Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

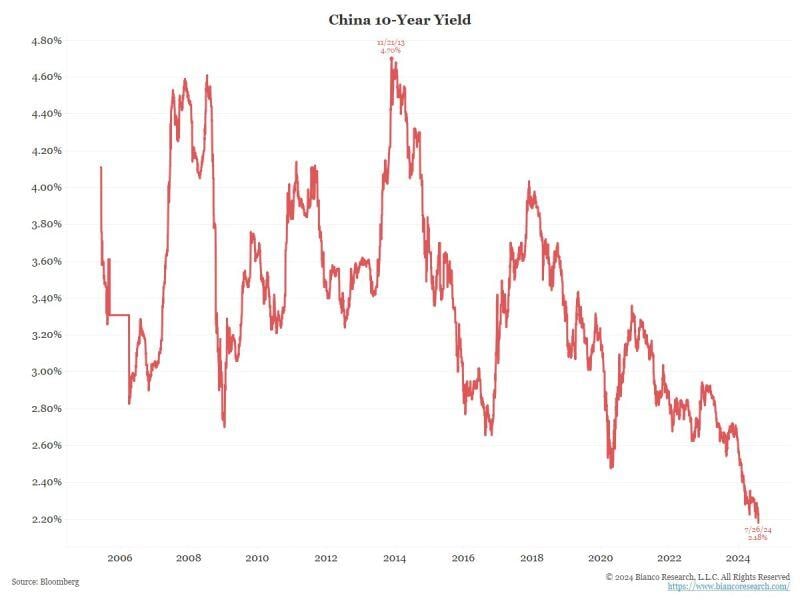

CHINA 10-YEAR YIELD FALLS TO A FRESH RECORD LOW

So, what is the Chinese bond market signaling about the Chinese economy? Source: Bianco research

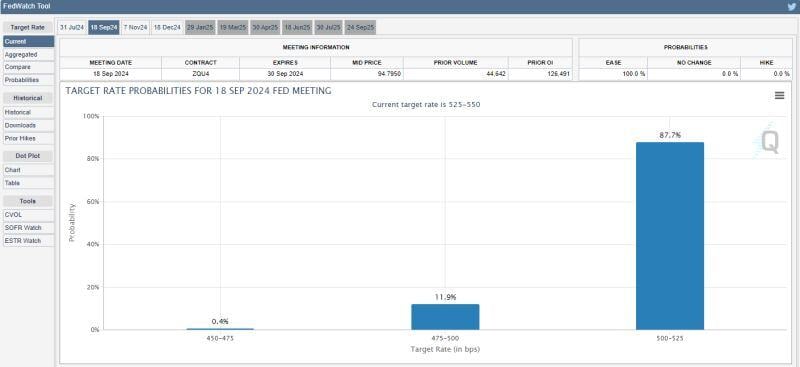

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

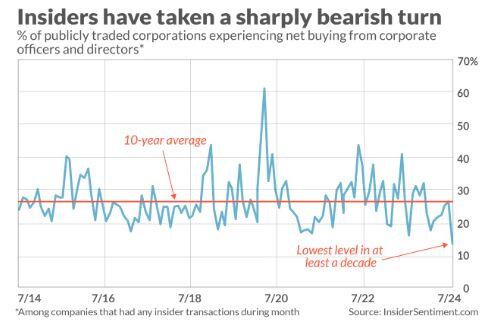

Corporate Insiders are dumping shares at the fastest pace in AT LEAST a decade 🚨🚨🚨

Source: Barchart

India quickly catches up to China as the world’s largest emerging market.

Indian stocks comprise nearly 20% of the MSCI Emerging Markets index, while China has dropped to a quarter from 40% in 2020. The narrowing gap has become one of the biggest issues for investors in emerging markets this year as they debate whether to put capital into an already red-hot Indian market, or into Chinese stocks that are relatively cheap, but are being hit by an econ slowdown. https://lnkd.in/ddkSqFy5 Source: FT, Charlie Bilello

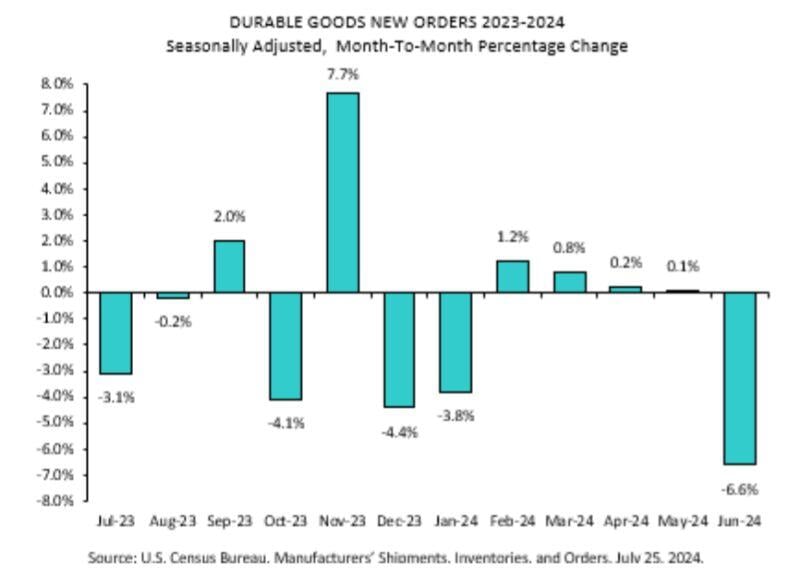

That was an enormous miss in durable goods, coming in at -6.6% vs a forecast of +0.3%.

We need to transport things in a growing economy, right? "Transportation equipment, down two of the last three months, drove the decrease, $19.6 billion or 20.5 percent to $75.8 billion. Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks