Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

The sp500 P/E ratio used to be tightly correlated to the US 2 year yield (inverted on the chart), i.e the lower the 2 year yield, the higher the P/E ratio and vice versa

Well, this is no longer the case as a giant crocodile jaw has been forming. Which of the 2 will bind firts? Source. Jeroen Blokland, True Insights

The S&P 500 earnings yield minus risk-free cash rate (3-month treasury bill) has dropped to its lowest level (-90 basis points) in 23 years

Source: BofA

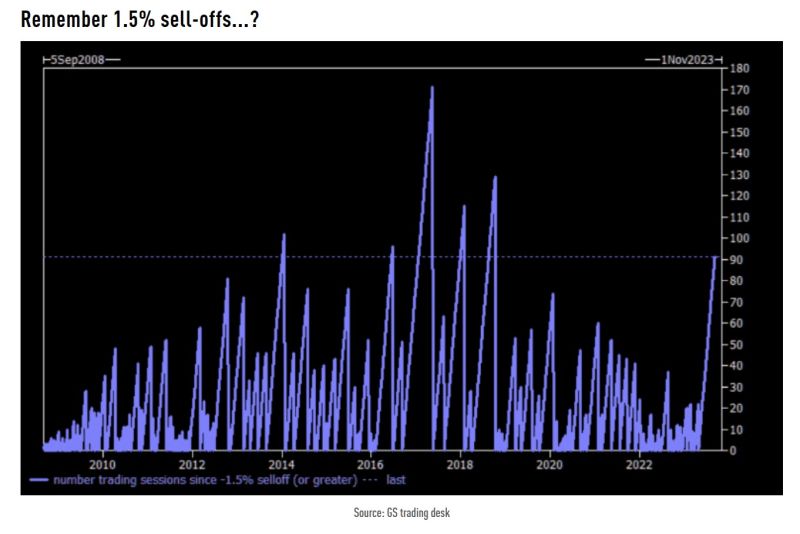

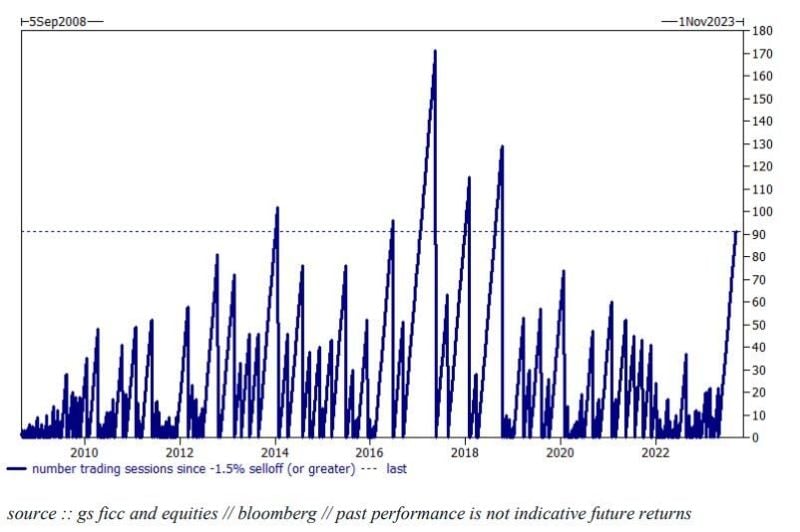

As Goldman's Brian Garrett noted yesterday, it has been 91 days since the sp500 suffered a 1.5% loss or greater in a day...

That's unusual - it has happened only 5 times in the last 15 years. As we have discussed recently, Sep + Oct are seasonally-volatile months... Source: Goldman Sachs

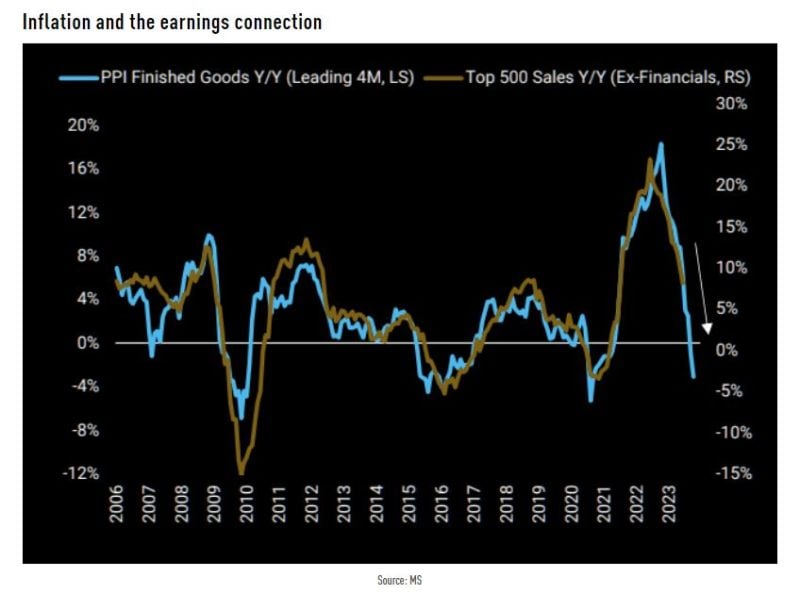

Inflation has been a boost to sp500 companies top-line growth

Now that inflation starts to cool down, could it work the otehr way around? here's the view from Morgan Stanley: "Our boom/bust framework would suggest inflation as it relates to corporate earnings (i.e., pricing) falls toward zero or even below. This is likely to have a significant impact on sales growth and, consequently, on earnings growth as negative operating leverage takes hold." Source: TME

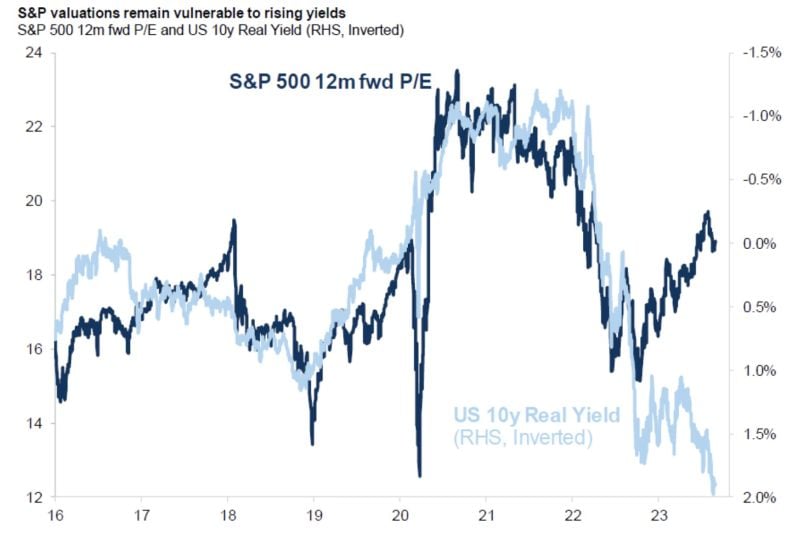

Mind the gap: The valuation of S&P 500 has become cheaper but attractiveness vs interest rates has decreased massively as US 10y real yields now at almost 2%

Chart via Goldman Sachs thru HolgerZ

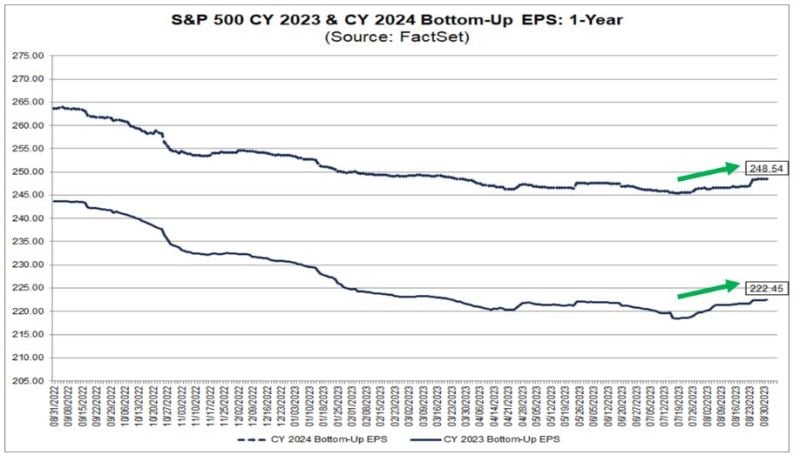

ANALYSTS ARE RAISING QUARTERLY S&P 500 EPS ESTIMATES FOR THE FIRST TIME SINCE Q3 2021

At the end of the earnings season for the second quarter, have analysts lowered EPS estimates more than normal for S&P 500 companies for the third quarter? The answer is no. During the months of July and August, analysts increased EPS estimates for S&P 500 companies for the third quarter. The Q3 bottom-up EPS estimate increased by 0.4% (to $56.10 from $55.86) from June 30 to August 31. While analysts were raising EPS estimates in aggregate for the third quarter, they were also increasing EPS estimates for the fourth quarter. The bottom-up EPS estimate for the fourth quarter increased by 0.6%. Source: Factset

Investing with intelligence

Our latest research, commentary and market outlooks