Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

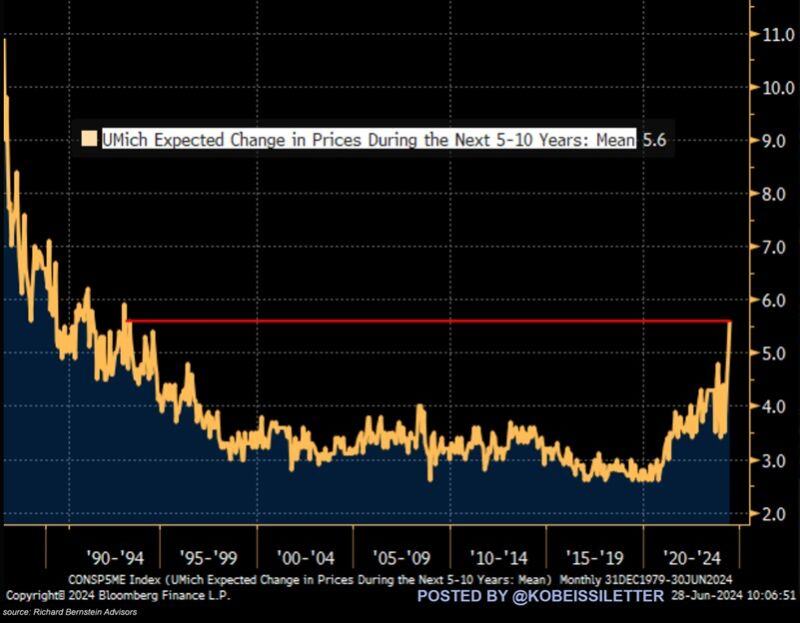

BREAKING: US consumers' average 5-10 year inflation expectations have spiked to 5.6%, the highest in 31 years.

This measure increased by ~2 percentage points in just a few months. By comparison, median inflation expectations are around 3%, in-line with the readings seen over the last 3 years. Meanwhile, CPI inflation has been above 3% for 38 consecutive months, the longest streak since the 1990s. Will inflation stay a major issue in H2 2024? Source: The Kobeissi letter, Bloomberg

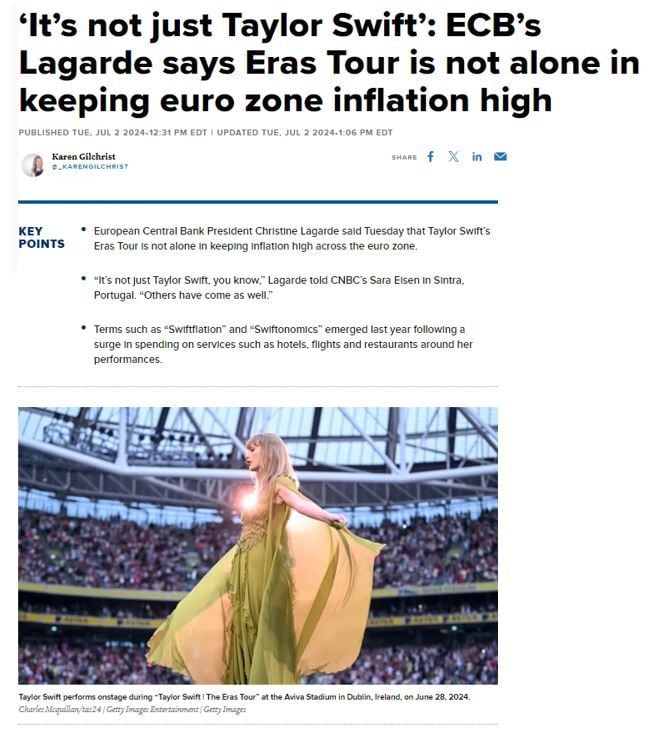

Good to know Mrs Lagarde...

ECB President Christine Lagarde said Tuesday that Taylor Swift’s Eras Tour is not alone in keeping inflation high across the euro zone. “It’s not just Taylor Swift, you know,” Lagarde told CNBC’s Sara Eisen in Sintra, Portugal. “Others have come as well.” Terms such as “Swiftflation” and “Swiftonomics” emerged last year following a surge in spending on services such as hotels, flights and restaurants around her performances.

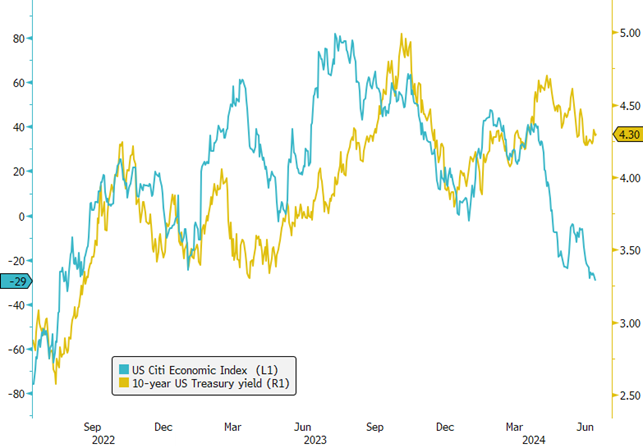

Q2 Fixed Income Review Chart: US Treasury Yields Resilient Amid Mixed Economic Signals!

As the second quarter of 2024 unfolded, a noticeable normalization of the US economy became evident, marked by a significant downturn in the US Citi Economic Index from 33 to -29, reaching its lowest level in nearly two years. Despite these economic headwinds, the 10-year US Treasury yields closed the quarter slightly higher at 4.30%, a 10-basis point increase. This apparent contradiction between economic normalization and rising yields can be largely attributed to substantial US Treasury issuances, necessary to fund the expansive US fiscal deficit. Furthermore, persistent inflationary pressures have prompted the central bank to delay the anticipated rate cut from July to November 2024, adjusting expectations amid changing economic conditions. As we approach a typically low-liquidity summer period, any shifts in interest rates could be magnified. Additionally, with the US presidential election on the horizon, market sentiments could be further influenced by electoral outcomes. The looming question is: Which will have a greater impact on third-quarter rates—the slowdown in the US economy, the ongoing inflationary and supply pressures, or the unfolding political landscape? #Finance #Economy #TreasuryYields #EconomicIndicators #Inflation #FiscalPolicy #InterestRates #USPresidentialElection #MarketAnalysis Source: Bloomberg

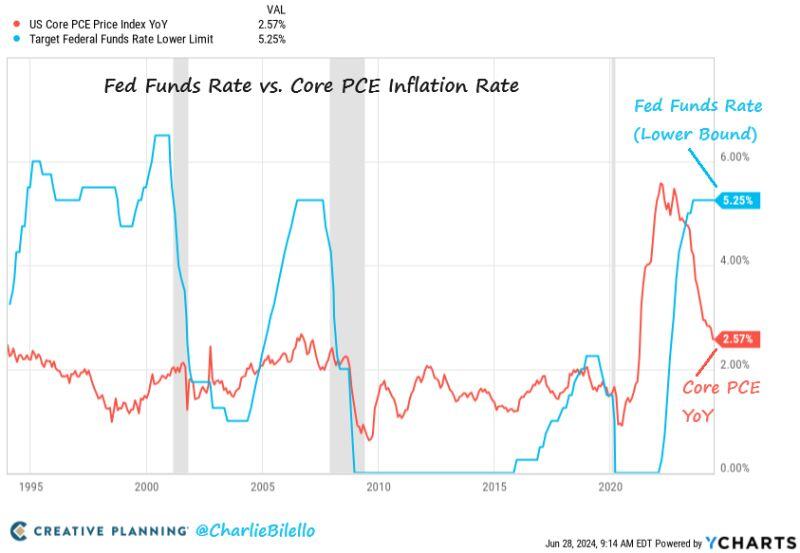

BREAKING: The Fed's preferred measure of inflation (Core PCE) moved down to 2.6% in May, in-line with expectations and the lowest since March 2021.

Core PCE inflation fell to 2.6%, in-line with expectations of 2.6%. So Both headline and Core PCE inflation declined last month. Another welcomed sign by the Fed. Note that "Supercore" PCE rose by 0.1% in May, its smallest monthly increase since August 2023. Health Care (light blue) was the dominant contributor, and 5 of the main sub categories actually declined (if it wasn't for soaring health insurance costs, supercore would be negative). The Fed Funds Rate is now 2.7% above Core PCE, the most restrictive monetary policy we've seen since September 2007. Source: Charlie Bilello

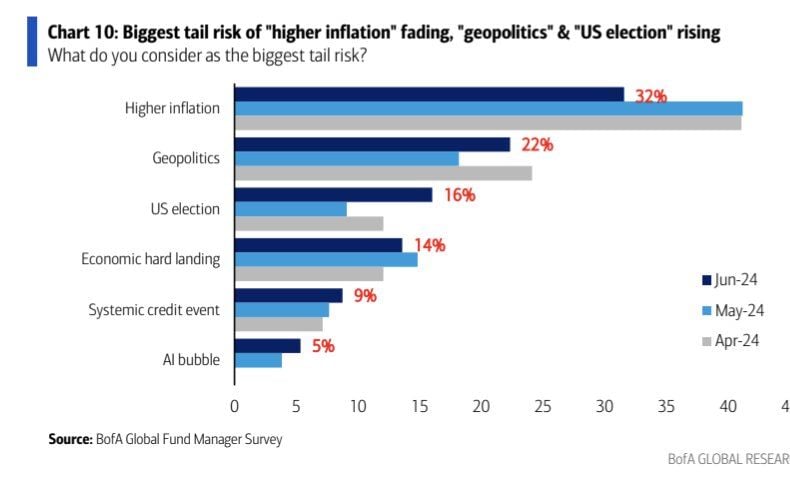

According to BofA fund managers survey, the biggest tail risk is still higher inflation.

WHAT IF the true risk is UNDERESTIMATING the current disinflation trend? PCE numbers today will give us more clue about where inflation is going next? Source: Ryan Detrick

BREAKING: Walgreens stock, $WBA, crashes nearly 25% after drugstore chain cuts profit guidance due to "challenging" consumer environment.

"We assumed the consumer would get somewhat stronger” but “that is not the case,” Walgreens CEO said. Walgreens cut their earnings per share outlook by 12.5% yesterday. The stock is now down 88% from its all time high and 55% in 2024. Another sign that consumers are struggling? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks