Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

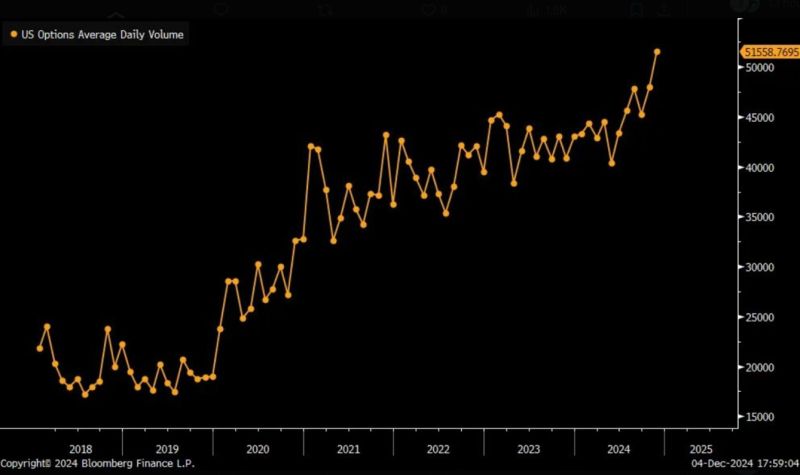

Average Daily Options Volume jumps to an all-time high.

Source: Barchart @Barchart

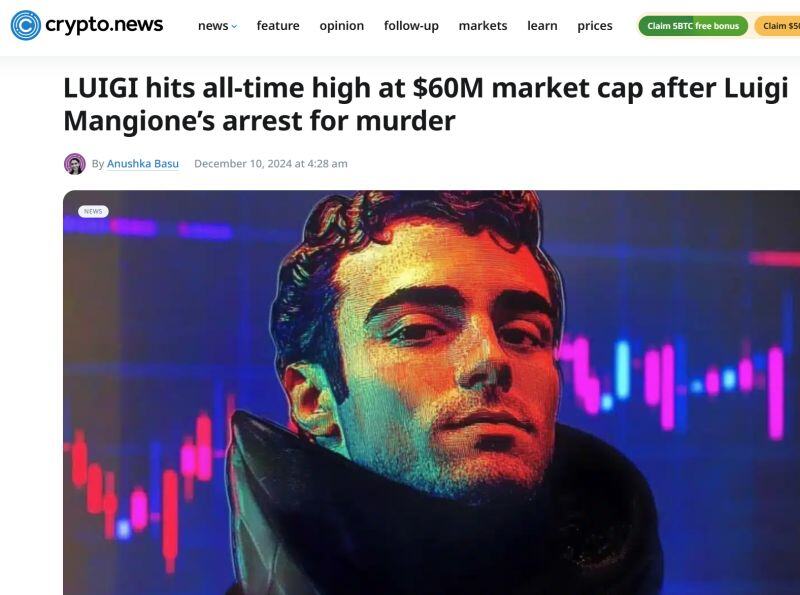

After the suspected United Healthcare CEO shooter Luigi Mangione was captured, "Luigi Coin" jumped +35,000%.

Luigi Coin hit a market cap of $60 MILLION with $100 million+ in volume over the last 24 hours... Source: The Kobeissi Letter

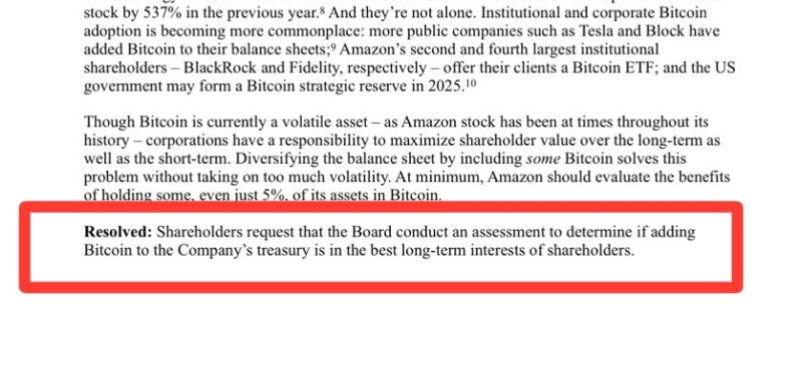

BREAKING: Amazon shareholders request the company explores adds Bitcoin to its treasury.

REMINDER: Microsoft shareholders are set to decide on the firm’s Bitcoin investment proposal this Tuesday, December 10. Source: Dennis Porter @Dennis_Porter, Bitcoin Archive @BTC_Archive

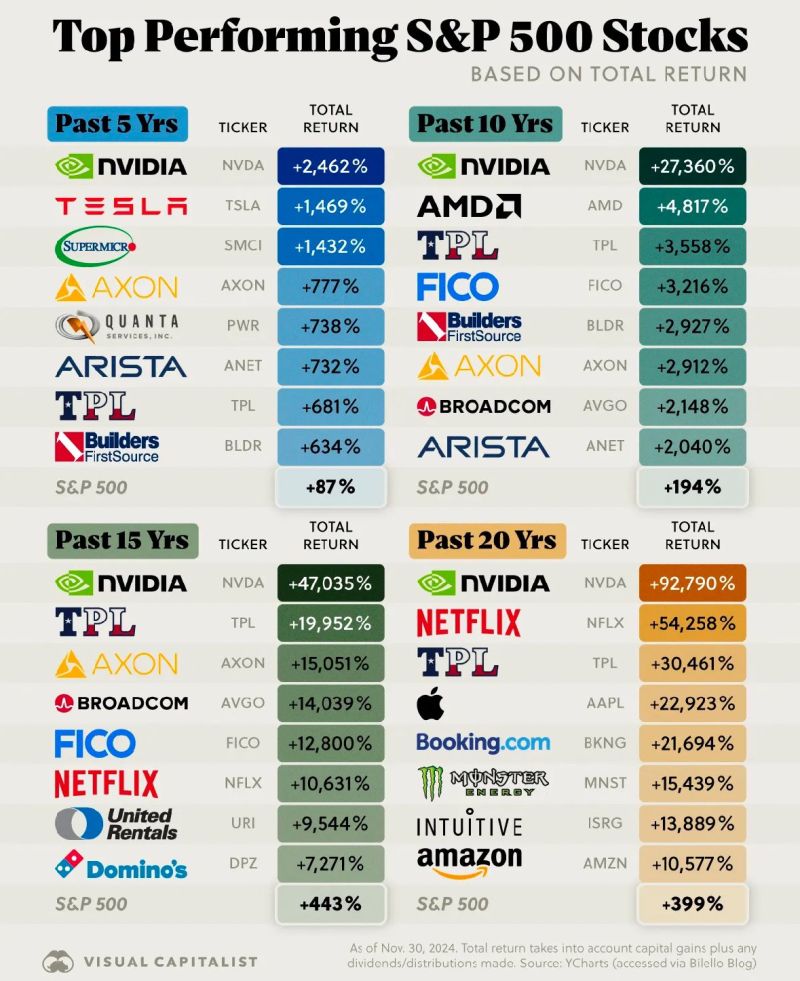

Nvidia $NVDA is the best performing S&P 500 stock over the last 5, 10, 15 and 20 years😲

Source: Evan @StockMKTNewz

China consumer inflation rate drops to a five-month low, missing expectations as economy slows. ARE MORE STIMULUS COMING?

China’s consumer prices rose less-than-expected in November, climbing 0.2% from a year ago, according to data from the National Bureau of Statistics released Monday. Analysts polled by Reuters had expected a slight pickup in the consumer price index to 0.5% in November from a year ago, versus 0.3% in October. China’s producer price index declined for the 26th month. Producer inflation fell by 2.5% year on year in November, less than the estimated 2.8% decline as per the Reuters poll. Source: CNBC, Evan

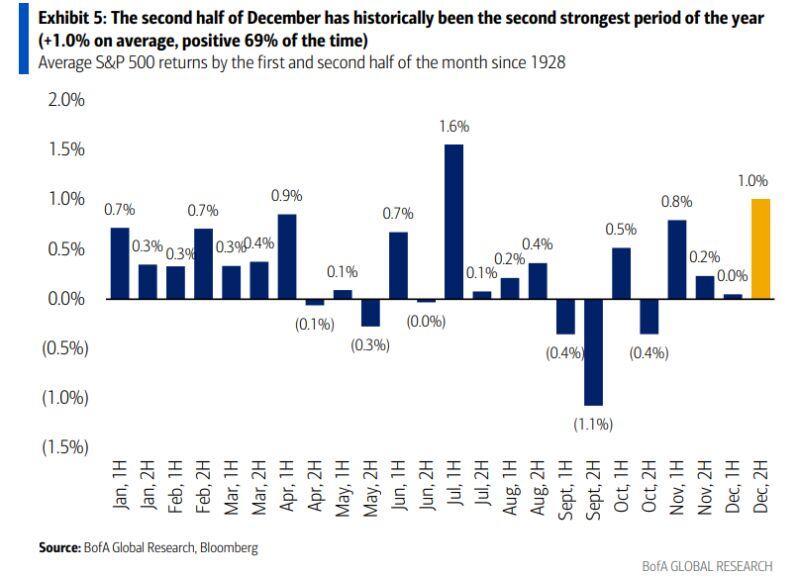

BofA: The second half of December has historically been the second strongest period of the year (+1.0% on average, positive 69% of the time)

Source: Mike Zaccardi, CFA, CMT, MBA

🚨BIG WEEK FOR CENTRAL BANK DECISIONS AHEAD🚨

The European Central Bank, the Bank of Canada, the Swiss National Bank and the Reserve Bank of Australia will announce rate decisions. ECB and SNB are expected to cut by 0.25%, and BoC by 0.50%, while RBA to leave rates unchanged. Source; Global Markets Investor @GlobalMktObserv, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks