Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China commodity stockpiles

Source: Robert Friedland on X, The Economist

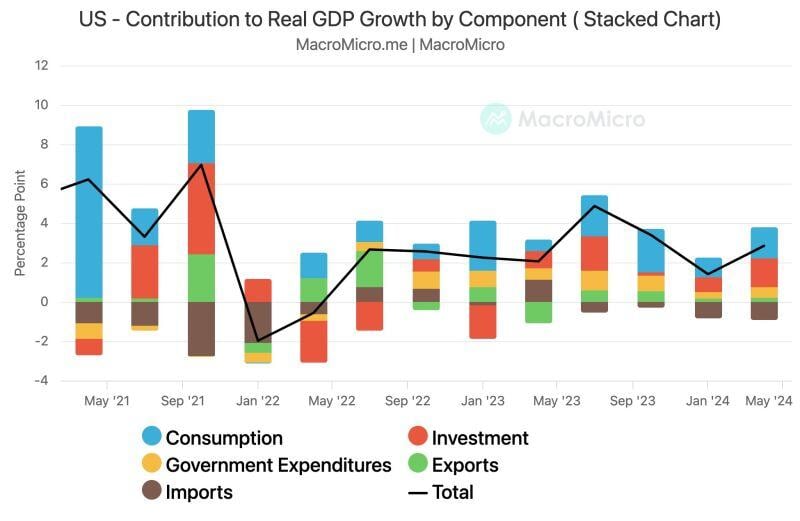

🚨 Breaking! US GDP growth surpasses expectations, hitting 2.8% (est. 2.0%, prev. 1.4%).

GDP Annualized QoQ Contribution: Consumption 1.57 pp (prev. 0.98 pp) Government Spending 0.53 pp (prev. 0.31 pp) Investment 1.46 pp (prev. 0.77 pp) Exports 0.22 pp (prev. 0.17 pp) Imports -0.93 pp (prev. -0.82 pp) Source: MacroMicro

NEW: Fold becomes the first Bitcoin only financial services company to go public on the NASDAQ 👏

They already have 1,000 BTC on their balance sheet 🚀 Source: Bitcoin magazine

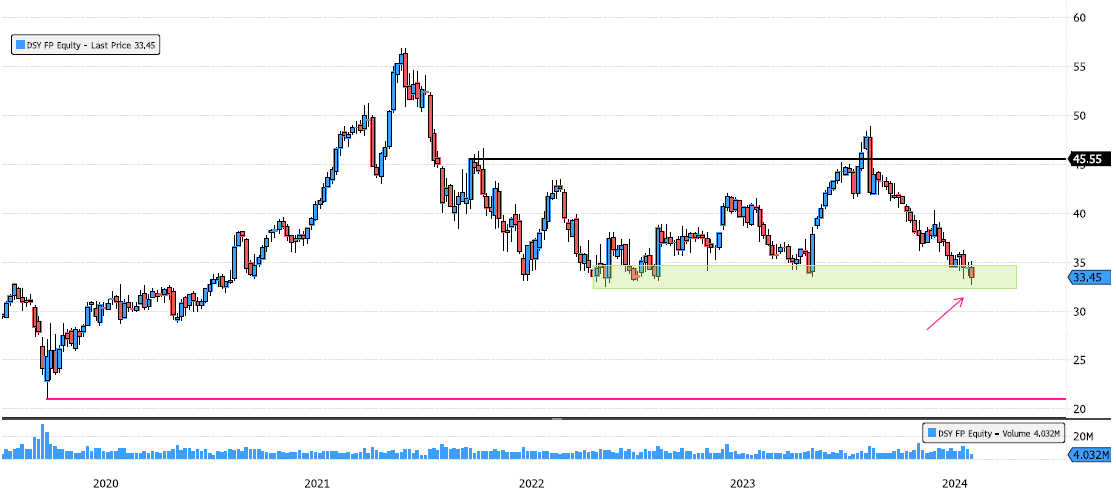

Dassault Systeme on Major Support Level

Dassault Systeme (DSY FP) has consolidated 33% since its January breakout! It is now testing a major support zone between 32.23 and 34.20. Keep an eye on this critical level over the next few days. Source: Bloomberg

The last time Tech stocks were at these levels relative to the S&P500, Tech stocks crashed, particularly relative to the rest of the market.

Source: J-C Parets

One for the Bulls... As shown below, during this tech pullback, forward 12-months EPS in tech has actually ticked higher.

So you could argue that this is mostly a positioning and sentiment pullback, especially in tech... Source: Bloomberg, RBC

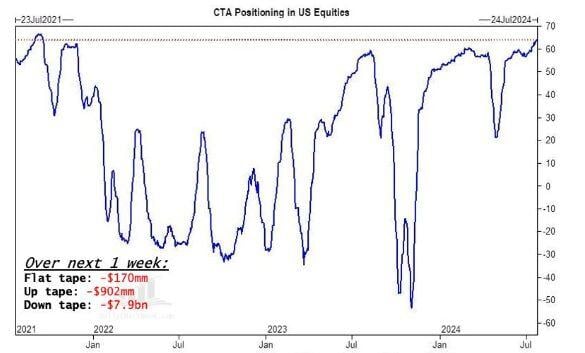

CTAs will dump stocks over the next week in EVERY SINGLE SCENARIO warns Goldman Sachs.

If the market trades lower, CTAs are projected to sell more than $7 billion worth of equities.

Investing with intelligence

Our latest research, commentary and market outlooks