Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

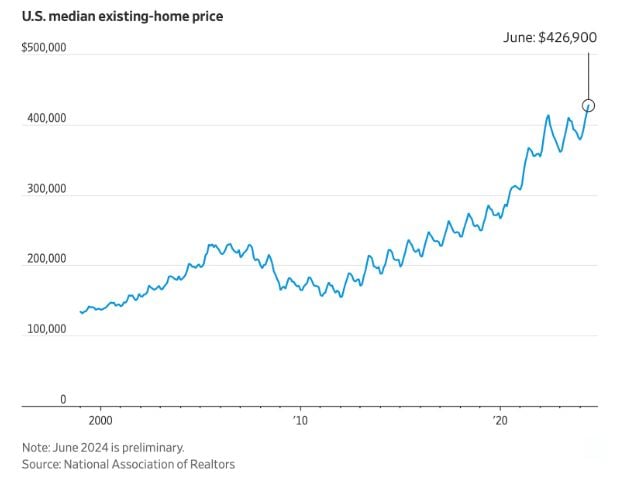

U.S. Home prices hit record high of $426,900!

Source: Barchart

BREAKING: Donald Trump announces that he will create a US government Bitcoin strategic reserve if elected president.

This would be a stockpile of Bitcoin similar to the Strategic Petroleum Reserve. Former U.S. President Donald Trump promised to build a “strategic Bitcoin stockpile” for the United States at the Bitcoin 2024 conference in Nashville on Saturday. The Republican presidential candidate's keynote address followed a week of growing rumors and reports on the matter with a relatively vague announcement to the packed room of Bitcoiners. "As the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, the United States of America, to keep 100% of all the Bitcoin the U.S. government currently holds or acquires into the future,” Trump said. “I hope you do well.” Source: Decrypt Activate to view larger image,

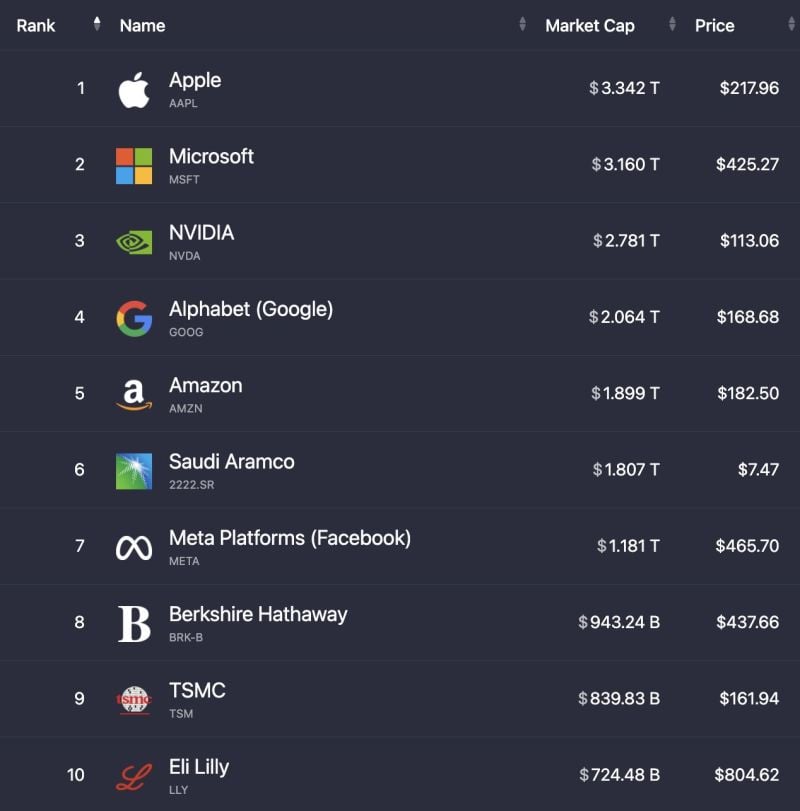

The top 10 largest stocks in the world are now worth a combined $18.74 Trillion down from $19.31T last week

Source: Evan

In the US, if your income and net wealth has not increased by 25% since 2020 you are poorer now than four years ago...

Source: Michel A.Arouet

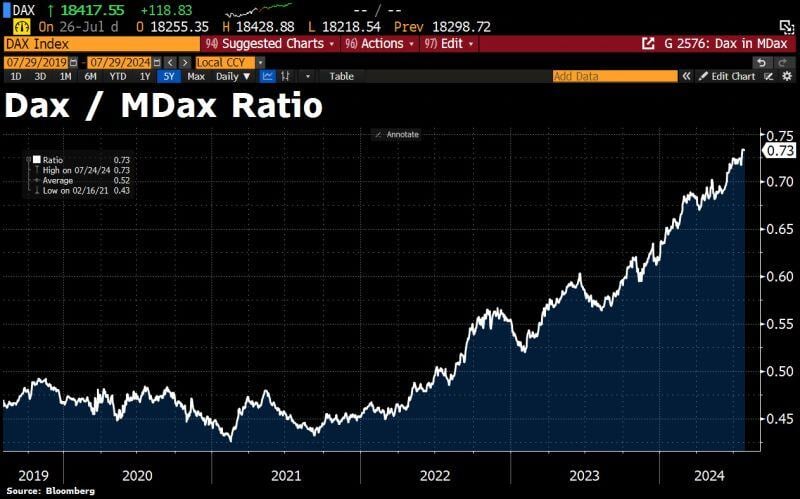

As highlighted by Michel A.Arouet on X: the German business model was based on:

1. Cheap energy from Russia 2. Cheap subcontractors in Eastern Europe 3. Steadily growing exports to China All three are gone by now, and not much has been done to change the trend. Source: Bloomberg, Michel A.Arouet

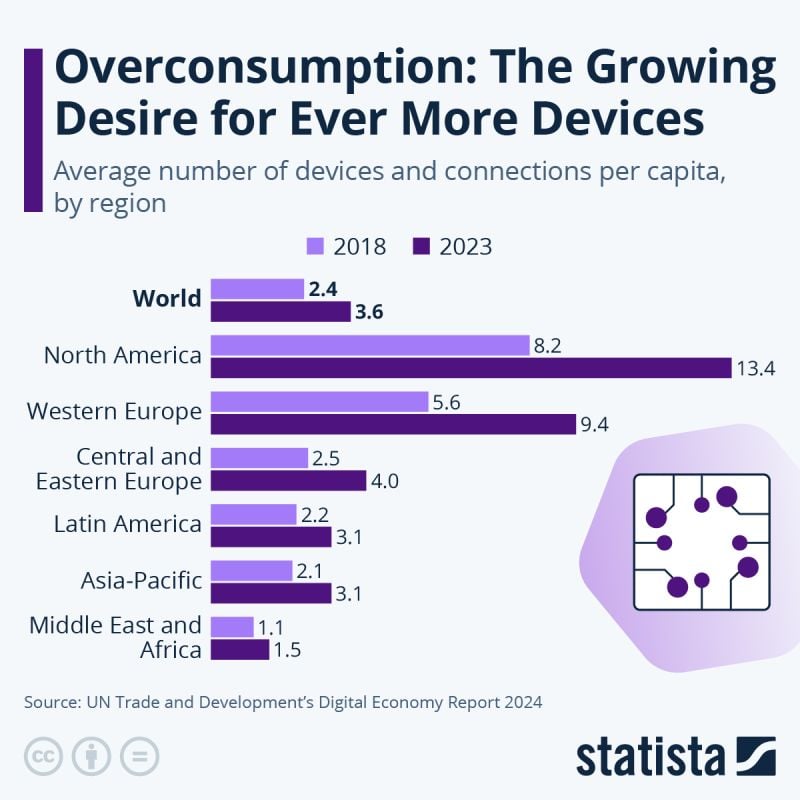

Data from the Digital Economy Report 2024 published by the UN Trade and Development.

it shows that the rising demand for more devices isn’t simply a case of more people buying electronic devices worldwide, but also that the average number of devices per consumer is increasing. Source: Statista

Under the surface, the US equity market looks stronger than before...

This might be counterintuitive to many investors who got hurt this week on their large-cap growth positions, the market looks actually healthier than it was a few weeks ago...As highlighted by the great J-C Parets, there are plenty of new all-time highs everywhere: DJ Industrial average, S&P 500 equal-weight, Mid-cap 400, etc. A mentioned by J-C Parets, we just saw the most amount of stocks on the NYSE above their 200 day moving average that we've seen this entire bull market. We also saw the most amount of stocks on the NYSE and the Nasdaq hitting new 52-week highs that we've seen this whole bull market. You can go sector by sector and you'll see. Source: J-C Parets

Interesting point by HolgerZ on X. Unlike on Wall Street – big stocks in germany are still doing well, while small stocks are struggling.

This can be seen in the ratio of the Benchmark Index Dax to the Mid-Cap-Index MDax, which hit its highest level since 2011. This could be because the economy isn't doing great, and small companies are more affected by this. The Purchasing Managers' Index for Germany dropped below make-or-break 50 this week, highlighting Germany's economic challenges. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks