Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

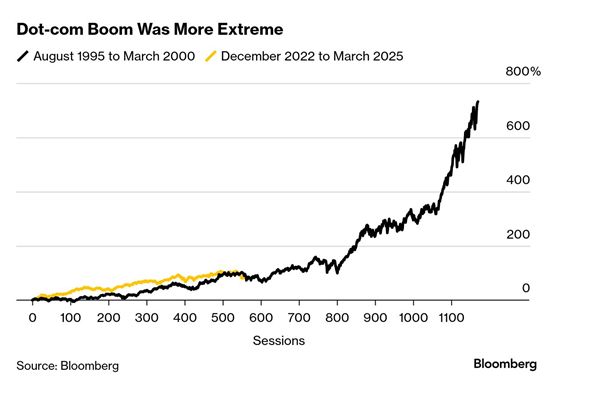

🎈 Happy Anniversary, Dot-Com Bubble.

On this day 25 years ago — March 24, 2000 — the S&P 500 hit a peak it wouldn’t revisit until 2007. Three days later, the Nasdaq 100 reached its final all-time high… for the next 15 years.

U.S. Earnings Revisions Index from @Citi has been negative for 13 consecutive weeks.

Source: Liz Ann Sonders, Bloomberg

White paper outlines more than 101 million Indians diagnosed with diabetes and 136 million with pre-diabetes.

Total diabetes treatment cost is projected to hit $12.8 billion by 2030, it said urging government action to curb hashtag#India's growing burden. Read more at: https://lnkd.in/eG_dSUDa

The army of retail investors is fighting the US stock market:

Mom-and-pop investors have bought US equities for 7 days STRAIGHT ending Wednesday. Individuals have sold stocks on net only in 7 trading sessions out of 52 in 2025. Is the army of retail investors going to win? Source: Global Markets Investor @GlobalMktObserv

US tariffs on April 2nd: Will it be not as bad as expected?

A “Trump put” ahead? Some articles caught a lot of bullish notice this weekend. S&P Futures are going UP this morning Source: Bloomberg, WSJ

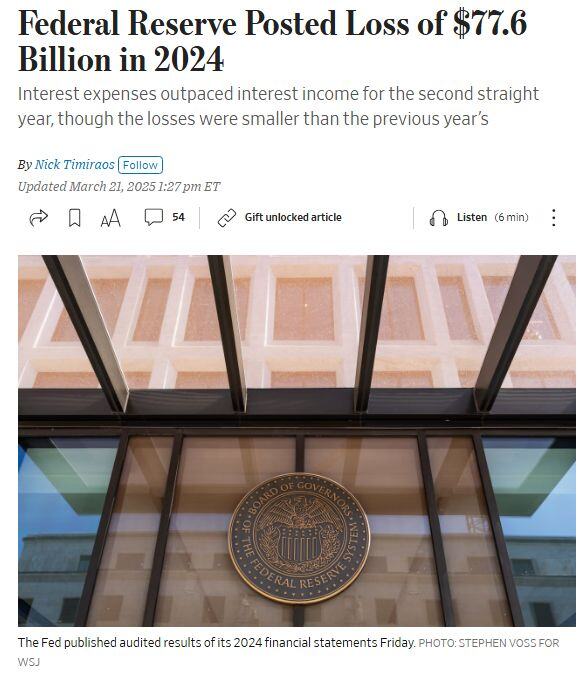

BREAKING 🚨: Federal Reserve lost $77.6 Billion last year and has now lost a combined $192 Billion over the last 2 years

Source: WSJ

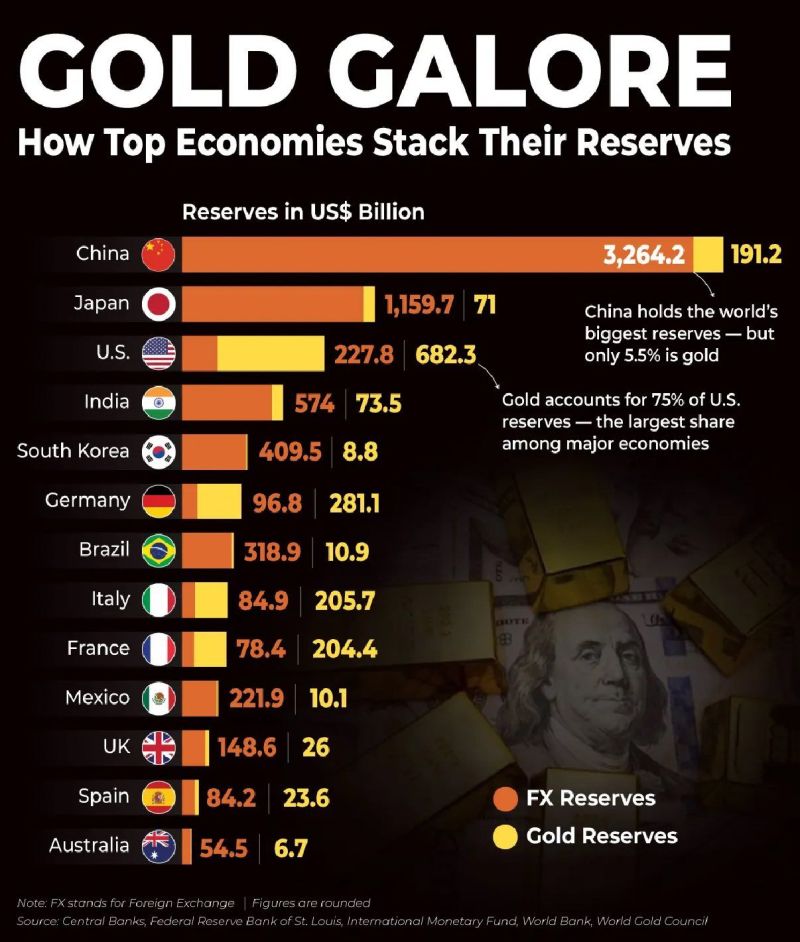

How Top Economies Stack Their Reserves...

Gold account for 75% of US reserves, the largest share among major economies. China holds the world's biggest reserves - but only 5.5% is gold... Source: Brad Moseley

Investing with intelligence

Our latest research, commentary and market outlooks