Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

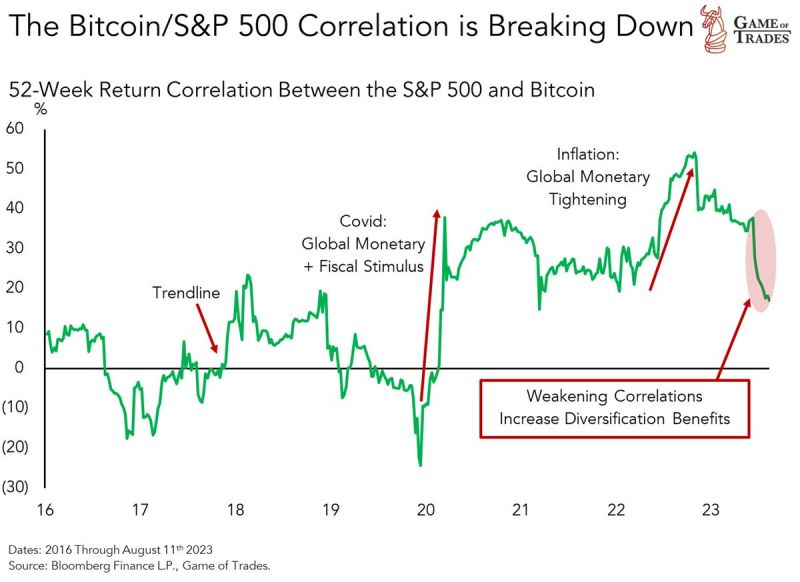

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

Since the COVID Crash lows in March 2020, US equity markets have more than doubled the performance of bonds

As shown below, that's the best performance ever over a similar time window, topping the strongest stocks-bonds outperformance from the tech bubble of the late 1990s and early 2000s. Source: Bespoke, J-C Gand

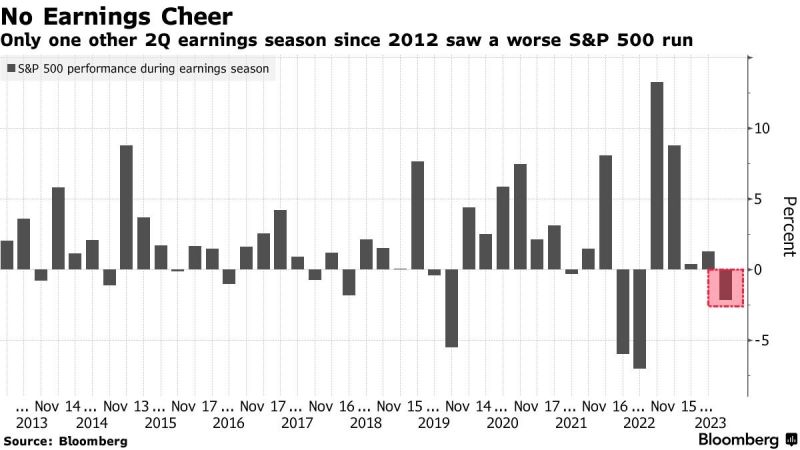

More than 80% of SP500 companies that have reported so far have beaten profit expectations but the returns are setting this up to be one of the worst earnings seasons over the last 11 years

Source: Bloomberg

There is bearish divergence spotted between the market (SP500) and % of stocks above their 200-day MA

The last occurrence led to significant downside for equities. Source: Game of Trades

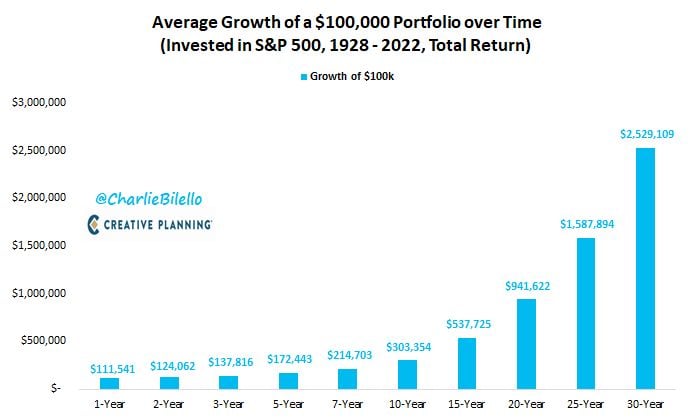

The biggest money in investing comes from patience and time

Your biggest edge as an individual investor comes from ignoring short-term fluctuations and playing the long game. Source: Peter Mallouk, Charlie Bilello

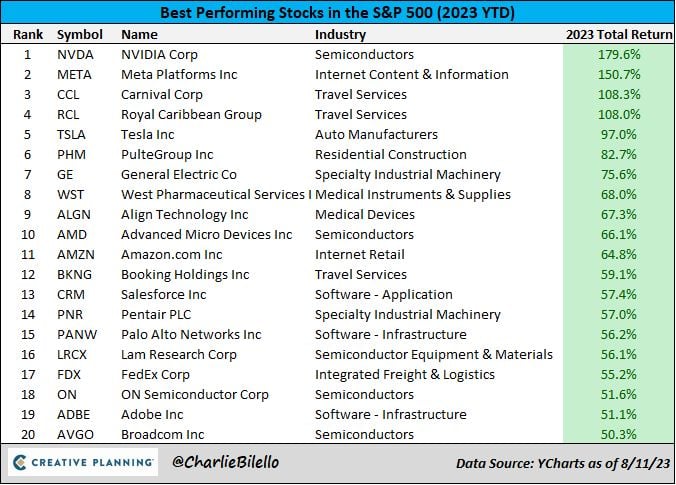

The best performance stocks in the S&P 500 this year...

Source: Charlie Bilello

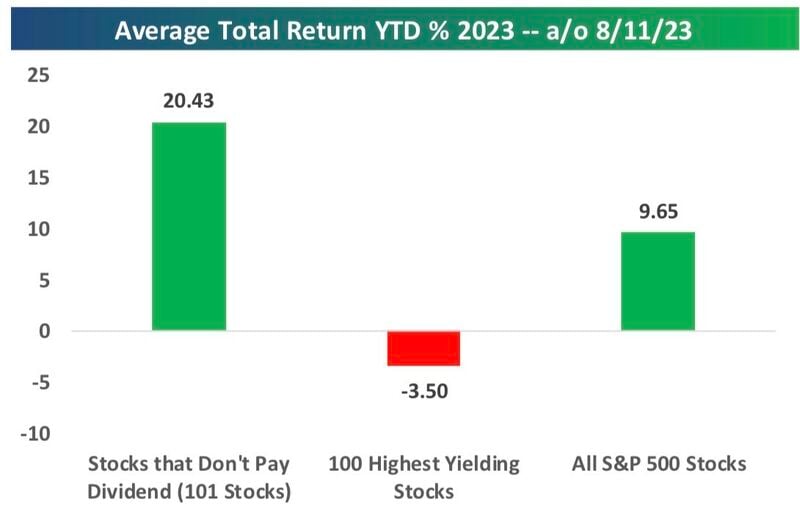

With “risk free” rates above 5%, the typically low-growth, high-dividend payers in the sp500 are massively underperforming in 2023

The 101 non-dividend payers are up 20.4% YTD, while the 100 highest yielders in the index are down an average of 3.5% on a total return basis. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks