Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

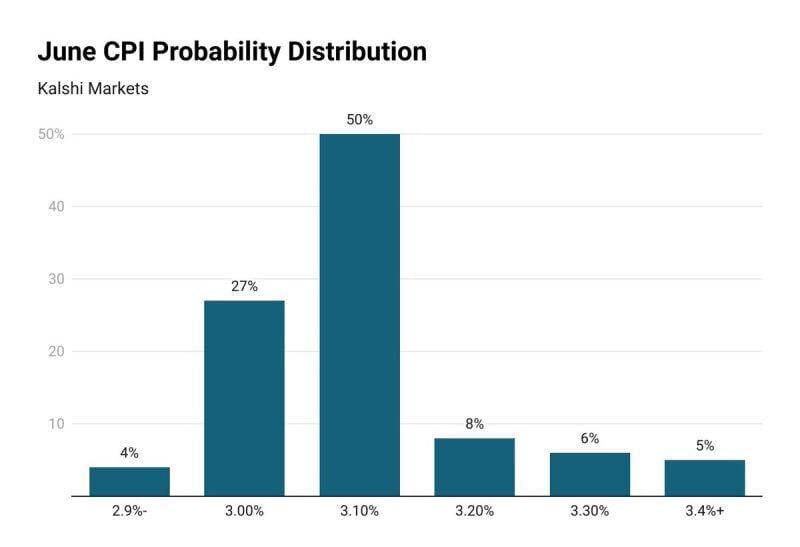

An important US macro data is expected today: the CPI inflation data for June. The median forecast for headline CPI inflation is 3.1%, but markets are showing a wide range.

Prediction markets currently show that there is a 19% chance of June CPI inflation coming in ABOVE 3.1%, according to Kalshi. On the other hand, there's a 31% chance of inflation coming in BELOW 3.1%. There's even a 5% chance of CPI coming in above 3.3%, which would put inflation back on the rise. If CPI inflation comes in as expected, it would mark the 3rd straight monthly decline in YoY inflation. Source: The Kobeissi Letter

Oops... I missed this one... Russia's economy has defied sanctions in the two years since Moscow invaded Ukraine in February 2022

So much so that the World Bank is now classifying Russia as a "high-income country." On Monday 1st of July, the World Bank announced it has upgraded Russia from an upper-middle-income country to a high-income country, according to a report from the financial institution's economists. "Economic activity in Russia was influenced by a large increase in military-related activity in 2023," World Bank economists wrote in their report. Last year, Russians earned $14,250 per person on a gross national income basis. The World Bank's upgrade confirms reports from Russia that suggest the growth is primarily driven by wartime activities that generate demand for military goods and services, making some sectors winners in Russia's wartime economy. Russia's trade jumped by nearly 7% last year, while activities in the financial sector and construction grew by 6.6% and 3.6%, respectively. This boosted Russia's real GDP — which is economic growth adjusted for inflation — by 3.6%. The development has made some poor Russians better off financially, complicating any calculus over how to end the war.

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

Setting the stage for a two-day appearance on Capitol Hill this week, the central bank leader said the economy remains strong as does the labor market, despite some recent cooling. Powell cited some easing in inflation, which he said policymakers stay resolute in bringing down to their 2% goal. “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Source: CNBC, Yusuf on X

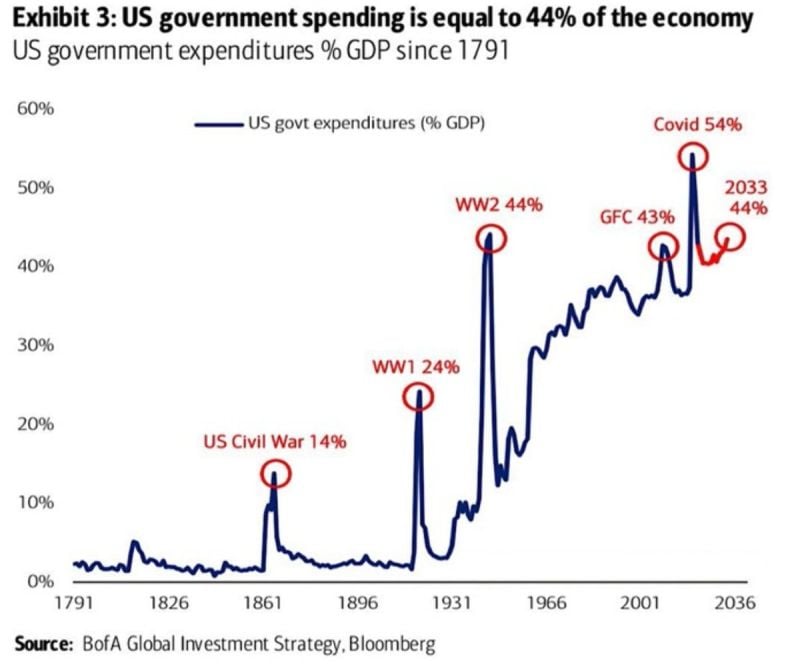

US GOVERNMENT SPENDS MONEY AS IF THERE IS A CRISIS:

US government spending as a % of GDP is now ~43%, in line with THE GREAT FINANCIAL CRISIS. This is just 1 % below World War II levels. Only the COVID crisis saw higher expenditures as a share of GDP of 54%... Source: BofA, Global Markets Investor

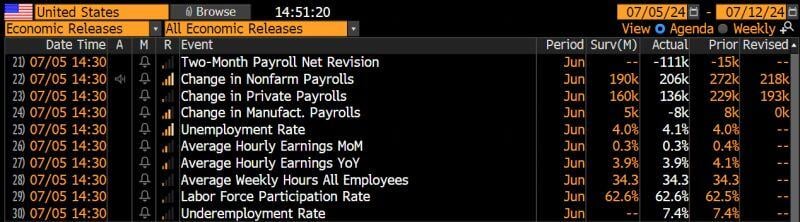

Latest US jobs numbers show economic momentum keeps cooling: Non-farm-payrolls rose by 206k jobs in June, ahead of 190k forecast.

However, 2 months net revisions were NEGATIVE with -110k. Moreover, government employment rose by a whopping 70k while PRIVATE employment with 136k was below estimates. Unemployment rate rose to 4.1% from 4.0% due to higher labor participation rate. Wage rose 3.9% YoY in line w/estimates. Bottom-line: these numbers seem to confirm our thesis that the US job market is NORMALIZING hence reinforcing the disinflation trend which will ultimately enable policy makers to NORMALIZE. More to come from our Chief Economist Adrien Pichoud... stay tuned... Source: Bloomberg, HolgerZ

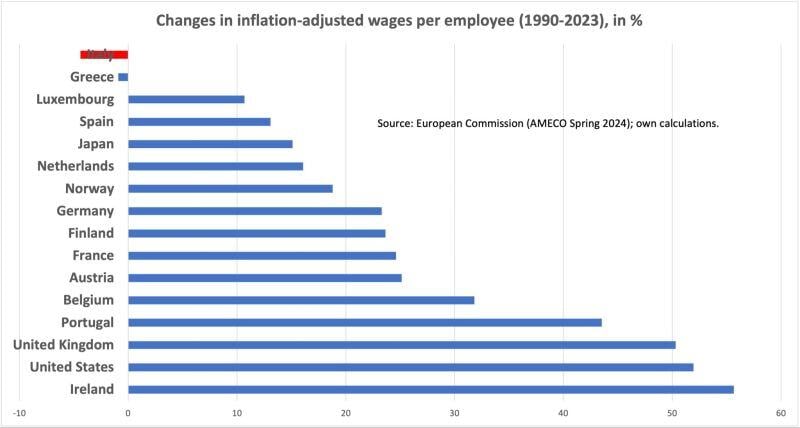

Italians make in real terms less today than they used to in 1990, one really needs to admire how calm they stay about it.

Chart: Michel A.Arouet, @heimbergecon

Investing with intelligence

Our latest research, commentary and market outlooks