Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- tech

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

BREAKING >>> THE NANCY PELOSI EFFECT ! Palo Alto Networks stock, $PANW, is now up 10% today after Nancy Pelosi bought call options on the stock.

The call options are reportedly worth up to $1.25 million. This comes just days after $PANW fell over 30% following their earnings results. Markets are effectively treating Pelosi's trades like an activist hedge fund took a stake in the company. Her track record on buying many large cap tech stocks at their lows, including $NVDA, is largely why... Is Nancy ‘Gordon Gecko’ Pelosi the new Cathie Wood ??? Source: The Kobeissi Letter

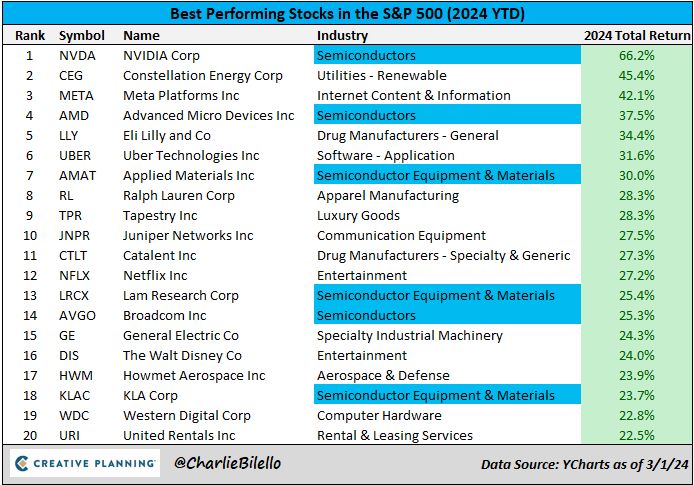

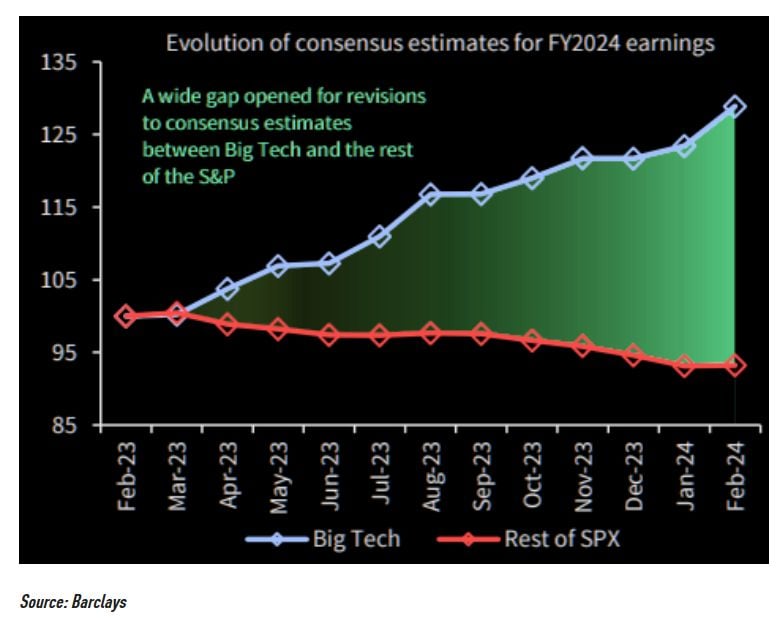

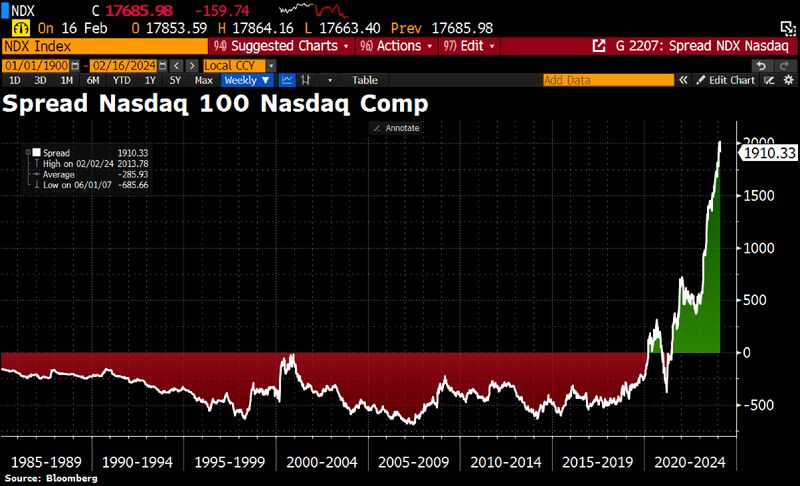

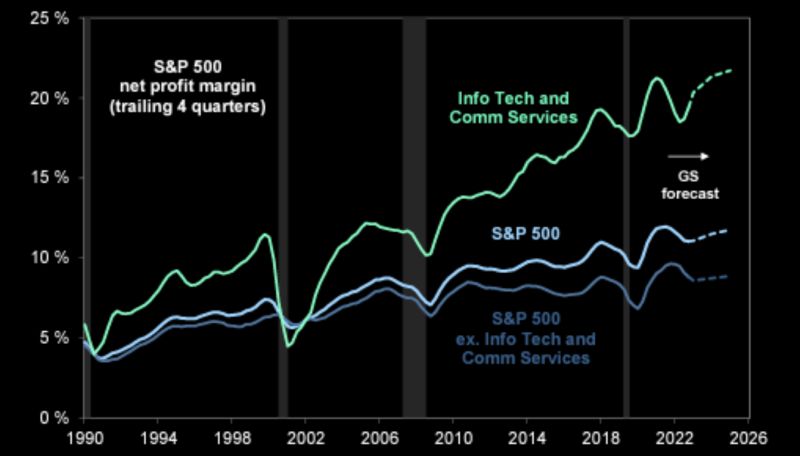

Magnificent 7 profits now exceed almost every country in the world

The so-called “Magnificent 7” now wields greater financial might than almost every other major country in the world, according to new Deutsche Bank research. The meteoric rise in the profits and market capitalizations of the Magnificent 7 U.S. tech behemoths - Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — outstrip those of all listed companies in almost every G20 country, the bank said in a research note Tuesday. Of the non-U.S. G20 countries, only China and Japan (and the latter, only just) have greater profits when their listed companies are combined. source : cnbc

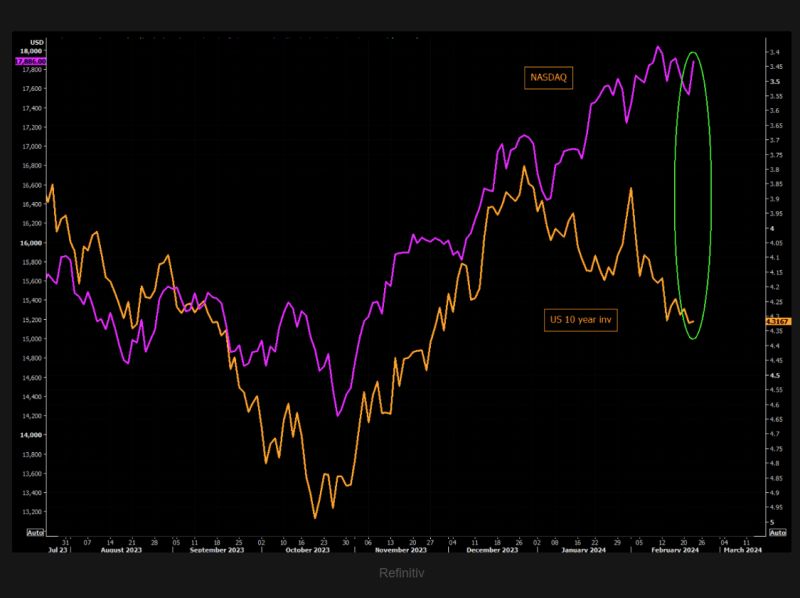

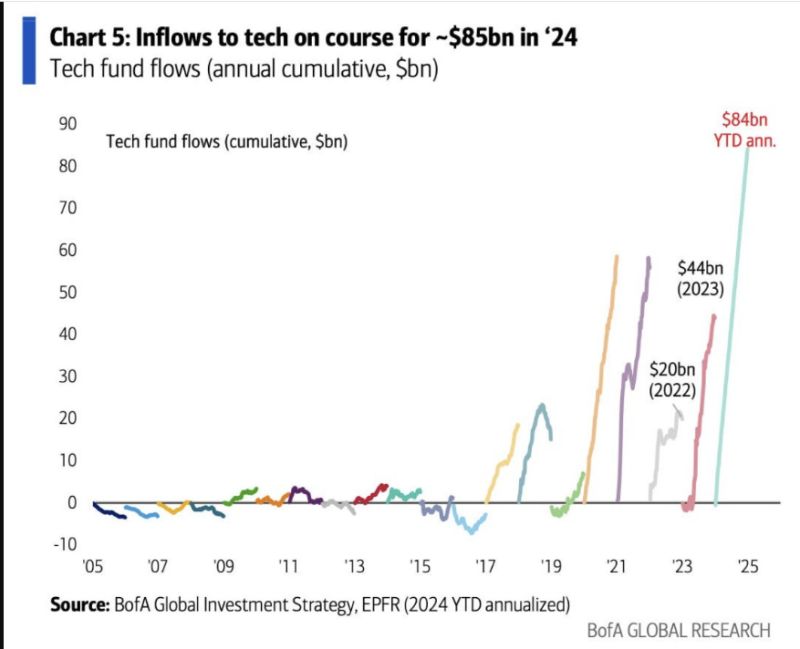

Tech Funds are on track to see inflows of $85 billion this year, an all-time high

source: BofA, barchart

Investing with intelligence

Our latest research, commentary and market outlooks