Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

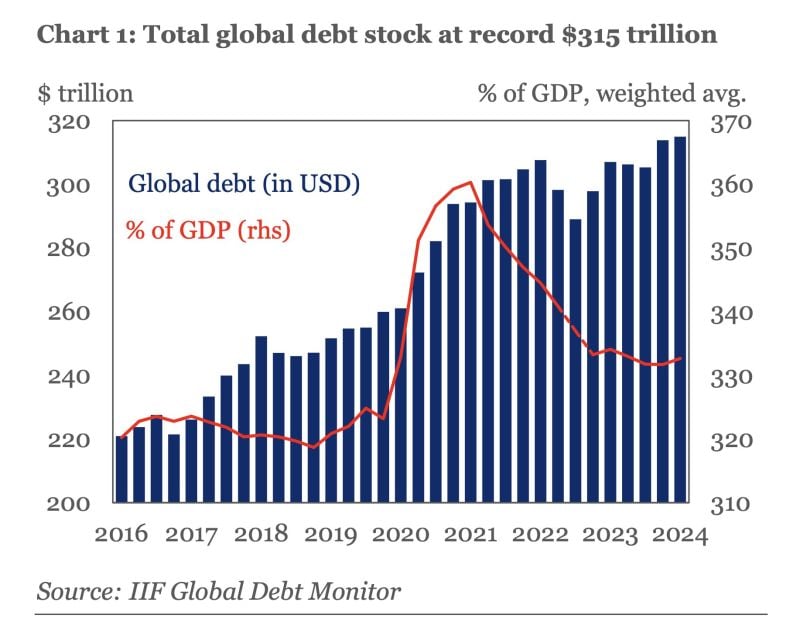

Global debt rose by $1.3tn to a new ATH of $315tn in Q1 2024.

Moreover, after 3 consecutive quarters of decline, global debt-to-GDP resumed its upward trajectory in Q1 2024. Emerging market debt topped $105tn in Q1 2024, w/largest increases coming from China, India, Mexico. Source: HolgerZ, IIF

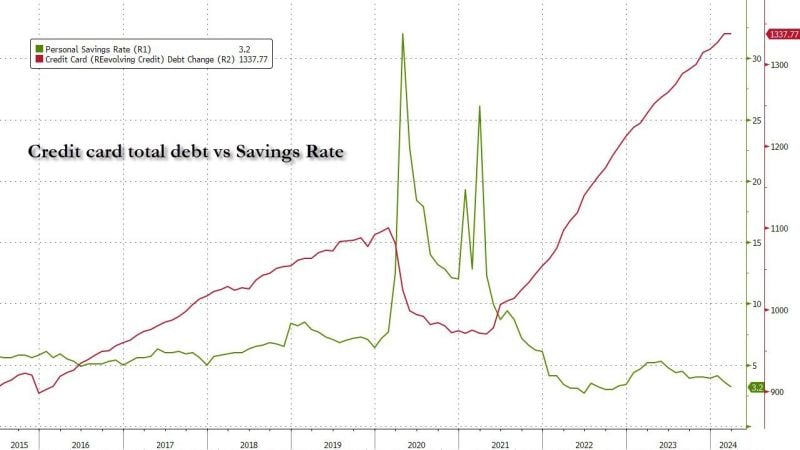

The US consumer (risk) in one chart: credit card debt at record high, personal savings rate record low

Source: www.zerohedge.com

ISM US manufacturing and services employment has simultaneously contracted for 3 consecutive months.

Over the last 20 years, this has happened ONLY twice, during the 2020 pandemic and 2008 Financial Crisis. More than 800 companies from manufacturing and services sectors claim that employment is falling. Meanwhile, according to US jobs data, the US job market has never been stronger. Are we going to see meaningful deterioration in jobs data in the coming months? Source: The Kobeissi Letter

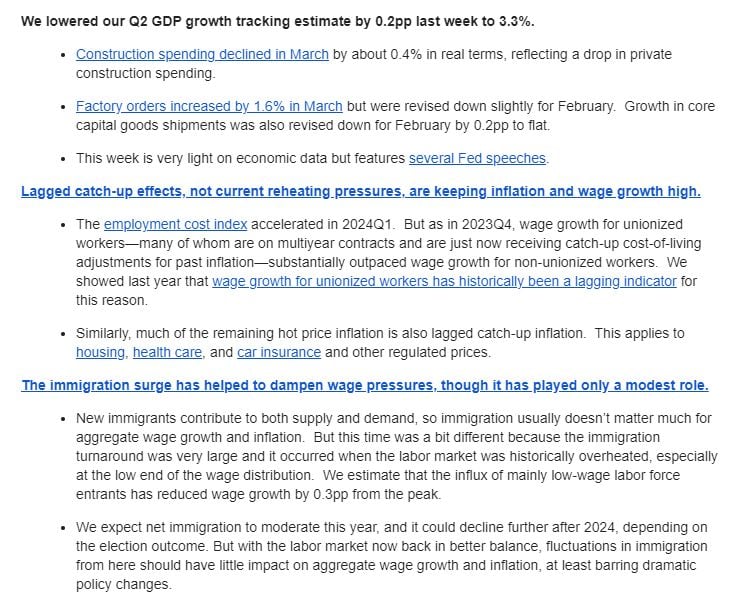

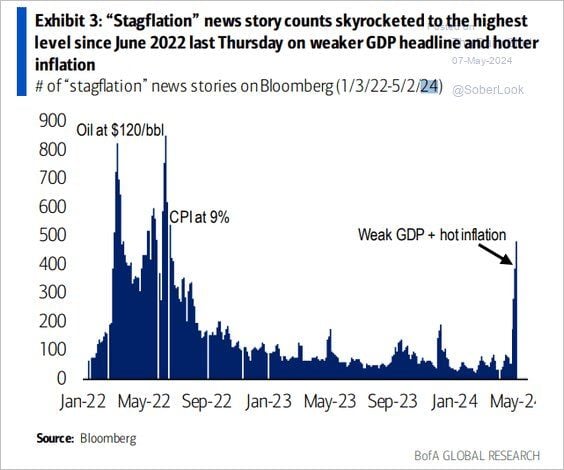

GS: much of the remaining hot price inflation is also lagged catch-up inflation.

This applies to housing, health care, and car insurance and other regulated prices Mike Zaccardi, CFA, CMT

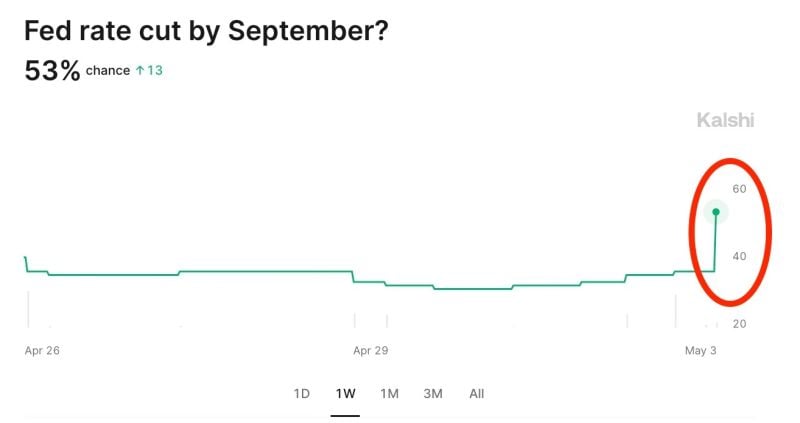

Odds of a September 2024 rate cut jump to 53% after the weaker than expected jobs report, according to Kalshi.

The base case now shows TWO interest rate cuts in 2024, up from ONE prior to the report. On Wednesday, Fed Chair Powell specifically said weakening of the labor market could spur rate cuts. Market implied odds of zero interest rate cuts this year have dropped from 35% to 27%. The Fed rollercoaster ride continues. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks