Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The White House announced Wednesday that it is imposing an additional 25% tariff on India, bringing the total levies against the major United States trading partner to 50%.

“I find that the Government of India is currently directly or indirectly importing Russian Federation oil,” President Donald Trump said in an executive order. “Accordingly, and as consistent with applicable law, articles of India imported into the customs territory of the United States shall be subject to an additional ad valorem rate of duty of 25 percent,” the executive order reads.

Apple $AAPL Proof of Life

White House adviser says new $APPL US investment likely to be announced today. Source: Barchart

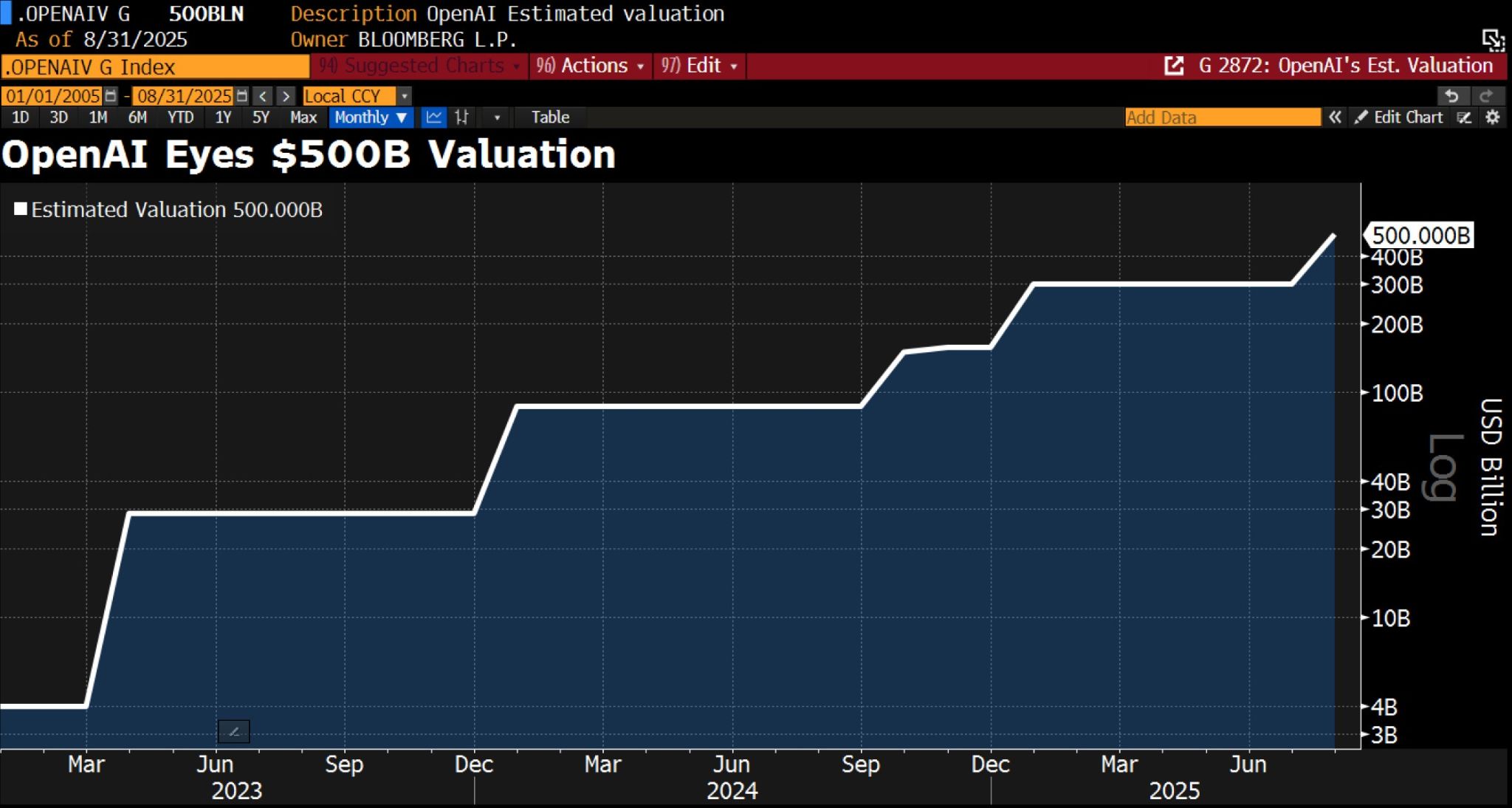

OpenAI might soon be worth $500bn – thanks to a potential stock sale for employees.

The company is reportedly in early discussions to allow current and former employees to sell their shares, which would value OpenAI at roughly $500bn. Source: HolgerZ, Bloomberg

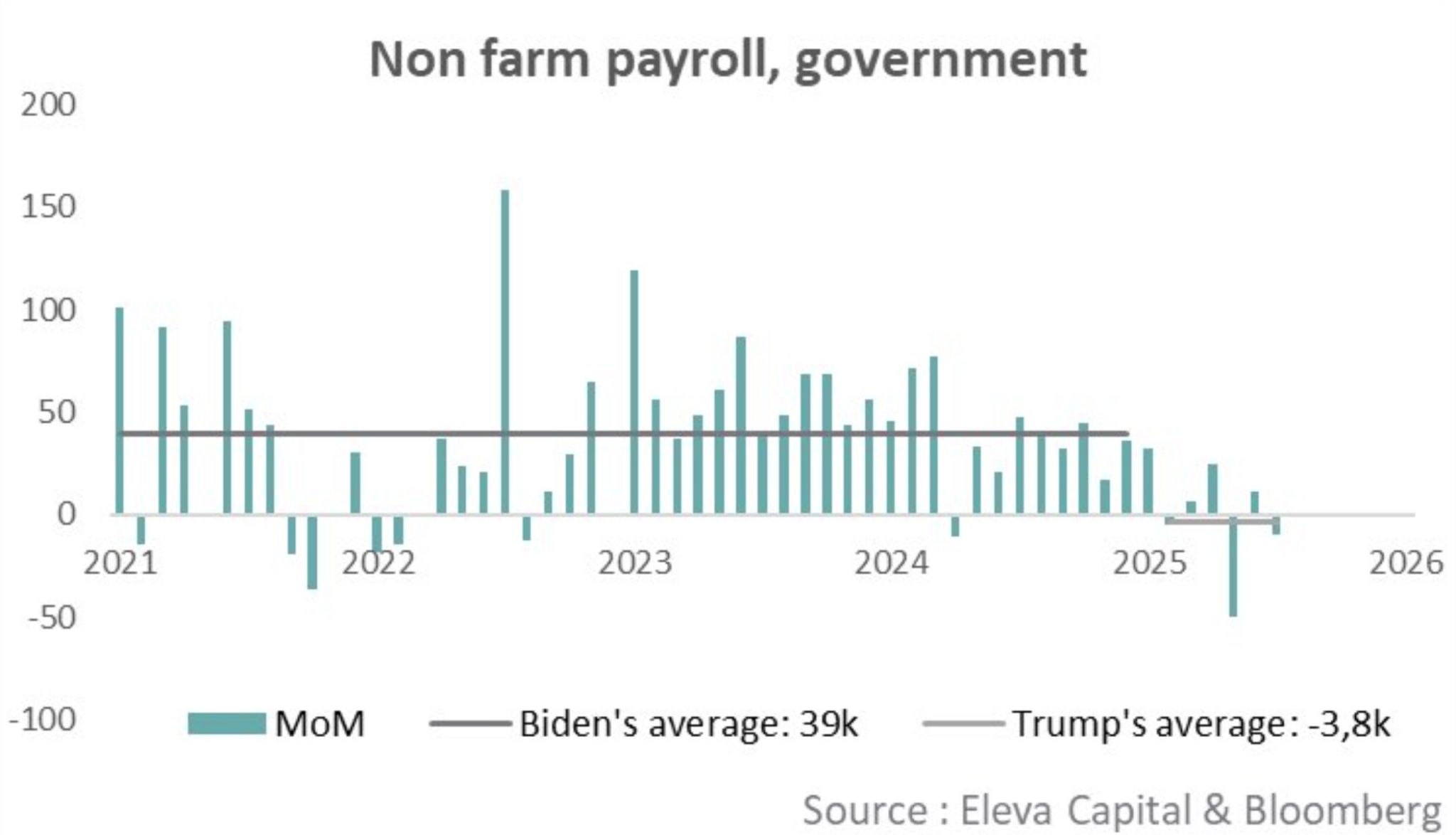

Government jobs created/eliminated under Biden and Trump.

Probably too early to call it a trend change, but worth being highlighted. Source: Chart Eleva Capital, Bloomberg thru Michel A.Arouet

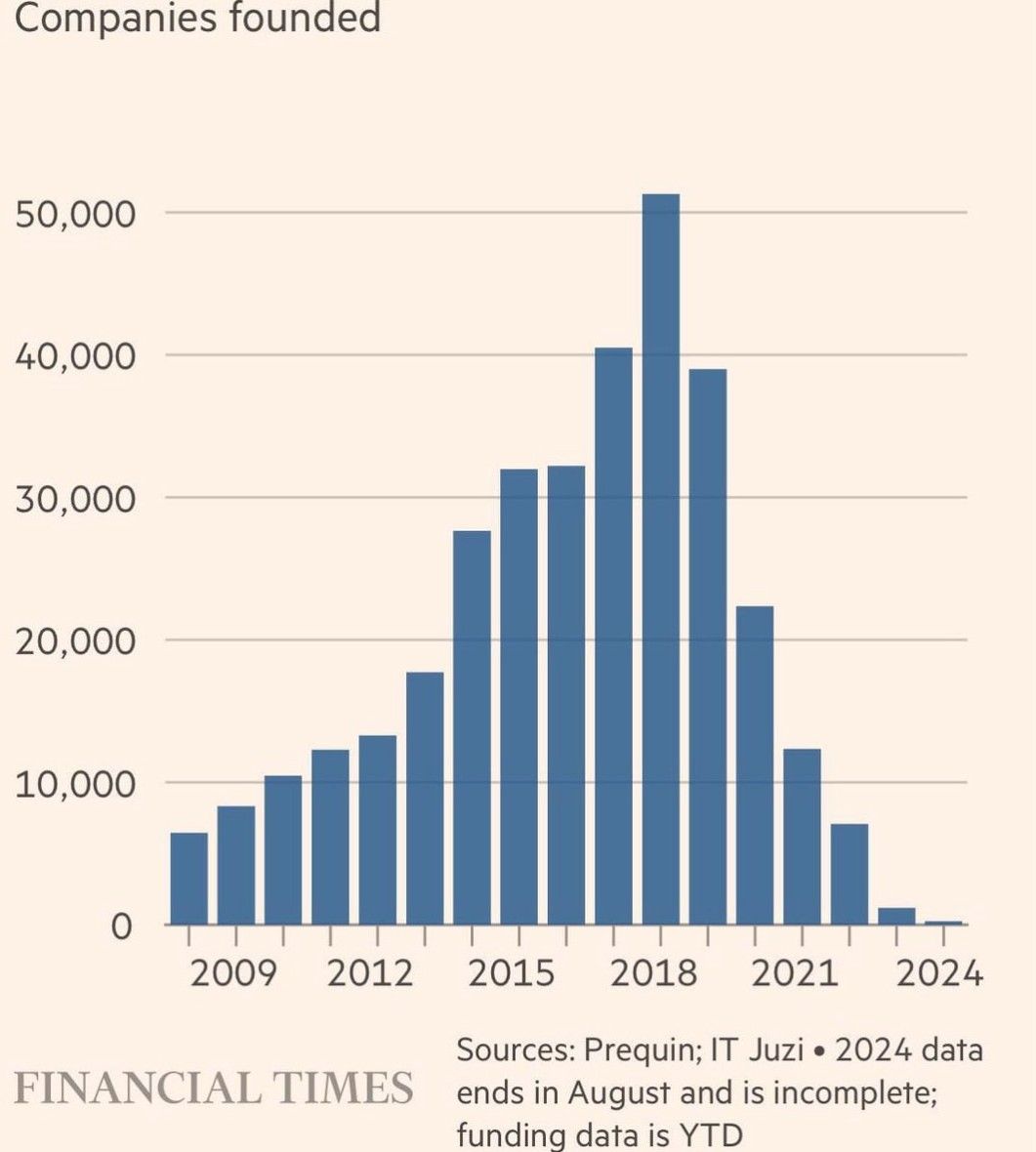

The chart below shows the number of companies founded in China each year.

Private entrepreneurialism fueling China’s economic rise has come to a full stop there. Time will tell what will be the consequences of a pivot to a state run economy again. Source: Michel A.Arouet, FT

Apple $AAPL increases commitment to $600 billion, announces american manufacturing program.

“Today, we’re proud to increase our investments across the United States to $600 billion over four years and launch our new American Manufacturing Program,” - Tim Cook Source: Evan on X, FT

Trump: 100% tariff on chips, semiconductors. Exempt from tariff if made commitment to build in US.

However, companies like hashtag#Nvidia ( $NVDA ) and hashtag#Apple ( $AAPL ), which have already invested heavily in U.S. manufacturing, are exempt from the new policy... Source: CNBC

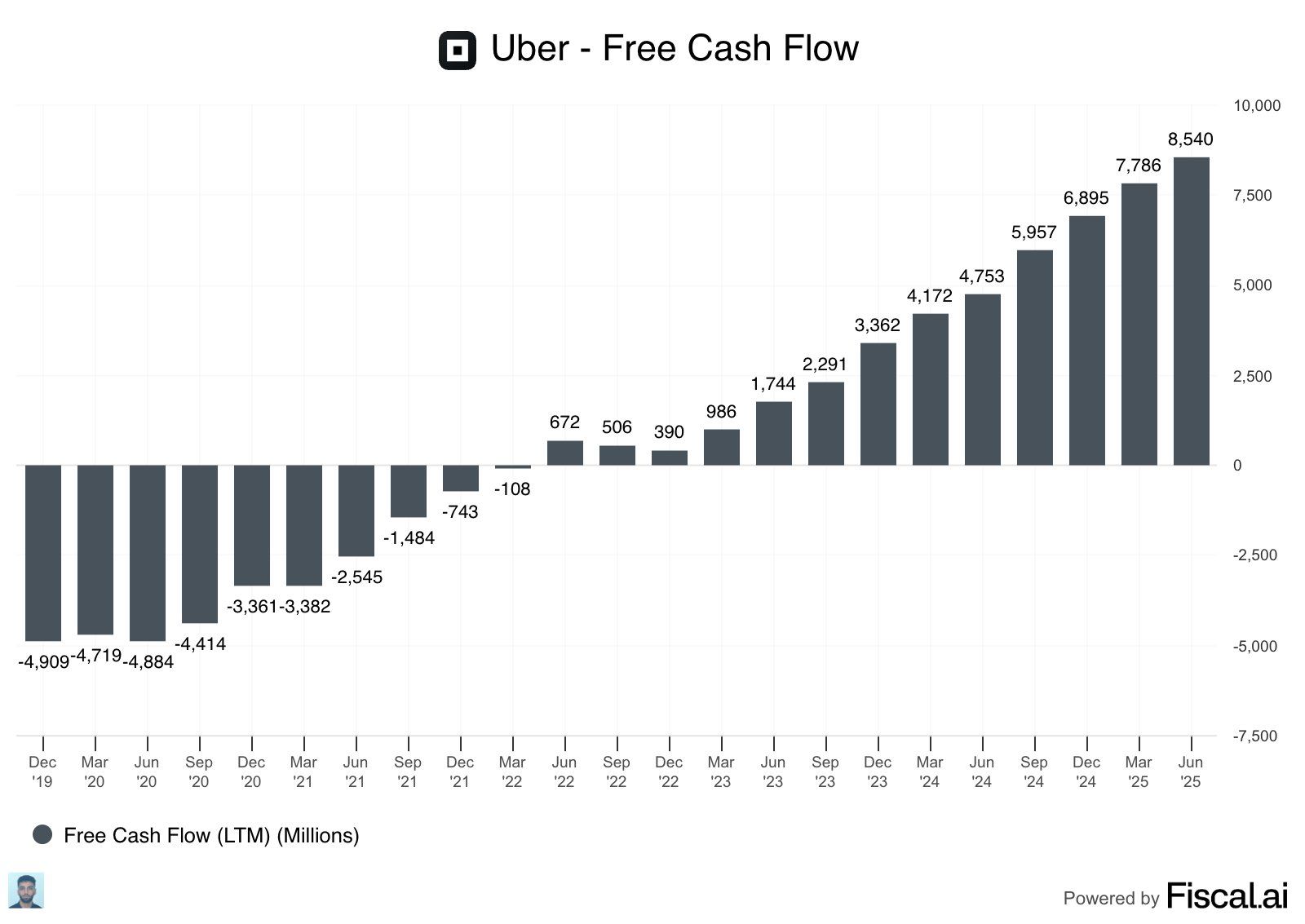

Updated Uber Free Cash Flow chart is incredible.

$8.5B and counting! 🤯 $UBER Source: Fiscal.ai

Investing with intelligence

Our latest research, commentary and market outlooks