Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

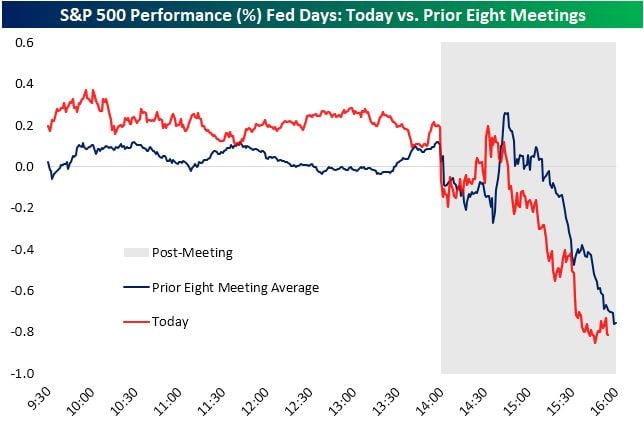

Another Powell Fed Day

Incredible how closely today's action tracked the average. Source: bespoke (read "today" red line as yesterday)

Heat map of the S&P 500's $SPY performance so far in 2023

Source: Evan, Bloomberg

The 10 largest companies in the S&P 500 now make up 34% of the index with an average P/E ratio of 50x

This is the highest percentage since 2001 during the Dot-com bubble. Even in the 2008 bubble, this percentage peaked at ~26%. These same 10 companies have accounted for ~80% of the Nasdaq's entire rally this year. Markets are increasingly held up by a few stocks, particularly in the technology sector. Source: The Kobeissi Letter, Apollo

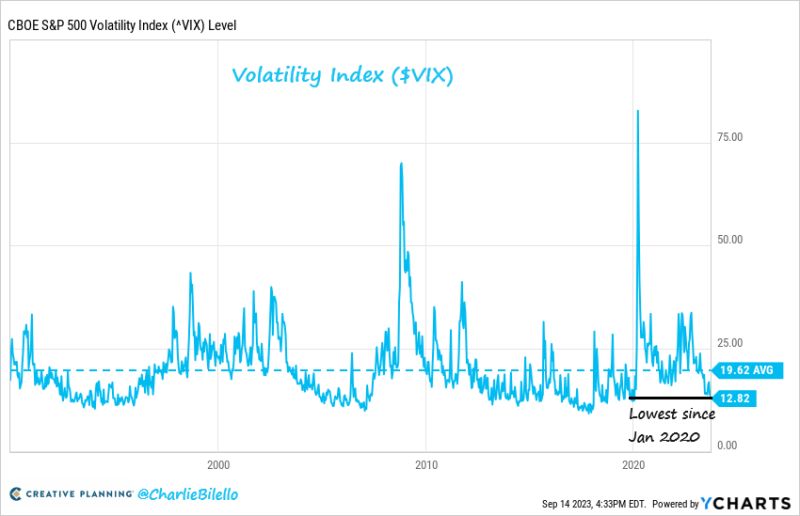

The $VIX ended the day at 12.82, its lowest close since January 2020

Source: Charlie Bilello

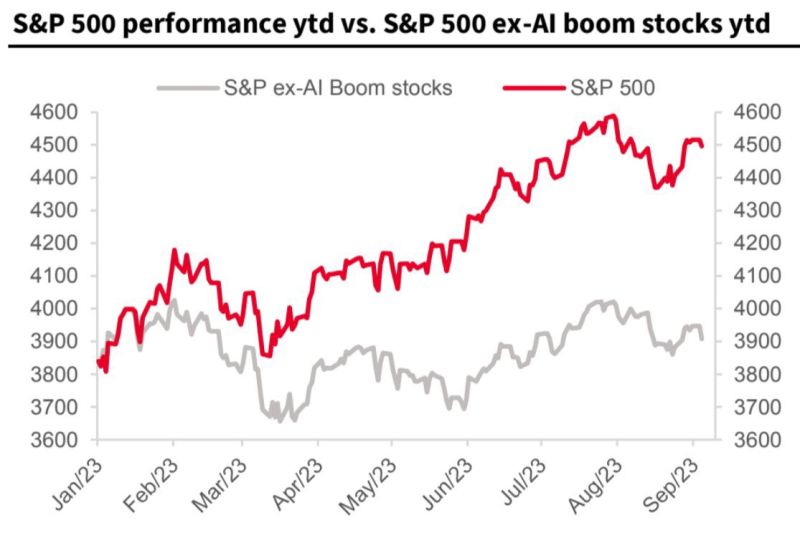

All S&P 500 gains this year came from the AI boom/mania, all other stocks are flat reflecting concerns about global economic slowdown

Source: Michael A. Arouet

The top 10 companies in the S&P 500 with outstanding credit ratings

Among them, Microsoft and Johnson & Johnson stand out as the only two companies boasting the highest AAA rating. Source: Genuine Impact

The sp500 P/E ratio used to be tightly correlated to the US 2 year yield (inverted on the chart), i.e the lower the 2 year yield, the higher the P/E ratio and vice versa

Well, this is no longer the case as a giant crocodile jaw has been forming. Which of the 2 will bind firts? Source. Jeroen Blokland, True Insights

The S&P 500 earnings yield minus risk-free cash rate (3-month treasury bill) has dropped to its lowest level (-90 basis points) in 23 years

Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks