Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Magnificent 7 dropped by more than $750 Billion yesterday

Source: Evan, Yahoo Finance

Bulls praying to Lord Powell for a rate cut next week

Source; Barchart

Thank you Crowdstrike... that's soooo king of you....

Source: Barchart

Trump odds of winning the Presidential election are BELOW where they were after the debate…

Source: Predictit

The steepening trade continues with US 2s/30s yield spread jumping to 12bps, the highest since 2022.

Source: Bloomberg, HolgerZ

WHAT A DAY...

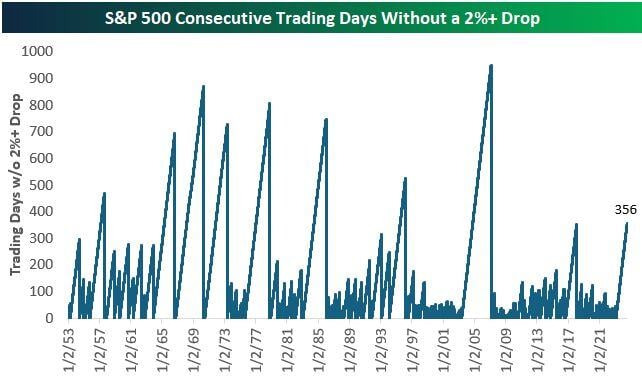

🌩 Mag 7 stocks all finished in the red today and have erased erased over $500 BILLION of market cap today. ⚡ Nasdaq and S&P 500 had worst their day since 2022 ☄ The S&P 500 just fell over 2% for the first time in 356 trading sessions. It ended the longest stretch without a >2% pullback since 2007 Source: Bloomberg

💪 How to end the meeting madness by Justin Mecham

Meetings can become an endless loop. They drain your time and energy. And the worst part: they can be counterproductive. But, at the same time, meetings are important. So, how can you reclaim those lost hours and convert them into strategic sessions? In a post, Justin Mecham share tips from some of the world's best business minds: 👉 Steve Jobs ↳ Invite only the right people. 👉 Tim Cook ↳ Hold everyone accountable. 👉 Jeff Bezos ↳ Use memos and not slideshows. 👉 Indra Nooyi ↳ Assign tasks before the meeting. 👉 Elon Musk ↳ Ensure everyone is needed in the meeting. 👉 Oprah Winfrey ↳ Prepare all meetings from beginning to end.

Investing with intelligence

Our latest research, commentary and market outlooks