Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

India’s dependence on Chinese imports keeps growing:

• In 2023-24 financial year China edged past the US to reclaim its position as India’s top trading partner • India’s imports from China rose by 56% since 2020, fuelling a 75% rise in country's trade deficit with China Source: Agathe Demarais, The Economist

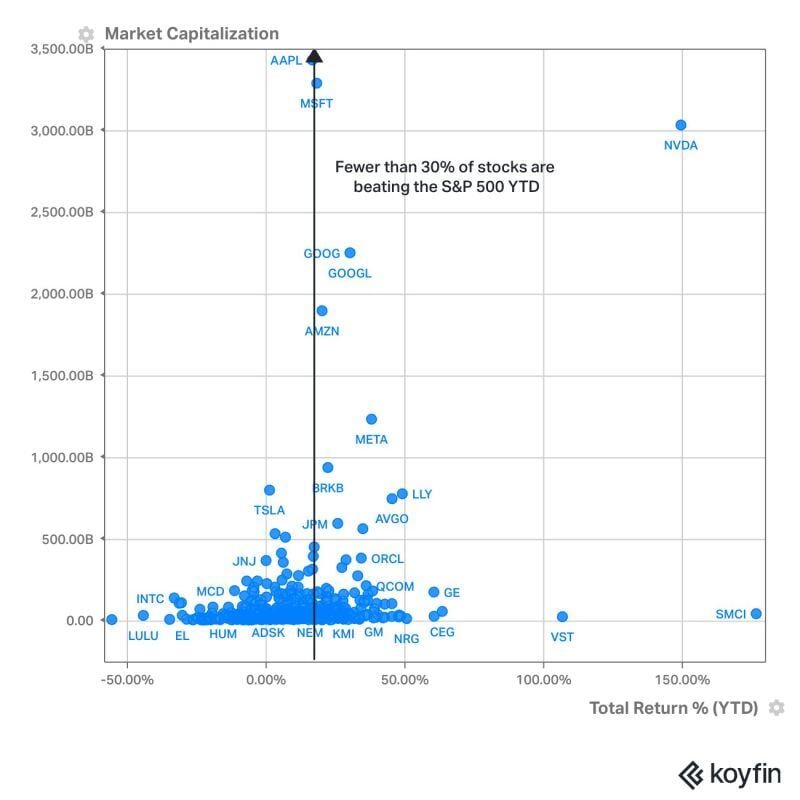

So far in 2024, only 29.8% of the stocks in the S&P500 are outperforming the benchmark.

Source: Koyfin

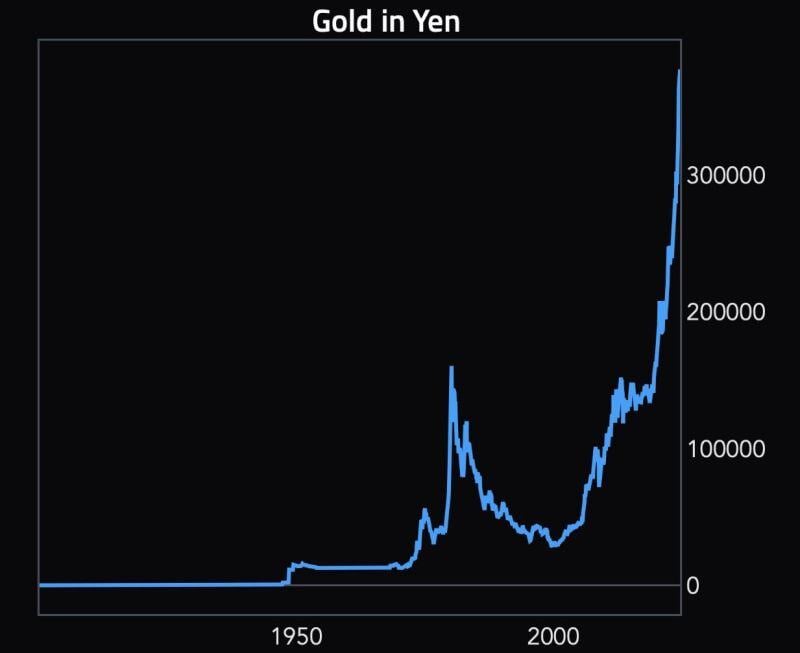

Remarkable chart: gold in yen.

No further comments necessary. Source: Michel A.Arouet, Ht @AugurInfinity

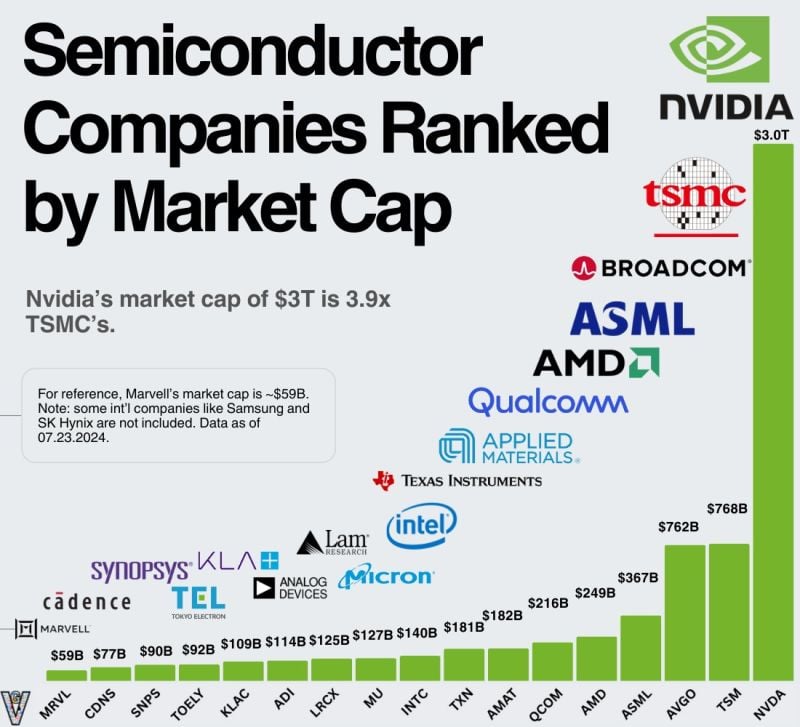

Semi conductors Companies Ranked by Market Cap - @EricFlaningam on X:

1)The scale of the industry is incredible. Many public companies larger than $10B aren’t listed here. 2) $NVDA's performance over the last two years has to be one of the best tech stories ever. Incredible how they built their accelerated computing ecosystem for over a decade before the current infrastructure boom.

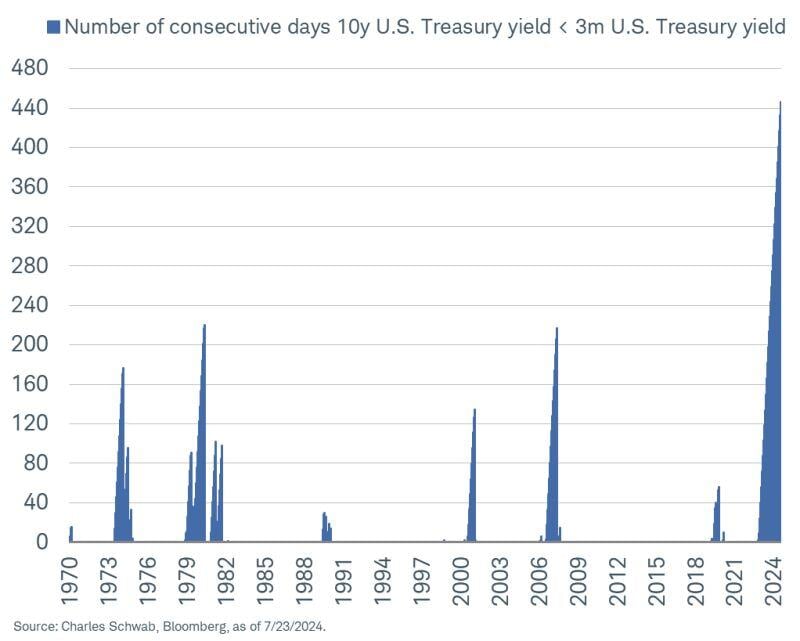

US 10y-3m yield spread has been negative for more than 440 days.

But no recession so far... Source: Kevin Gordon

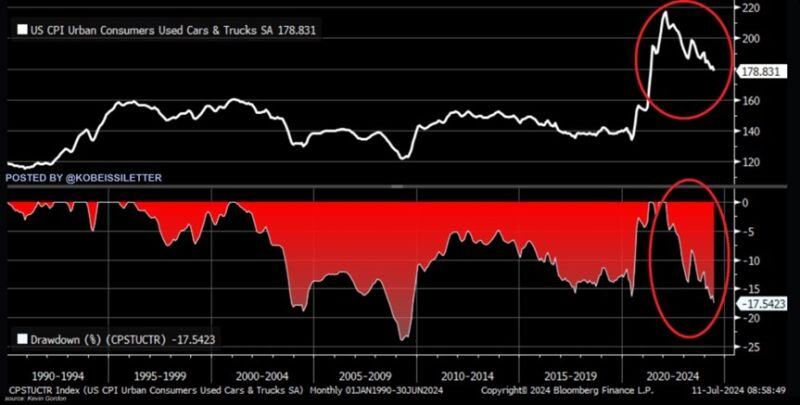

Used car prices are crashing: Used car and truck prices are now down 17.5% since the 2021 peak, the largest decline in 15 years.

Over the last 35 years, there were only two times when prices of used vehicles saw a bigger drawdown: in 2004 and 2009. Overall, US wholesale prices of used vehicles have declined for 22 consecutive months. In June, average wholesale prices decreased by 8.9% year-over-year to $17,934. EV makers have been hit the hardest, with some EV prices falling over 40% since last year. The car market bubble has popped. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks