter

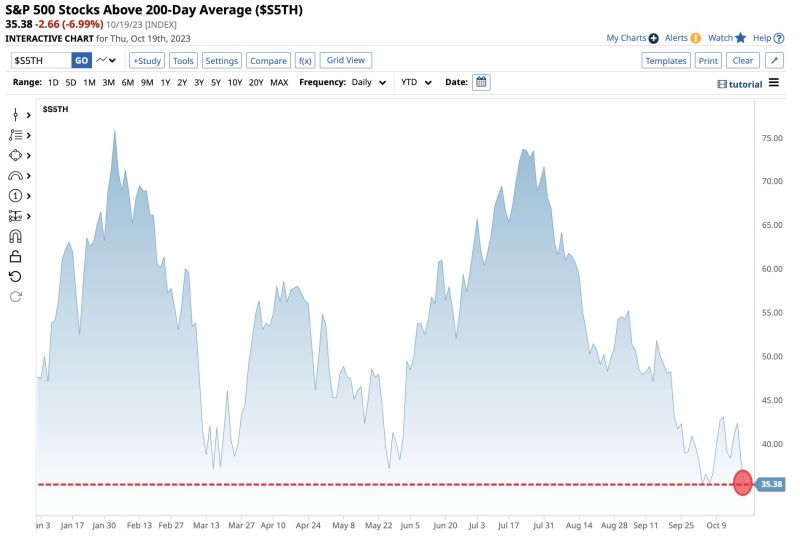

MARKET BREADTH NEGATIVE ALERT >>>

SP500 Market Breadth drops to lowest level of the year as only 35.38% of Index Stocks are trading above their 200 Day Moving Averages Source: Barchart

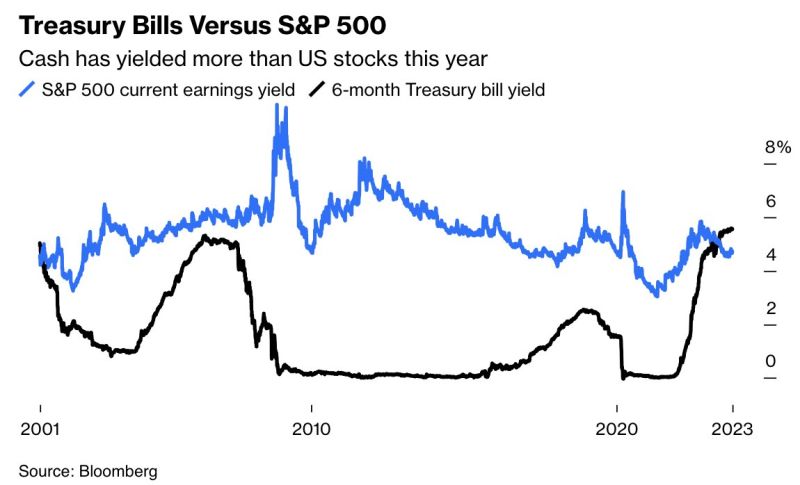

This is the first time since 2000 that Treasury Bills are yielding higher than the S&P 500 earnings yield

Even during the 2008 Financial Crisis, cash never yielded higher than S&P 500 earnings. And the gap between the SP500 earnings yield and cash is widening. Competition from cash and bond yields versus stocks keeps rising. For a USD-reference account investor, here's the median Return by Asset Class: 1. High Yield Savings Accounts: 5.5% 2. 6-Month Treasury Bill Yield: 5.0% 3. Investment Property Cap Rate: 4.5% 4. S&P 500 Earnings Yield: 4.2% Bottomm-line: Cash and Treasury Bills are now paying a HIGHER yield than real estate and the S&P 500. In other words, risky assets are paying less than risk-free assets, i.e taking a risk is compensated LESS than just holding cash. Source: The Kobeissi Letter

Wondering why high interest rates hasn't hurt sp500 performance so far?

Just have a look at the chart below courtesy of Linas Beliūnas. The S&P 500 heavy weights are full of cash and have been benefiting from the higher yield paid on short-term deposits. E,g Apple is making $1 billion on their cash holdings doing absolutely nothing...

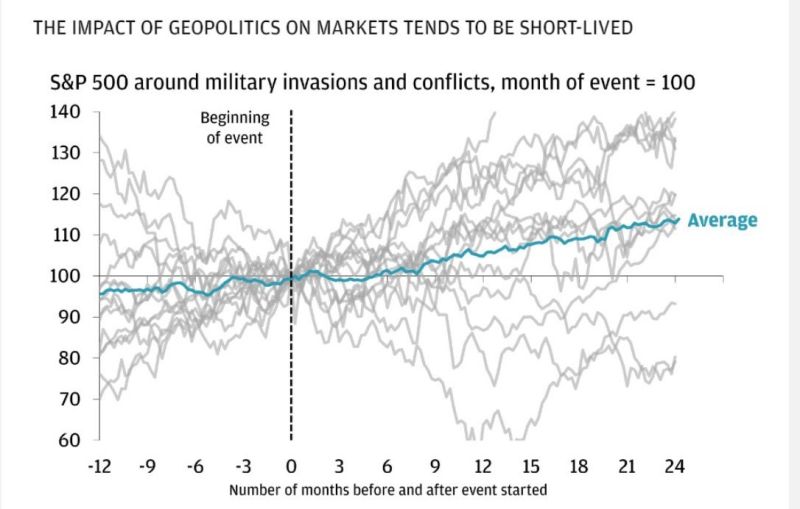

Nobody can predict at the moment how the Middle East situation will unfold, but if history is a guide market impacts of geopolitical scares are usually short lived

Will it be different this time? Source: Michel A.Arouet

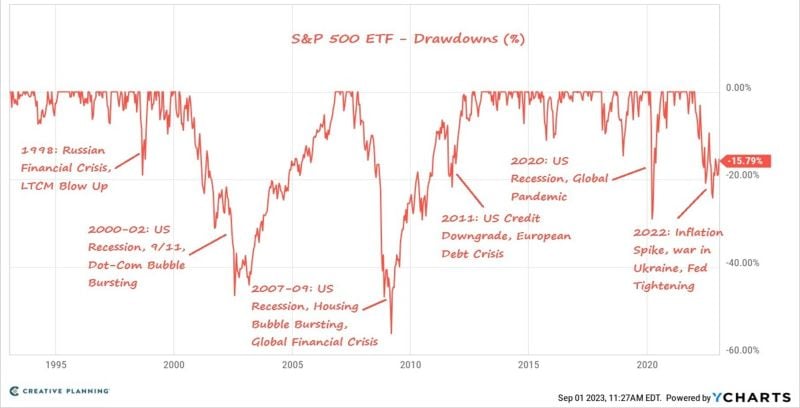

The bull-market is one-year old and the leadership has been unusual

• Since 1980, every single end to a bear market and start of a new bull has been accompanied by a broad rally in stocks, with the Equal Weight Index and small-caps stocks outperforming the S&P 500. • This time is different: the S&P 500 is heavily influenced by the 10 largest companies, which have enjoyed outsized returns. The so-called "magnificent seven" (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA and Tesla) are up 77% over the past 12 months. But the S&P 500 Equal Weight Index, which assigns the same weight to all the stocks that are included, is up a more modest 11% for the same timeframe. Small-cap stocks are up 5%. Source: Edward Jones

Investing with intelligence

Our latest research, commentary and market outlooks