Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US government just moved $2 billion of seized bitcoin $BTC, two days after Trump's speech 👀

Source: Joe Consorti

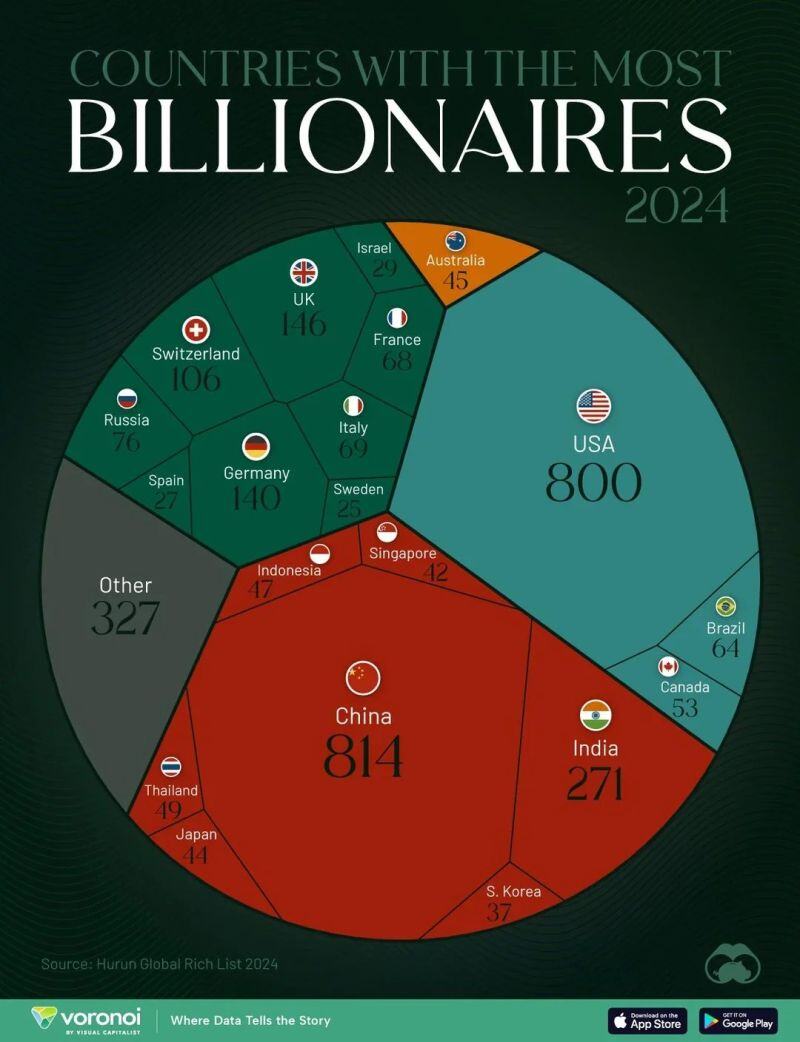

Countries with the most billionaires 📊

Source: Voronoi, Visual Capitalist

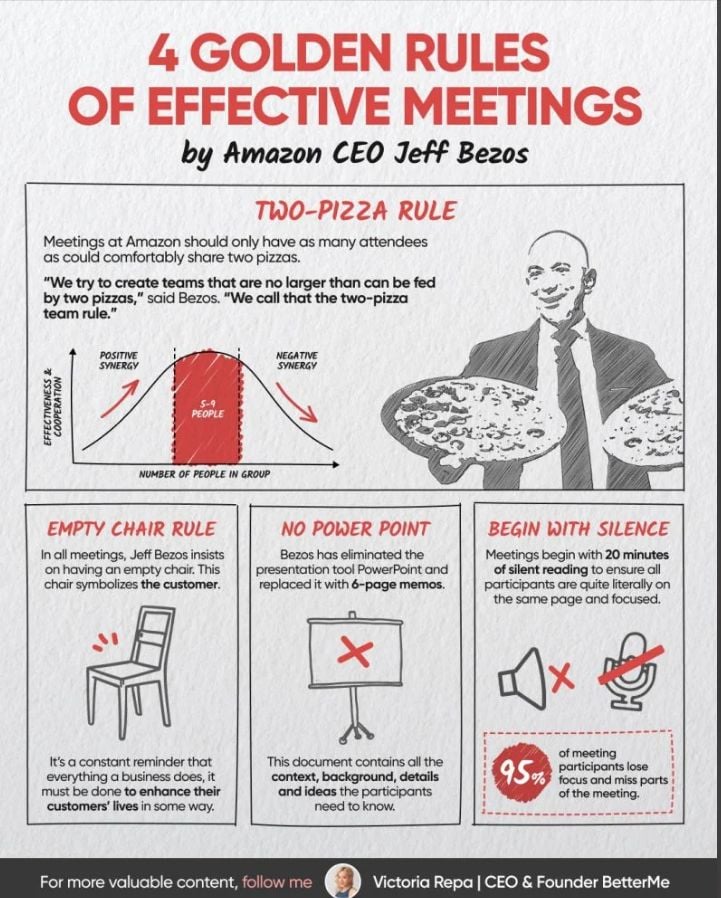

4 Golden rules of effective meetings by Jeff Bezos

Source: Victoria Repa

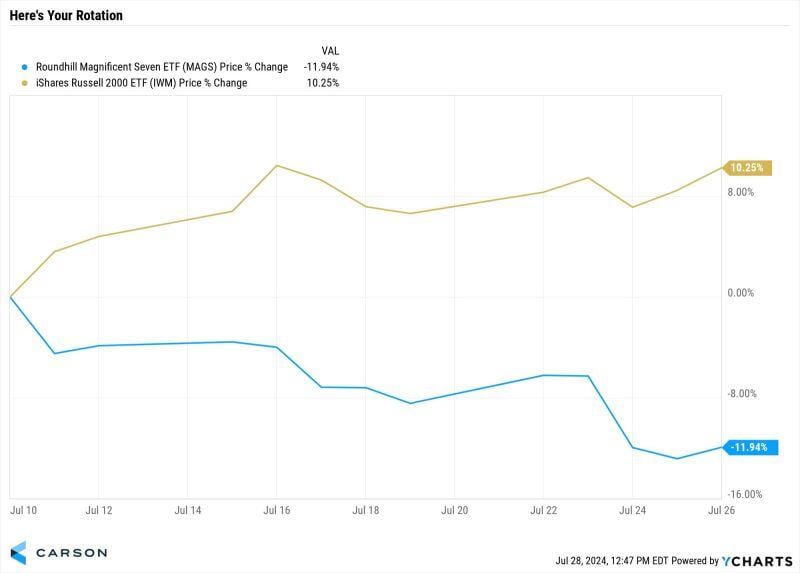

The Mag7 peaked on July 10. Since then it has dropped close to 12%, while smallcaps are up more than 10%.

Quite amazing how the market has been behaving despite the pullback of the "generals" Source: Carson, Ryan Detrick

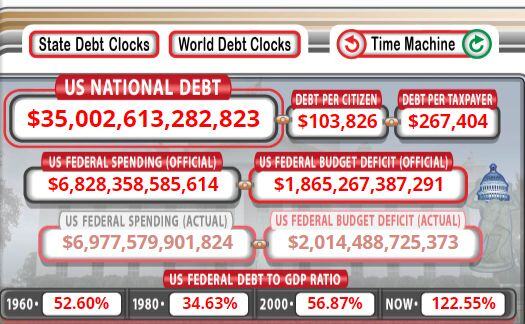

JUST IN: U.S. National Debt surpasses $35 Trillion for the first time in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks