Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

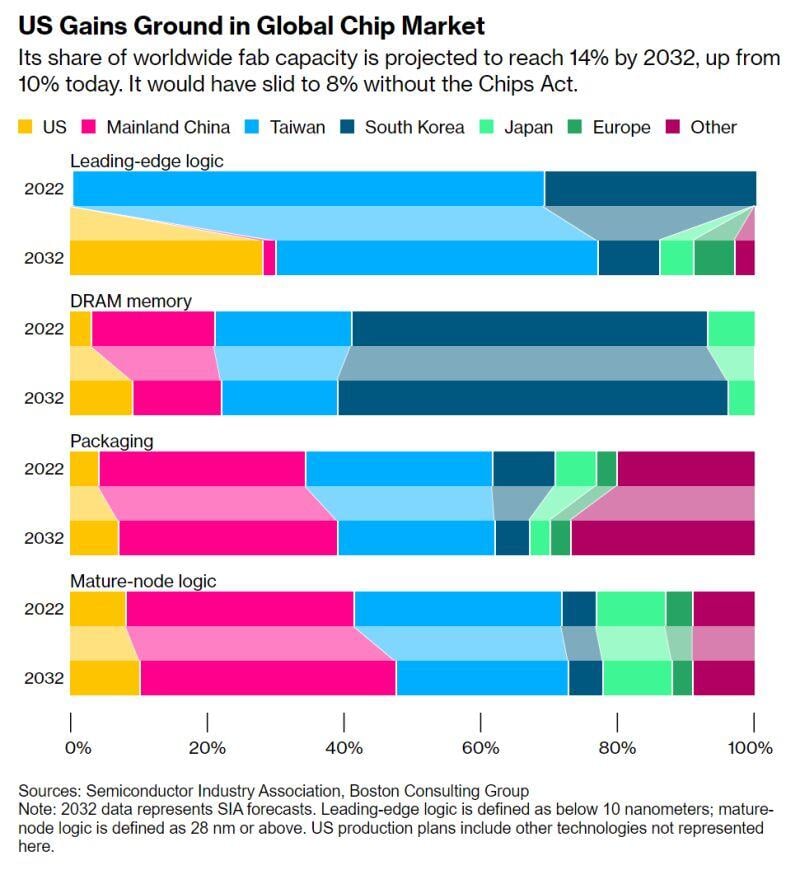

US Chips Act is reshaping global semiconductor landscape

• America looks set to produce around one-third of global supply for leading-edge chips by 2032 • US rise will come at expense of South Korea, which could become minor player for top-notch chips Source: Agathe Demarais

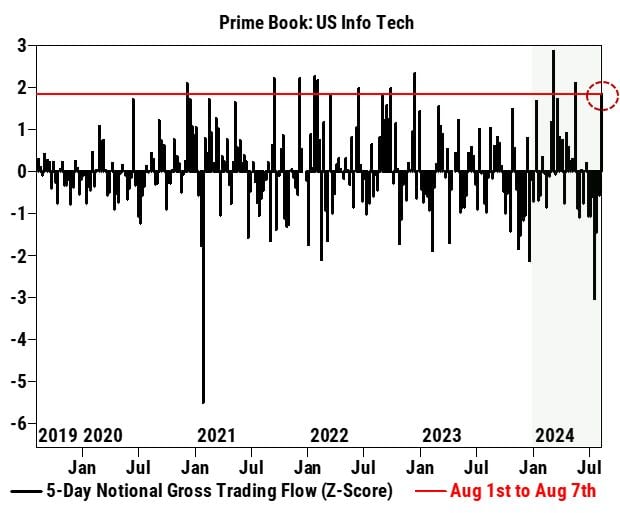

Bank of America survey shows continued optimism on Big Techs

Source: Bloomberg

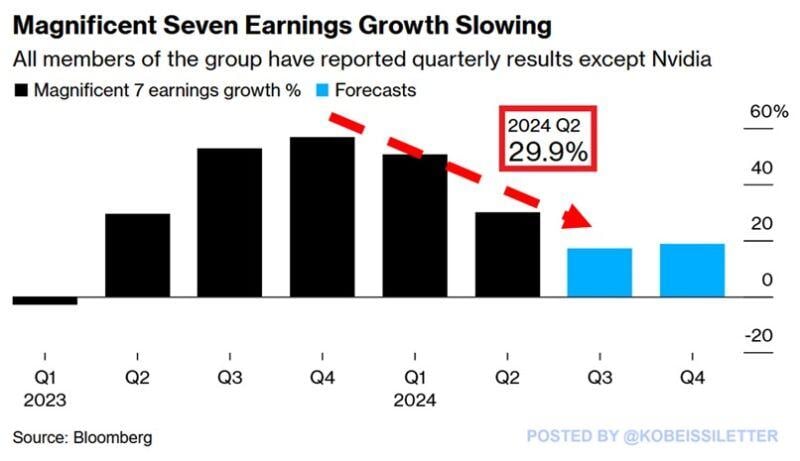

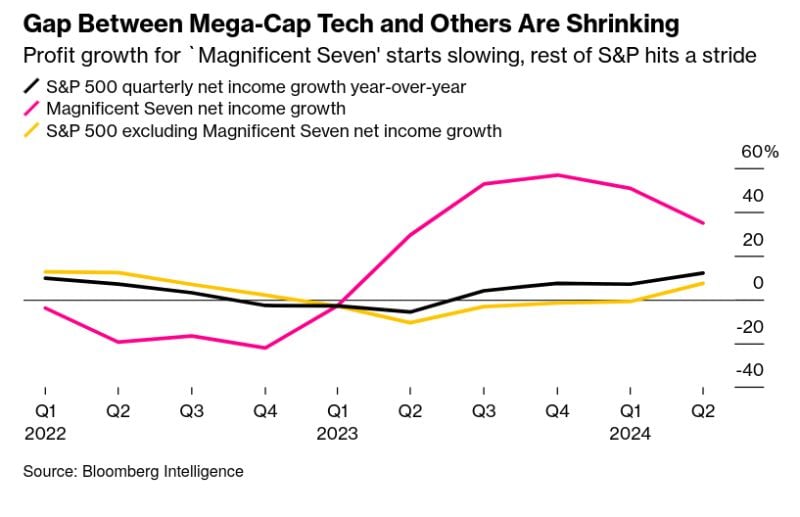

Has the Magnificent 7's earnings growth peaked?

In Q2 2024, the Magnificent 7' net income, excluding Nvidia, $NVDA, rose by 30% year-over-year, the slowest growth since Q2 2023. This is down from 51% in Q1 2024 and below the record 57% seen in Q4 2023. It is estimated that the growth rate will decelerate further to ~17% in Q3 2024. Source: The Kobeissi Letter

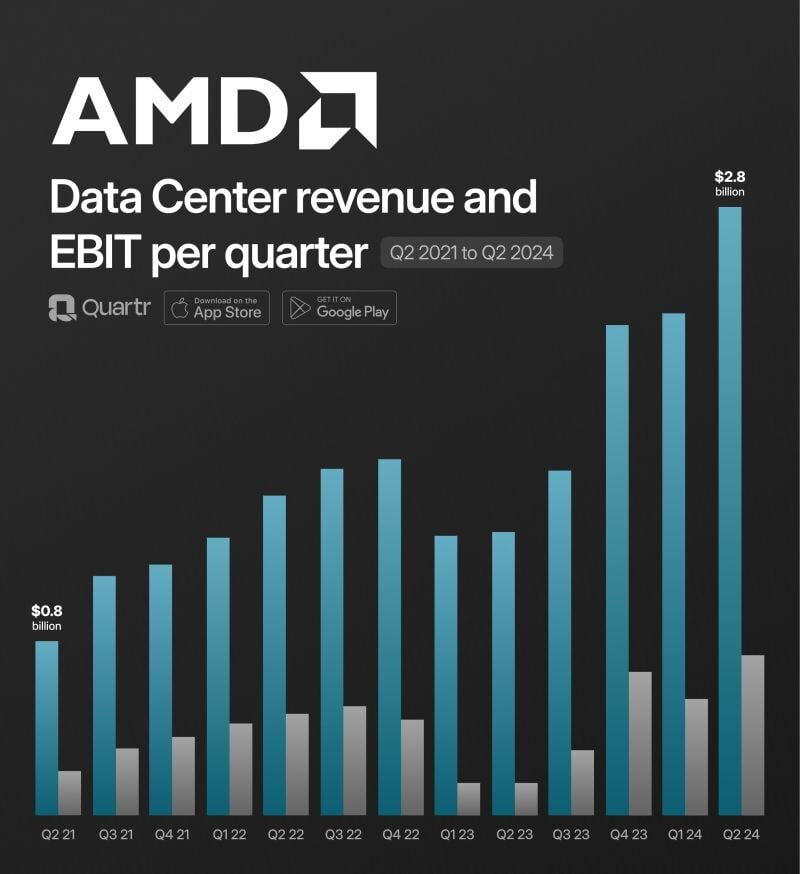

$AMD Q2 2024: "Our AI business continued accelerating and we are well positioned to deliver strong revenue growth in the second half of the year" - Lisa Su, CEO

Details by Quartr: Revenue +9% *Data Center +115% *Client +49% *Gaming -59% *Embedded -41% Gross Profit +17% *marg. 49% (46%) EBIT +1445% *marg. 5% (0) EPS +700%

Microsoft and Alphabet are now exactly on par since the launch of ChatGPT at the end of November 2022.

Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks