Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

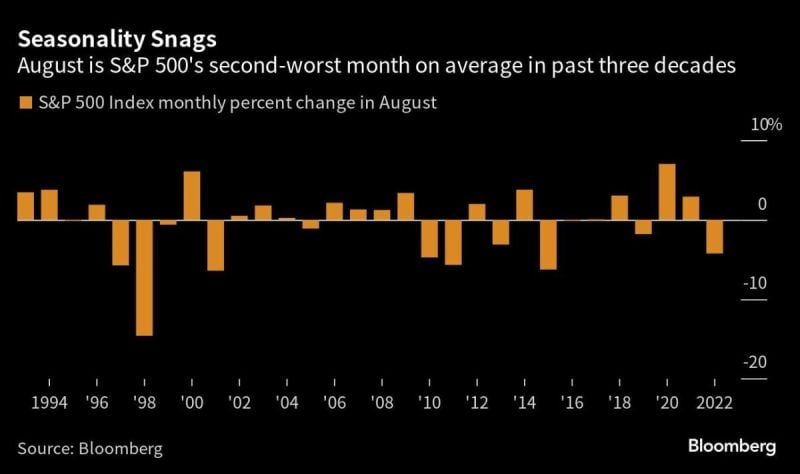

If the S&P500 is going to take a well-deserved break, this would be a perfectly logical time in the cycle for that to happen according to S&P 500 pre-election cycle

Source: J-C Parets

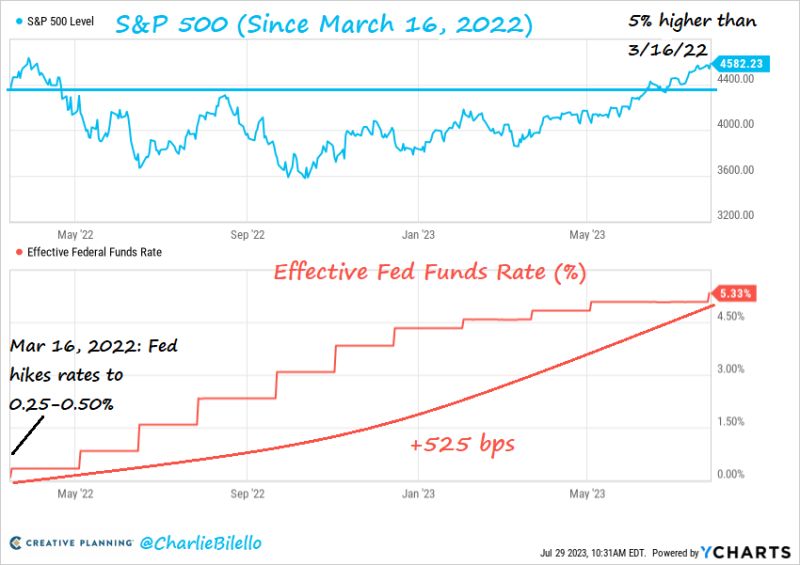

The SP500 is now 5% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

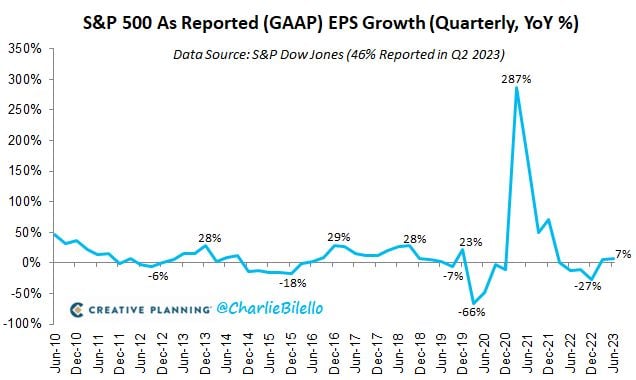

With 46% of companies reported, S&P 500 Q2 GAAP earnings per share are up 7% over the last year, the highest YoY growth rate since Q4 2021.

Source: Charlie Bilello

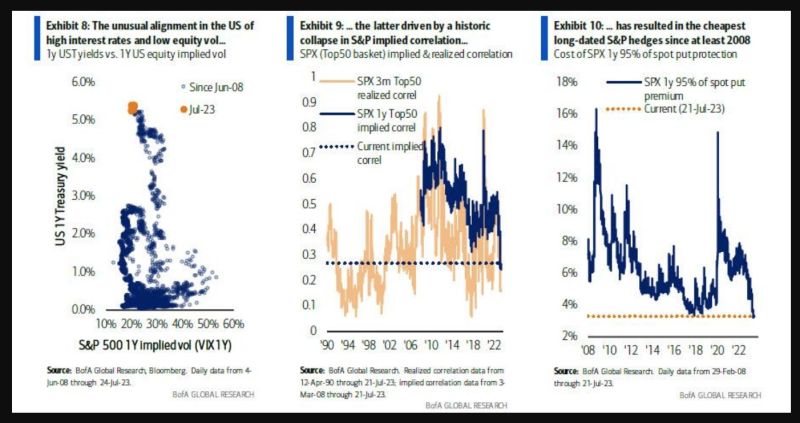

It has never been cheaper to hedge against a market crash

According to Bank of America's derivatives strategists, it has never cost less to protect against an #sp500 crash drawdown in the next 12 months. Why is the cost of longer-dated S&P protection at record lows today? The most common explanations are a mix of fundamentals (e.g. a recession, if it materializes, will be short-lived and shallow; or, realized correlation is too low to warrant higher implied correlation) and vol technicals (e.g. the supply of vega on US underlyings for yield remains robust; or, due to the rise of short-dated option selling, the next shock will likely be a “gamma event” in which systemic tenors of risk don’t react strongly). Source: BofA, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks