Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Trump threatens tariffs if the EU doesn't buy more US oil and gas

The President-elect said he told the EU they must "make up their tremendous deficit" with large scale purchases of American fuel The US is the world's top LNG exporter, and the biggest Oil producer. Source: Stephen Stapczynsk

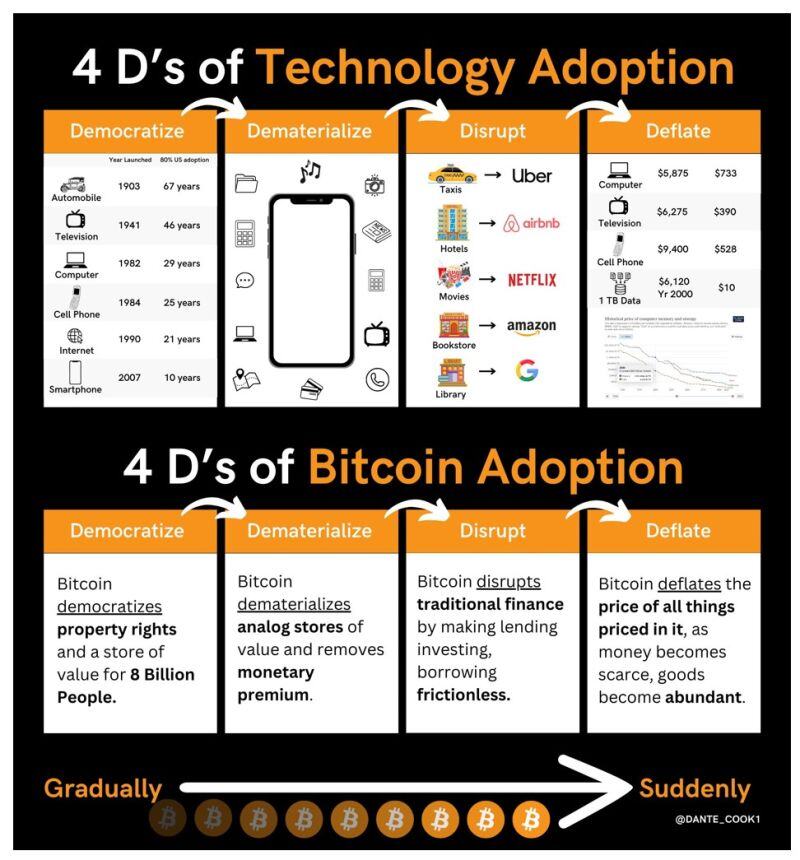

The 4D's of Bitcoin Adoption are happening:

- Democratization Bitcoin democratized property rights. - Dematerialization Capital is moving from analog capital->digital capital. - Disruption Finance is shifting -> Bitcoin. - Deflation All goods are being repriced by this. Source: Dante Cook

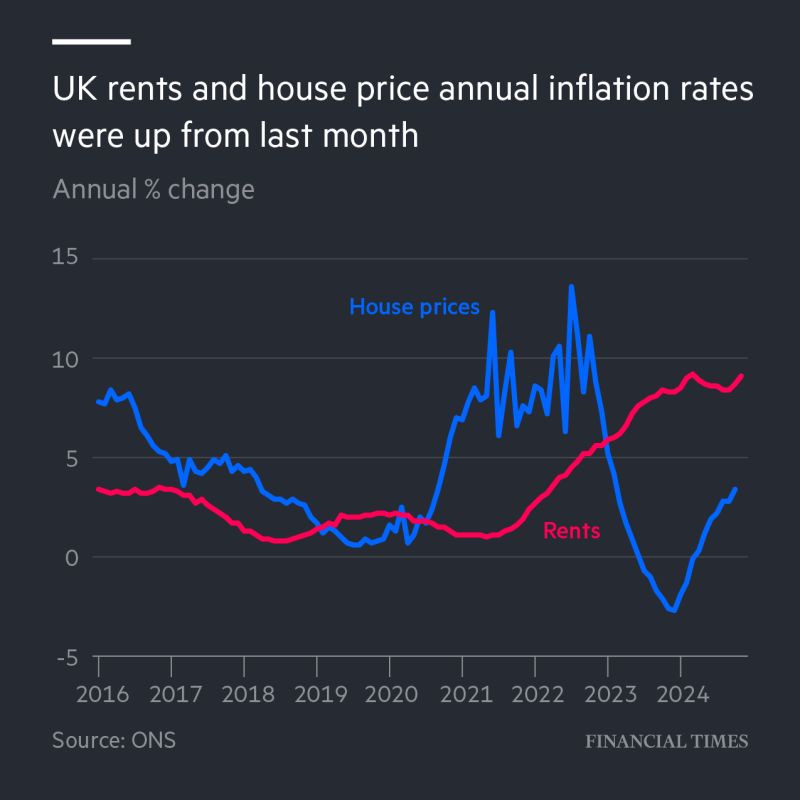

‘Renting is nothing short of brutal. Rents are rising at an astronomical and unsustainable rate.’

Rents in London increased by 11.6% in the 12 months to November 2024. Source: FT

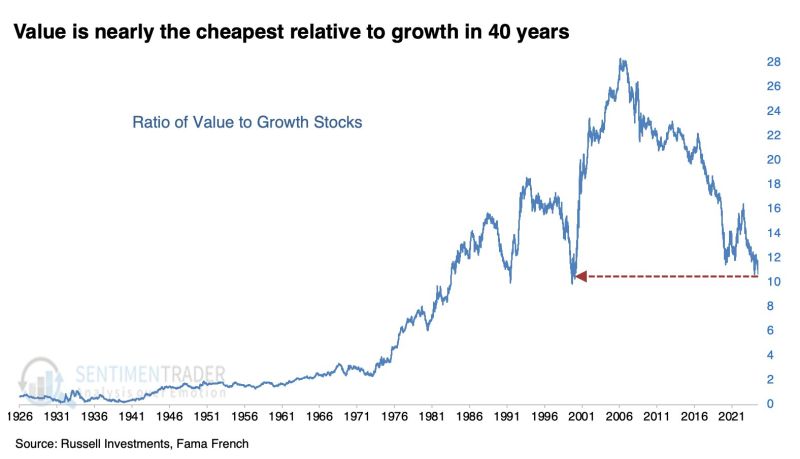

🚨 The ratio of US value to growth stocks has plummeted to the lowest in 24 YEARS.

The ratio is on track to fall to the lowest level in 42 YEARS. Since the end of the Financial Crisis, growth stocks have outperformed value by nearly 3x. Source: Global Markets Investor

🚨 S&P500 erased $1.8 TRILLION of market cap on Fed "hawkish cut".

‼️ Big Tech, Bonds, Bullion and Bitcoin fell sharply after the Fed cuts rates by 25 basis points - which is exactly what 97% of market participants expected. So what happened❓ 👉 Actually, today's market reaction had NOTHING to do with the rate decision. Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction. 👉Indeed, the hashtag#Fed reduced their outlook from 3 to 2 rate cuts in 2025. 👉Furthermore, the Fed now sees hashtag#inflation at 2.1% at the end of 2026, still slightly above their 2.0% target. ⚠️ The stock market's decline accelerated after Powell said one specific sentence in his press conference today: "Today was a closer call but we decided it was the right call." ⚠️The US Dollar surged to its highest since November 2022 after he said that. Clearly, the Fed has acknowledged that inflation is an issue, once again. ⚠️On top of this, Cleveland Fed President Beth Hammack dissented in today's decision. 1 out of 19 Fed officials sees no rate cuts in 2025 and 3 officials see just 2 rate cuts. Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. This led to what appears to have been the biggest panic sell in the market since the Yen carry trade collapsed. Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974. Sentiment is shifting as we look into 2025.

⚡ Foreign holdings allocation to US stocks hit nearly 60%, a record.

This share has more than DOUBLED over the last 15 years. Allocation to equities exceeds the levels seen at the 2000 Dot-Com Bubble peak Foreigners are all-in on US stocks. Chart: @topdowncharts thru Global Markets Investors

Investing with intelligence

Our latest research, commentary and market outlooks