Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- tech

- nvidia

- earnings

- Forex

- oil

- Real Estate

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- assetmanagement

- Middle East

- UK

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Disinflationary forces are intensifying in Germany

Producer Prices drop for 1st time since 2020, a good leading indicator for Consumer Prices. In July, producer prices (PPI) fell by 6.0% YoY, the biggest decline since October 2009, when the financial crisis has caused prices to collapse. Last year, the prices received by manufacturers for their goods had at times risen at a record rate of 45.8%. Source: HolgerZ, Bloomberg

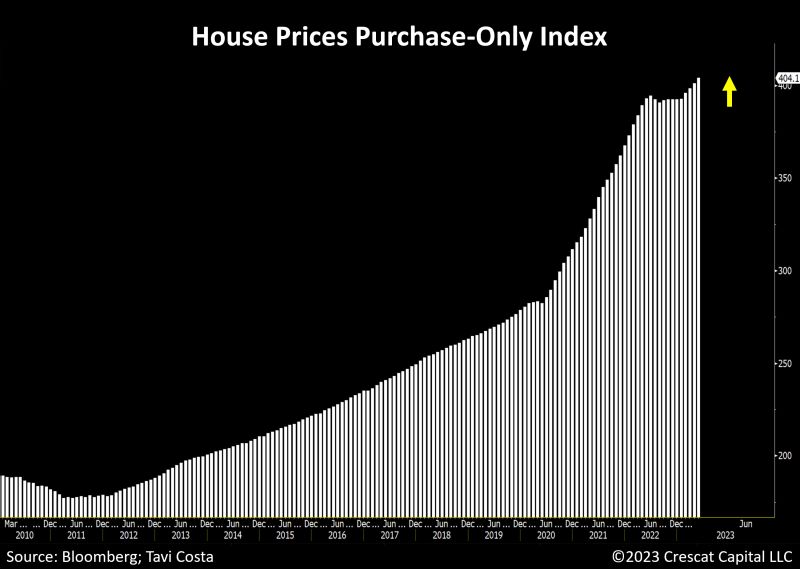

Looking at the recent sales transactions, house prices have accelerated significantly in the last 4 months to record levels, now growing at almost a 10% annualized rate

As a remainder, shelter costs / rents jave been putting upward pressure on core CPI and are expected to ease. Really? Source: Tavi Costa, Crescat Capital, Bloomberg

Michael Burry is an outstanding contrarian investor and did exceptionally well during the 2006-2008 US housing crash

However, performance is not always repeatable and his next bets haven't paid off that well (at least the market views shared publicly - hedge fund long-term performance looks quite strong on a sharper ratio basis). Adam Khoo had a look at all of Michael Burry's recent predictions and he shared it with a chart on X. Here's a summary: In 2005, Predicted the collapse of the subprime mortgage market -> Housing market crashes in 2008, Global Financial Crisis. On Dec 2015, he predicted that the stock market would crash within the next few months. -> SPX +11% Next 12 months. On May 2017, he predicted a global financial meltdown-> SPX +19% Next 12 months. On Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs -> SPX +15% Next 12 months. Source: Adam Khoo Trader

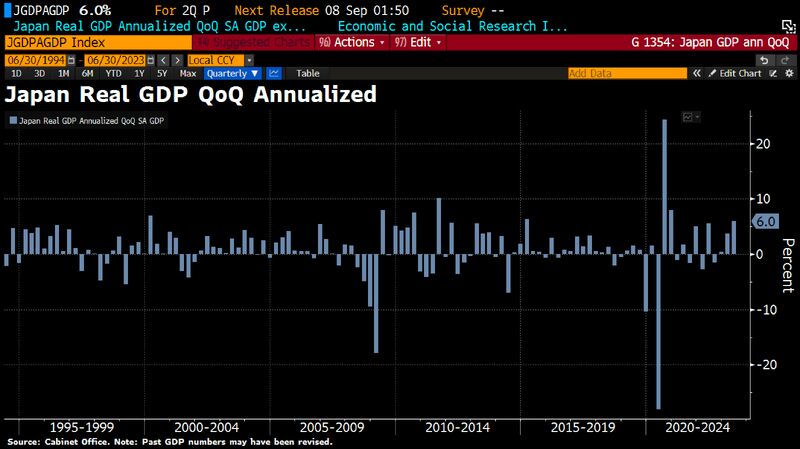

Japan GDP grew 6%, handily beating expectations on robust exports - but domestic demand disappoints

Japan Q2 GDP improves to 1.5% QoQ vs 0.8% expected and 0.1% prior, meaning Japan grows 6.0% on annualized basis, far more than expected (+2.9% yoy). However, some details of the report weren’t as impressive as the headline. As pointed out by analysts in CNBC report, nearly all of the increase in output was driven by a 1.8%-pts boost from net trade. That marked the second-largest contribution from net trade in the 28-year history of the current GDP series, with only the bounce back in exports from the first lockdown at the beginning of the pandemic providing a larger boost. Exports rebounded 3.2% from the previous quarter — largely driven by the spike in car shipments — while imports plunged 4.3% over the time period. Source: Bloomberg, HolgerZ, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks