Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- oil

- Real Estate

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

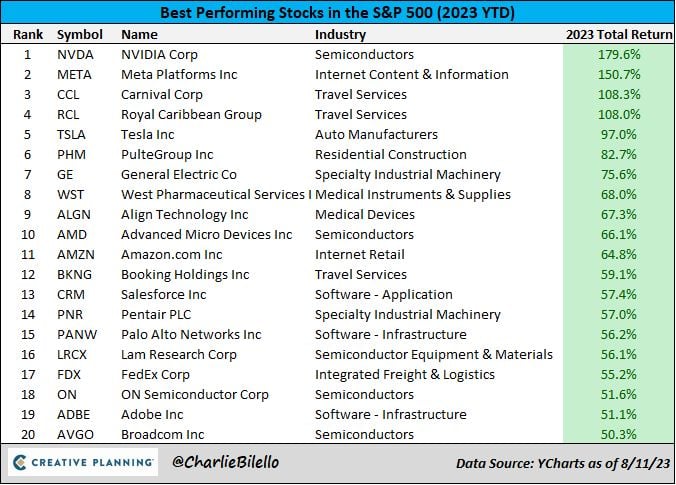

The best performance stocks in the S&P 500 this year...

Source: Charlie Bilello

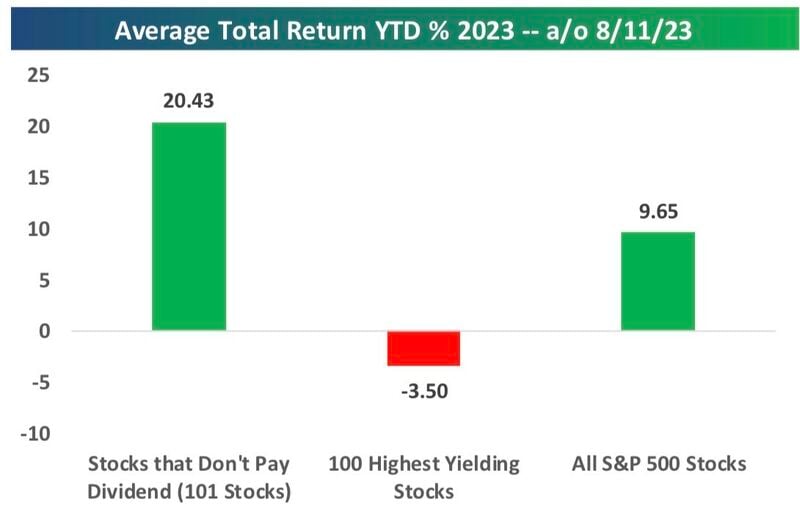

With “risk free” rates above 5%, the typically low-growth, high-dividend payers in the sp500 are massively underperforming in 2023

The 101 non-dividend payers are up 20.4% YTD, while the 100 highest yielders in the index are down an average of 3.5% on a total return basis. Source: Bespoke

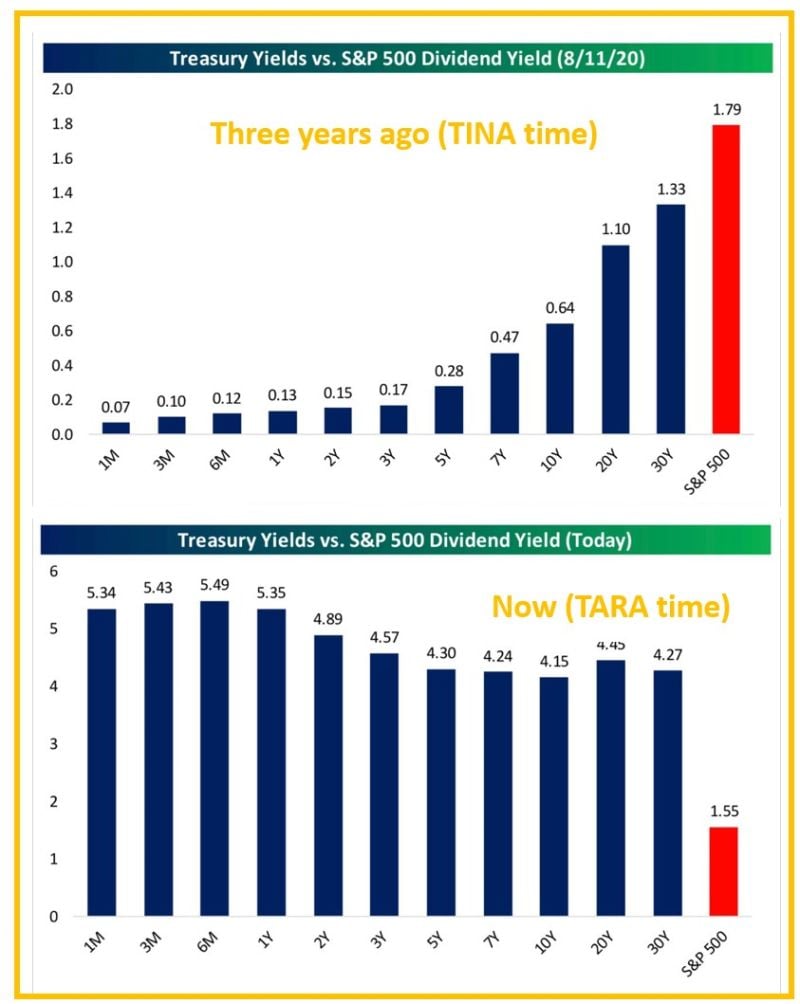

From T.I.N.A (There is No Alternatives to risk assets) to T.A.R.A (There Are Reasonable Alternatives, i.e bonds)

Three years ago in August 2020, the S&P’s dividend yield (in red below) was 1.8%, almost 50 bps higher than the highest yield on the treasury curve. Every treasury note with a duration shorter than 5 years had a yield below 0.2% and the 1-month was almost ZERO. Fast forward to today and the S&P’s dividend yield of 1.55% is 260 bps lower than the lowest point on the treasury curve right now (the 10-year at 4.15%). And the 1-month T-bill yielding at 5.34% is 380 basis points higher than the S&P’s dividend yield. Source: Bespoke

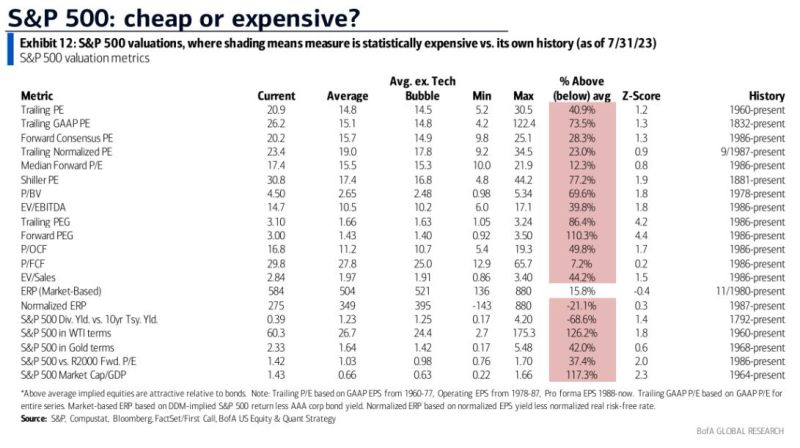

Out of 20 valuation metrics, the SP500 is currently overvalued on 19 of them relative to historical levels

Source: Barchart

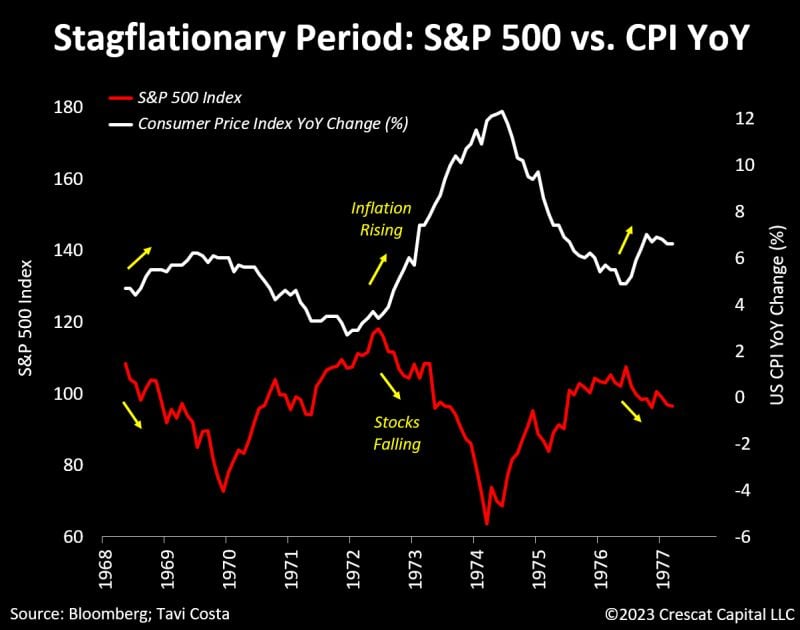

During stagflationary periods, the SP500 index tends to be inversely correlated with inflation

Tavi Costa: "From the late-1960s to the mid-1970s, equity markets declined whenever CPI rates re-accelerated to the upside. The primary driver behind this negative correlation stems from the market's growing concern about the potential for a tighter monetary policy to address the persistent increase in consumer prices". Source: Crescat Capital, Bloomberg

SP500 seasonality and 4-year cycle analysis suggests a consolidation before a year-end rally

Source: Nautilus Research

Should you do the opposite of what Wall Street strategists say? Data over the last 3.5 years suggests that strategists underperform the S&P 500

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks