Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A critical week ahead for the Nasdaq 100 QQQ which is sitting at critical trendline support at the time of FOMC meeting + $AAPL $MSFT $AMZN $META earnings...

Source; Trend Spider

Junk bonds closed at an ATH (total return) last week $HYG

Source: Mike Z.

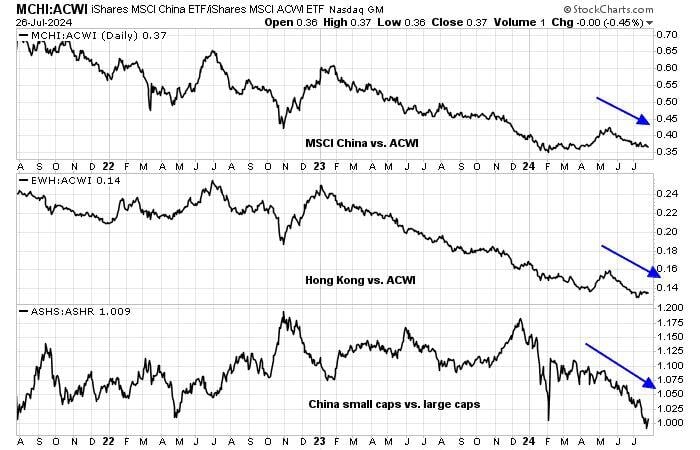

Remember when China had a huge rally in April and May?

Nice chart from @HumbleStudent showing relative strength rolling over again. Source: Ryan Detrick on X

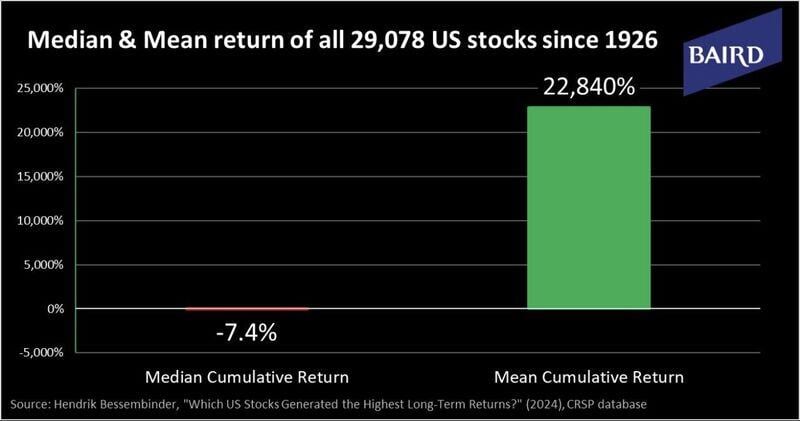

The difference between the MEDIAN and the MEAN CUMULATIVE returns of US stocks since 1926 is amazing...

As mentioned by @SpencerHakimian on X: "Stock returns are so skewed to the 4% of stocks that are responsible for all equity market returns that have occurred in the past 100 years. Statistically, it is virtually impossible to outperform an index over time since you would have needed to specifically own the tiny percentage of stocks that beat the index, and specifically avoid the vast majority of stocks that underperformed the index. Individual stock picking turns investing from a positive sum game to a negative sum game. Index investing is like being the casino. Individual stock picking is like being the gambler". Source: Baird, Michel A.Arouet

Should Lamborghini be spun out of Volkswagen $VOW?

In 2023, they sold 10,600 cars, which is actually less than $RACE's 13,700. The two car manufacturers also have similar EBIT margins of about 27%. Lamborghini has grown its revenue with a 17% CAGR over the past 6 years, while EBIT had a CAGR of 53% during the same period. This visual by Quartr shows the number of Lamborghini cars sold per year between 1999 and 2023:

Even very clever people are not always right in their vision

Source: Massimo on X

Investing with intelligence

Our latest research, commentary and market outlooks